Apple vs Microsoft: Which Technology Stock Should You Buy?

With the consumer price index (CPI) coming in softer than market expectations, interest rate cuts could be on the horizon.

This news triggered a market rally, sending the S&P 500 Index (^SPX) above 5,400 for the first time in history, marking 12 June 2024 as a significant day for the market.

The positive market outlook was further bolstered by the exciting developments revealed during Apple’s (NASDAQ: AAPL) Worldwide Developers Conference (WWDC) 2024, which propelled Apple’s stock to an all-time high.

On that day, Apple briefly overtook Microsoft (NASDAQ: MSFT) as the world’s most valuable company, although it lost this position before the market closed, as shown below.

Source: Author’s Calculation

Apple faced challenges at the beginning of 2024 due to weak iPhone sales in China for the first quarter of fiscal year 2024 (1Q FY2024) ending 31 December 2023.

This weakness pushed Apple’s stock price to its 52-week low in April this year but the iPhone manufacturer managed to stage a remarkable comeback.

As these two technology titans wrestle for the title of the world’s most valuable company, which is more worthy of your investment?

Financial performance and valuations

Both Apple and Microsoft are reputable companies with solid earnings histories.

Let’s dissect each company.

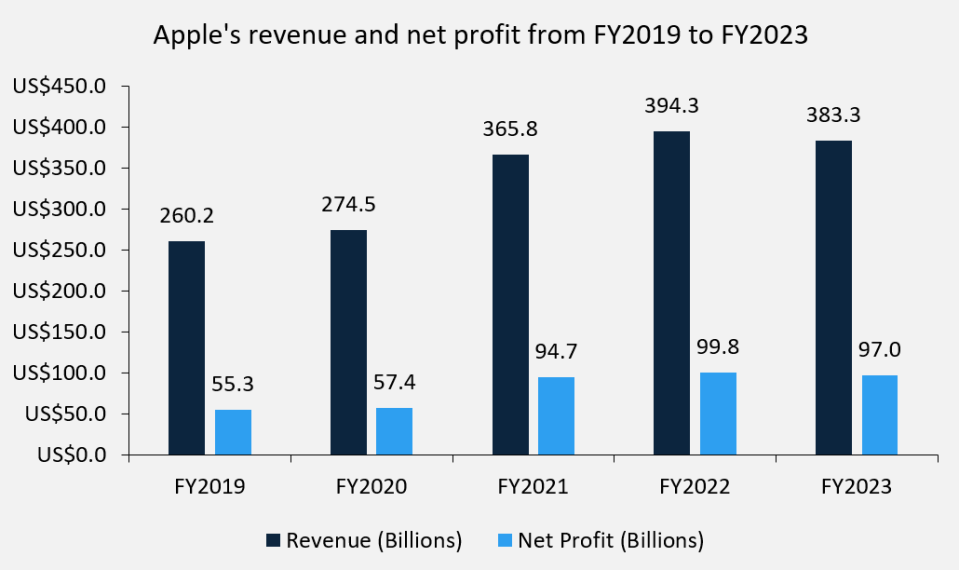

While Apple enjoyed explosive revenue growth of 33.3% year on year from FY2020 to FY2021, its growth trajectory has since plateaued.

FY2022 saw a year-on-year revenue increase of just 7.8% while FY2023 saw revenue log a slight 2.8% year on year decline.

Source: Author’s Calculation

Furthermore, Apple’s latest earnings report for the second quarter of fiscal year 2024 (2Q FY2024) also showed revenue and net profit declining by 4% and 2% year on year, respectively.

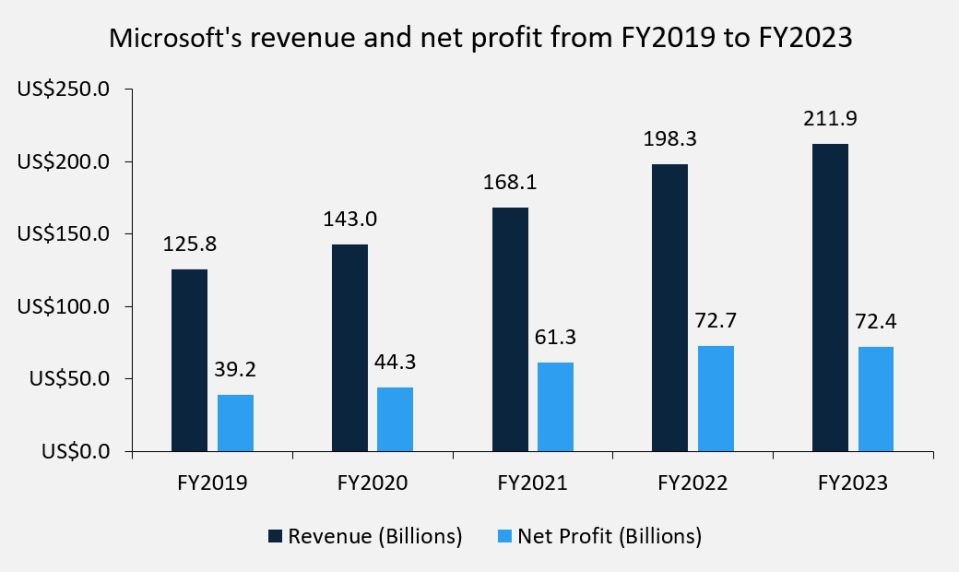

On the other hand, Microsoft has delivered consistent yearly revenue growth.

Source: Author’s Calculation

Investors need to keep in mind that Apple’s hardware business is exposed to macroeconomic cycles, which explains FY2023’s weaker performance, largely driven by the weakening of oversea currencies to the US dollar.

While Microsoft experienced consistent revenue growth over the past 5 years, in FY2023, Microsoft also experienced a slight decline in net profit, similar to Apple.

Despite this, both companies showed strong profit growth over the past five years.

Apple’s net profit has soared by over 75% since FY2019, while Microsoft’s net profit surged by a more impressive 85%.

Apple currently trades at a trailing twelve-month (TTM) price to earnings (P/E) ratio of 33.3x.

On the other hand, Microsoft currently trades at a TTM P/E ratio of 38.2x.

Apple is trading at a slightly lower valuation compared with Microsoft but this can be explained by the blip in its revenue and profit growth

Also, for dividend investors, Microsoft’s dividend yield of 0.68% is slightly higher than Apple’s dividend yield of 0.47%.

Both companies have increased their annual dividend payout since they first started issuing dividends.

Microsoft’s dividend growth stands at a five-year compound annual growth rate (CAGR) of 10.3%, while Apple’s CAGR came in at 5.4%.

Apple prefers to enhance shareholder returns through share buyback programmes, with a recent announcement to repurchase US$110 billion worth of shares, the largest in corporate history.

In terms of cash generation ability, Apple’s free cash flow to operating cash flow (FCF to CFO) still remains superior.

Over the past three years, Apple’s FCF to CFO ratio has been exceptionally high, consistently around 0.9x, highlighting Apple’s ability to generate significant cash after accounting for capital expenditures required to maintain or expand the business.

On the other hand, Microsoft is playing catch up with its ratio ranging from 0.6x to 0.7x.

The growth angle

What are the growth opportunities for both companies?

Apple’s recent WWDC 2024 showcased several exciting innovations.

The biggest highlight was the unveiling of iOS 18, set to debut on the iPhone 15 and iPhone 15 Pro Max.

iOS 18 comes with Apple Intelligence, an artificial intelligence (AI) system that puts generative AI models into Apple’s three main devices: iPhone, iPad, and Mac.

Among the many groundbreaking technologies introduced with Apple Intelligence, Eye-Tracking controls and a personalised Siri stand out.

Siri is a virtual assistant integrated in Apple devices, allowing users to interact through spoken commands.

ChatGPT will also be integrated into Siri as a result of a recent partnership between OpenAI and Apple.

Eye-Tracking controls is a design for users with physical disabilities, allowing them to control their iPhones or IPads with just their eyes.

While iOS 18 grabbed the spotlight, WWDC 2024 brought us more information on other Apple products.

Notably, Apple’s first 3D headset, Vision Pro, will be available in Singapore later this month accompanied by an update with visionOS 2.

The Apple watch is also slated for some new updates, such as enhanced customisability and an improved health-tracking system called “Vitals”.

These releases are expected to drive demand for Apple products, triggering a wave of replacements for the latest models equipped with these new features.

Likewise, Microsoft has recently announced the launch of new Windows personalised computers (PCs).

These new PCs, named Copilot + PCs, will be available from 18 June.

Some of these PCs include Microsoft’s own Surface Pro, with Surface being a touchscreen laptop designed by Microsoft for versatility and productivity.

Other Copilot + PCs include models from brands such as Dell (NYSE: DELL) and HP (NYSE: HPQ).

These devices are equipped with Microsoft’s new artificial intelligence (AI) model, Copilot.

They are powered with Qualcomm’s (NASDAQ: QCOM) latest processors, offering superior performance compared to the latest Macbook Air model.

Designers and creatives will likely find these PCs appealing, especially with pre-installed Adobe (NASDAQ: ADBE) applications and more application tools such as CapCut .

Additionally, Copilot features a subscription service for more advanced versions, creating a new revenue stream for the company.

With these introductions, Microsoft is looking to diversify its business away from its service and software segment.

Beyond new hardware devices, Microsoft has also partnered with OpenAI to enhance Azure, its leading cloud computing platform.

This move signals the technology behemoth’s intention to be the leading cloud provider.

Competitor analysis

As mentioned earlier, Apple’s business model is influenced by macroeconomic conditions.

Additionally, the electronic device market is intensely competitive, with Samsung (KRX: 005930) weighing in as Apple’s strongest competitor, offering a comparable product in nearly every category.

Apple also grapples with stiff competition from Chinese smartphone brands, with companies like Xiaomi (SEHK: 1810) and Oppo catching up.

Furthermore, Apple’s iCloud ecosystem no longer serves as a unique selling point, given the widespread adoption of Google Cloud across both Android and iOS systems.

To maintain its market position, Apple has to continuously innovate.

Fortunately, the company’s strong fundamentals enable investment in research and development without jeopardising financial stability.

On the other hand, Microsoft holds a duopoly status with Alphabet (NASDAQ: GOOGL) for office productivity tools, with more than 60% of Fortune 500 companies using Microsoft 365 for their operations.

LinkedIn continues to dominate as the best business networking website, boasting over one billion members with almost two billion monthly visits.

Given the subscription model for most of their services, such as cloud, office and Windows solutions, Microsoft is less susceptible to replacement cycles.

However, in the cloud computing space, which is Microsoft’s largest revenue generator, the company faces strong competition from two other companies of the “Magnificent 7”, being Alphabet and Amazon (NASDAQ: AMZN).

Get Smart: Concluding thoughts

Overall, both Apple and Microsoft are companies worthy of investment consideration.

Despite being the two largest companies globally, they still have ample room for growth.

Choosing which company to invest in depends on your investment preference, as each company has its pros and cons.

If you are an innovator, Apple’s new products and generative AI technology may appeal to you more.

But if you prefer the stability of a technology stalwart with a less volatile financial profile, Microsoft may be the right stock for you.

Attention Growth Investors: Our latest report, “The Rise of Titans,” gives you a front-row seat on the 7 most influential US stocks today. If you’re passionate about tech and growth, you can’t go wrong with our research. Downloading this FREE report could be the most strategic move you make this year. Click here to get started now.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Aw Kai Rui does not own any of the stocks mentioned in this article.

The post Apple vs Microsoft: Which Technology Stock Should You Buy? appeared first on The Smart Investor.

Yahoo Finance

Yahoo Finance