Kroger (KR) Unveils 10% Dividend Hike: Key Insights to Know

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- KR

- GPS

- WMT

- ANF

The Kroger Co. KR has again signaled its robust financial health and commitment to shareholders by announcing a 10% hike in its annual dividend. The new dividend payout now stands at $1.28 per share, up from $1.16. The next quarterly installment of 32 cents is due on Sep 1, 2024, to shareholders of record as of Aug 15, 2024.

This increase marks the 18th successive year of Kroger raising its dividend, seeing a compounded annual growth rate of 13.5% since the dividend's reinstatement in fiscal 2006. Such consistent increases underscore the company’s stable and reliable growth, even in fluctuating economic climates.

Rodney McMullen, Kroger's chairman and CEO, emphasized that this dividend increase is a testament to the board of directors' confidence in the company's diverse and effective business model. According to McMullen, Kroger’s ability to deliver consistent operating results and generate a strong free cash flow facilitates meaningful returns to shareholders, while simultaneously fueling further expansion and innovation within the company. The company expects an adjusted free cash flow between $2.5 billion and $2.7 billion for fiscal 2024.

This strategic balance between rewarding shareholders and investing in growth initiatives positions Kroger well for sustained success, making it an attractive option for investors seeking stability and steady growth in their portfolios.

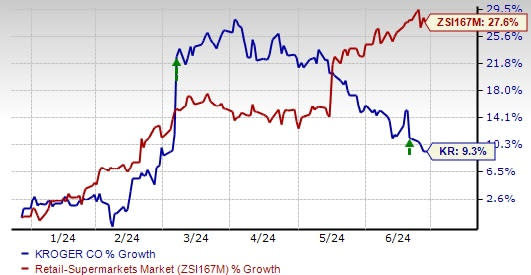

Image Source: Zacks Investment Research

More About the Stock

Kroger's well-defined customer segmentation strategy, emphasis on value and focus on its 'Our Brands' portfolio have enabled it to effectively maintain a competitive position. The company remains committed to its core strengths, which include offering an array of fresh products, providing personalized shopping experiences and fostering a seamless digital ecosystem. These initiatives are all aimed at sustaining Kroger's positive momentum and continued growth.

Additionally, KR's omnichannel initiatives, including pickup and delivery services, have been significant growth drivers. Furthermore, the company's alternative profit businesses, such as Kroger Precision Marketing and Kroger Health, have demonstrated balanced growth and profitability. These segments contribute to overall earnings growth and generate additional revenue streams.

Kroger has undertaken cost-saving initiatives to enhance operational efficiency and improve profitability. These efforts encompass various strategies, implementing sourcing efficiencies and enhancing supply-chain operations. By streamlining processes and eliminating waste across its business operations, Kroger seeks to drive sustainable savings.

We note that shares of this Zacks Rank #3 (Hold) company have gained 9.3% in the past six months compared with the industry’s growth of 27.6%.

3 Stocks Looking Red Hot

A few better-ranked stocks in the retail space are The Gap, Inc. GPS, Abercrombie & Fitch Co. ANF and Walmart WMT.

Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Gap’s fiscal 2024 earnings and sales indicates growth of 21.7% and 0.2%, respectively, from the fiscal 2023 reported figures. GPS has a trailing four-quarter average earnings surprise of 202.7%.

Abercrombie is a specialty retailer of premium, high-quality casual apparel. It flaunts a Zacks Rank of 1 at present. ANF delivered a 28.9% earnings surprise in the last reported quarter.

The consensus estimate for Abercrombie’s fiscal 2024 earnings and sales indicates growth of 47.3% and 10.4%, respectively, from the fiscal 2023 reported levels. ANF has a trailing four-quarter average earnings surprise of 210.3%.

Walmart, which operates a chain of hypermarkets, discount department stores and grocery stores, currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Walmart’s current fiscal-year sales and earnings suggests growth of 4.2% and 9% from the year-ago period’s reported numbers. WMT has a trailing four-quarter earnings surprise of 8.3%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

The Kroger Co. (KR): Free Stock Analysis Report

The Gap, Inc. (GPS): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance