Unveiling Three Swedish Dividend Stocks With Yields Ranging From 3% To 6%

As global markets navigate through varying economic signals, Sweden's market remains a focus for investors seeking stable returns, particularly through dividend stocks. In the current landscape where cautious optimism in European markets is juxtaposed with concerns about political stability and monetary policies, dividend-yielding stocks from Sweden present an appealing balance of potential income and relative security.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 6.08% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 4.26% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.38% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.24% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.07% | ★★★★★☆ |

Duni (OM:DUNI) | 4.83% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.55% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.30% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.13% | ★★★★★☆ |

Bahnhof (OM:BAHN B) | 4.02% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Betsson

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Betsson AB operates an online gaming business across the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally with a market capitalization of SEK 16.36 billion.

Operations: Betsson AB generates €974.50 million in revenue from its Casinos & Resorts segment.

Dividend Yield: 6.1%

Betsson AB's recent dividend decisions and financial performance underscore its mixed appeal as a dividend stock. The company has set two redemption procedures in 2024, totaling EUR 0.645 per share, with the first payout converted to SEK 3.77 at an exchange rate of EUR/SEK: 11.6815. Despite a reasonable payout ratio of 48.9%, indicating earnings and cash flow coverage, Betsson's dividend history over the past decade has been marked by volatility and unreliability, reflecting inconsistent growth in payments despite a current yield that ranks in the top quartile for Swedish stocks. Moreover, while trading below estimated fair value suggests potential upside, analysts expect a price increase of only about 27%.

Eolus Vind

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eolus Vind AB operates in the renewable energy sector, focusing on the development, construction, and operation of assets across Sweden, Norway, Finland, the United States, Poland, Spain, and the Baltic states with a market capitalization of approximately SEK 1.86 billion.

Operations: Eolus Vind AB generates its revenue through the development, construction, and management of renewable energy projects across multiple countries, including Sweden, Norway, Finland, the United States, Poland, Spain, and the Baltic states.

Dividend Yield: 3%

Eolus Vind, despite a recent dividend of SEK 2.25 per share, shows unstable and unreliable dividend trends over the past decade with fluctuations exceeding 20% annually. The company's low dividend yield of 3.02% contrasts with Sweden's top payers at 4.26%. Financially, Eolus reported a significant drop in Q1 sales to SEK 44 million from SEK 277 million year-on-year and a net loss increase to SEK 32 million from SEK 15 million, indicating potential challenges ahead despite reasonable cash coverage for dividends at a payout ratio of about 55.5%.

Take a closer look at Eolus Vind's potential here in our dividend report.

Upon reviewing our latest valuation report, Eolus Vind's share price might be too pessimistic.

New Wave Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Wave Group AB operates in designing, acquiring, and developing brands and products within the corporate, sports, gifts, and home furnishings sectors across various global regions with a market capitalization of SEK 15.31 billion.

Operations: New Wave Group AB generates revenue through three primary segments: Corporate (SEK 4.68 billion), Sports & Leisure (SEK 3.82 billion), and Gifts & Home Furnishings (SEK 874.40 million).

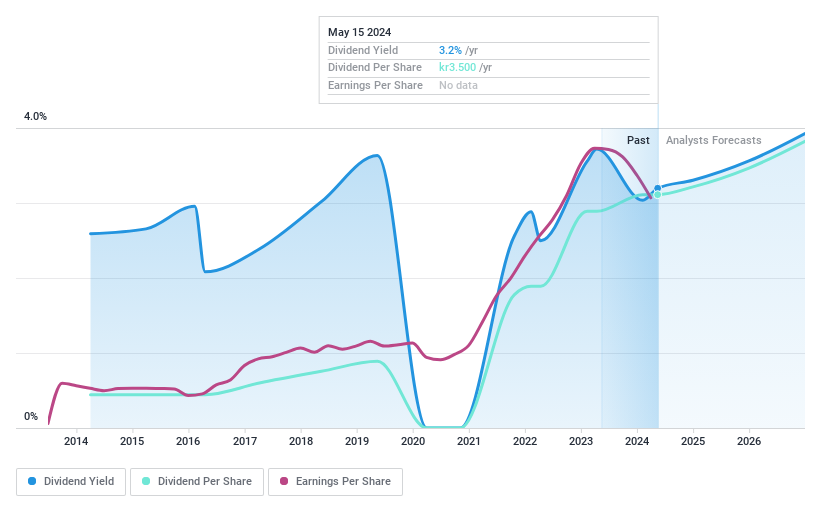

Dividend Yield: 3%

New Wave Group's recent dividend increase to SEK 3.50 per share, payable in two installments, reflects a commitment to shareholder returns despite a volatile dividend history over the past decade. The company's dividends are supported by earnings and cash flows with payout ratios of 45.6% and 42.6%, respectively, suggesting sustainability from financial operations. However, its current yield of 3.03% remains below the Swedish market's top quartile at 4.26%. Recent board changes and auditor appointments could influence future governance and performance strategies.

Click here to discover the nuances of New Wave Group with our detailed analytical dividend report.

Our valuation report here indicates New Wave Group may be undervalued.

Key Takeaways

Reveal the 23 hidden gems among our Top Dividend Stocks screener with a single click here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BETS B OM:EOLU B and OM:NEWA B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance