Unveiling Three SGX Stocks That Might Be Trading Below Their Estimated Fair Value

As the Singapore market continues to evolve, investors are keenly observing trends and shifts that could signal new opportunities. Amidst these developments, identifying stocks that may be trading below their estimated fair value could offer potential for those looking to diversify or optimize their portfolios in current market conditions.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

Name | Current Price | Fair Value (Est) | Discount (Est) |

Singapore Technologies Engineering (SGX:S63) | SGD4.14 | SGD7.86 | 47.3% |

Hongkong Land Holdings (SGX:H78) | US$3.19 | US$5.63 | 43.3% |

Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD0.965 | SGD1.63 | 40.6% |

Seatrium (SGX:5E2) | SGD1.49 | SGD2.37 | 37% |

Digital Core REIT (SGX:DCRU) | US$0.58 | US$1.10 | 47.3% |

Nanofilm Technologies International (SGX:MZH) | SGD0.71 | SGD1.33 | 46.7% |

Let's take a closer look at a couple of our picks from the screened companies

Frasers Logistics & Commercial Trust

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust that manages a portfolio of 107 industrial and commercial properties valued at approximately S$6.4 billion, spread across five developed markets including Australia, Germany, Singapore, the United Kingdom, and the Netherlands, with a market capitalization of about S$3.63 billion.

Operations: The revenue for this trust is derived from its industrial and commercial properties located in Australia, Germany, Singapore, the United Kingdom, and the Netherlands.

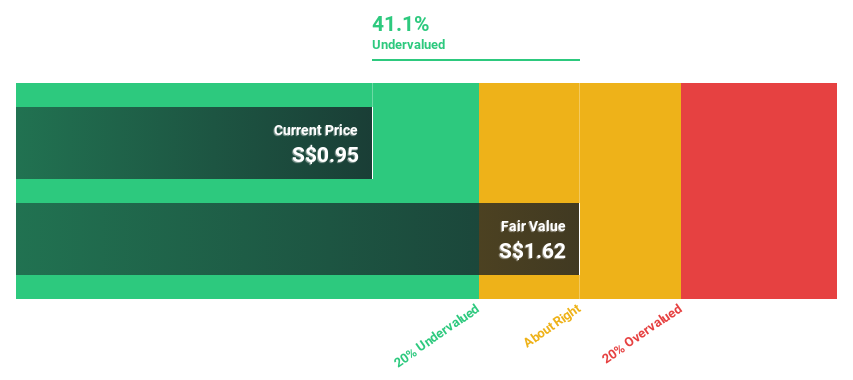

Estimated Discount To Fair Value: 40.6%

Frasers Logistics & Commercial Trust is currently trading at SGD0.97, below the estimated fair value of SGD1.63, indicating a significant undervaluation based on discounted cash flow analysis. Despite this, challenges persist as its debt is poorly covered by operating cash flow, and its forecasted Return on Equity stands at a modest 6%. Additionally, while revenue growth projections are positive at 6.1% annually—outpacing the Singapore market's average—its earnings have recently declined year-over-year in the first half of 2024.

Digital Core REIT

Overview: Digital Core REIT (SGX: DCRU) operates as a pure-play data centre real estate investment trust in Singapore, sponsored by Digital Realty, and has a market capitalization of approximately $755.20 million.

Operations: The company generates its revenue primarily from the commercial real estate investment trust (REIT) segment, amounting to $71.10 million.

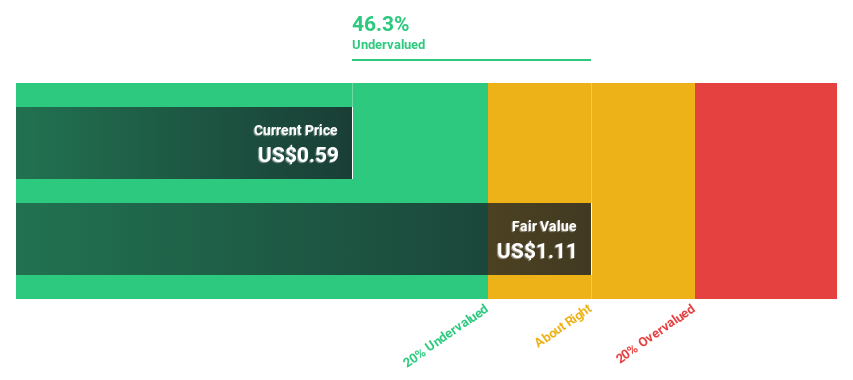

Estimated Discount To Fair Value: 47.3%

Digital Core REIT, priced at $0.58, is considered undervalued by 47.3% relative to its fair value of $1.10, with expectations to become profitable within three years amidst a forecasted revenue growth of 8.1% per year. However, concerns include a low forecasted Return on Equity of 4.9% and an unstable dividend track record. Recent actions include initiating a share buyback program authorized for up to 10% of its shares, signaling potential confidence in its valuation by management.

Singapore Technologies Engineering

Overview: Singapore Technologies Engineering Ltd is a global technology, defense, and engineering group with a market capitalization of approximately SGD 12.91 billion.

Operations: The company's revenue is generated from three primary segments: Commercial Aerospace (SGD 3.97 billion), Urban Solutions & Satcom (SGD 1.98 billion), and Defence & Public Security (SGD 4.29 billion).

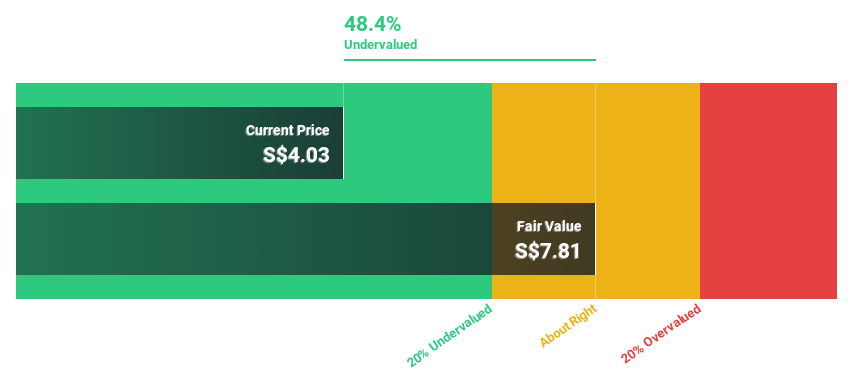

Estimated Discount To Fair Value: 47.3%

Singapore Technologies Engineering, trading at S$4.14, appears undervalued based on discounted cash flows with a fair value estimate of S$7.86. Recent share repurchase initiatives and consistent dividend payouts underscore management's confidence in the company's financial health despite its high level of debt. Forecasted annual earnings growth of 11.5% outpaces the Singapore market average, complemented by a projected revenue increase of 6.7% annually, indicating robust future prospects relative to current market expectations.

Key Takeaways

Investigate our full lineup of 6 Undervalued SGX Stocks Based On Cash Flows right here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:BUOU SGX:DCRU and SGX:S63.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance