TSX Growth Companies With High Insider Ownership And Earnings Growth Up To 51%

In the past year, Canada's market has shown resilience with an 8.0% increase, despite a recent 2.6% drop over the last seven days. In this context, growth companies with high insider ownership stand out as particularly compelling, especially those demonstrating robust earnings growth up to 51%, aligning well with the broader market's expected annual earnings increase of 15%.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Payfare (TSX:PAY) | 15% | 46.7% |

goeasy (TSX:GSY) | 21.7% | 15.8% |

Propel Holdings (TSX:PRL) | 40% | 36.4% |

Allied Gold (TSX:AAUC) | 22.5% | 68.2% |

Aritzia (TSX:ATZ) | 19% | 51.2% |

ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

Ivanhoe Mines (TSX:IVN) | 13% | 65.5% |

Artemis Gold (TSXV:ARTG) | 31.8% | 48.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Aritzia

Simply Wall St Growth Rating: ★★★★★☆

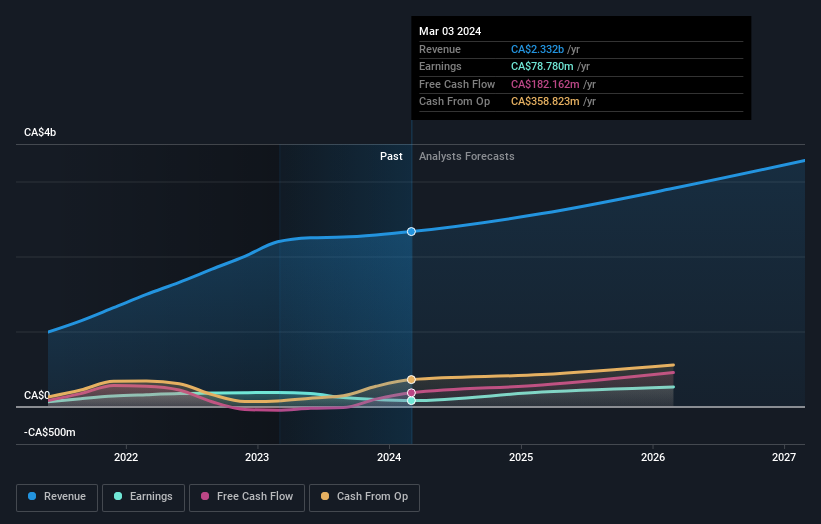

Overview: Aritzia Inc. operates as a designer and retailer of women's apparel and accessories in the United States and Canada, with a market capitalization of approximately CA$4.22 billion.

Operations: The company generates CA$2.33 billion in revenue from its apparel sales.

Insider Ownership: 19%

Earnings Growth Forecast: 51.2% p.a.

Aritzia has demonstrated robust growth with its revenue forecast to increase by 11% annually, outpacing the Canadian market's 7.2%. Despite a recent dip in net profit margins from 8.5% to 3.4%, earnings are expected to surge significantly, predicted at an annual growth rate of 51.2%. The company's strategic buybacks and insider ownership underscore a commitment to shareholder value, aligning with its optimistic revenue projections for fiscal 2025 ranging between CAD$2.52 billion and CAD$2.62 billion.

Colliers International Group

Simply Wall St Growth Rating: ★★★★☆☆

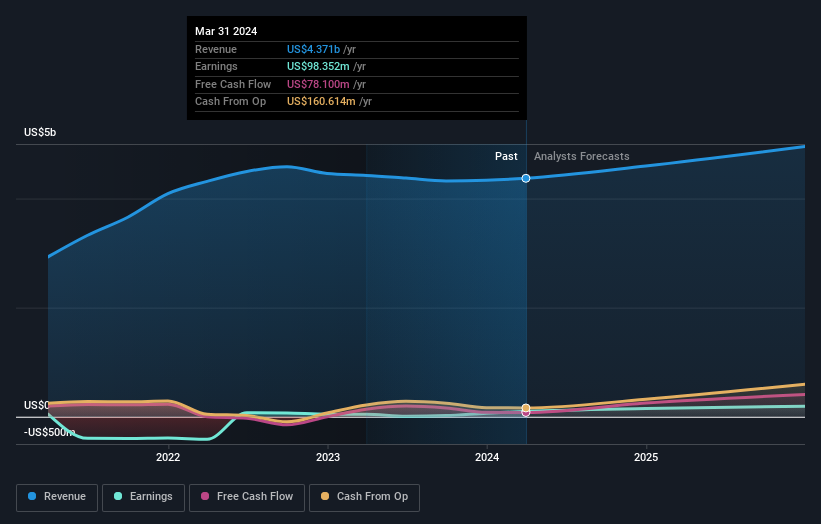

Overview: Colliers International Group Inc. operates globally, offering commercial real estate professional and investment management services, with a market capitalization of approximately CA$7.62 billion.

Operations: Colliers International Group's revenue is primarily derived from the Americas with CA$2.53 billion, followed by Europe, the Middle East & Africa at CA$730.10 million, Asia Pacific contributing CA$616.58 million, and Investment Management services generating CA$489.23 million.

Insider Ownership: 14.3%

Earnings Growth Forecast: 38.3% p.a.

Colliers International Group has recently engaged in significant activities, such as assisting Diamondhead Casino Corporation with property marketing and financing, indicating strategic business expansion. Despite a challenging financial position with debt poorly covered by cash flow, Colliers reported a strong earnings recovery in Q1 2024 and expects revenue growth of 5% to 10% this year. However, insider transactions show more selling than buying over the past three months, suggesting mixed confidence from insiders despite the company's operational progress and optimistic future earnings projections.

Vitalhub

Simply Wall St Growth Rating: ★★★★☆☆

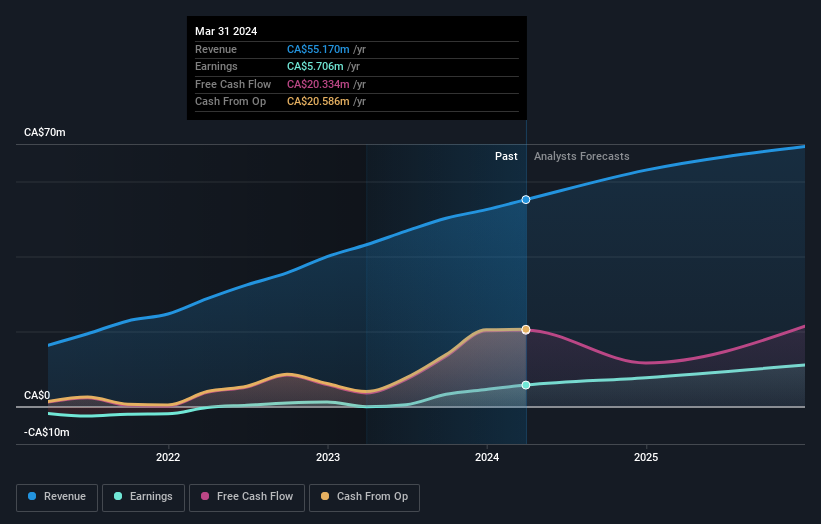

Overview: Vitalhub Corp. offers technology solutions to health and human service providers across Canada, the U.S., the UK, Australia, Western Asia, and other international markets, with a market capitalization of approximately CA$396.93 million.

Operations: The company generates its revenue primarily from the healthcare software segment, which contributed CA$55.17 million.

Insider Ownership: 15.1%

Earnings Growth Forecast: 38.1% p.a.

Vitalhub Corp., a Canadian company with high insider ownership, reported a revenue increase to CAD 15.26 million in Q1 2024 from CAD 12.6 million the previous year, reflecting a strong growth trajectory. The company's net income also rose significantly to CAD 1.32 million. Recent strategic moves include a partnership with Lumenus Community Services to enhance data management and client outcomes, plus leadership enhancements aimed at bolstering operations for future growth. These developments underscore Vitalhub's commitment to leveraging technology for expansion and efficiency in the healthcare sector.

Where To Now?

Take a closer look at our Fast Growing TSX Companies With High Insider Ownership list of 30 companies by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:ATZTSX:CIGITSX:VHI and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance