Top Three Japanese Growth Companies With High Insider Ownership In June 2024

Amid a backdrop of mixed weekly returns and a strengthening yen, Japan's market landscape presents a nuanced picture as of June 2024. This environment underscores the importance of considering growth companies with high insider ownership, which often signals confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 26.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.3% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 80.2% |

Money Forward (TSE:3994) | 21.4% | 63.6% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Soracom (TSE:147A) | 17.2% | 54.1% |

Here we highlight a subset of our preferred stocks from the screener.

SHIFT

Simply Wall St Growth Rating: ★★★★★★

Overview: SHIFT Inc., headquartered in Japan, specializes in providing software quality assurance and testing solutions with a market capitalization of approximately ¥268.40 billion.

Operations: The company specializes in software quality assurance and testing solutions, generating its revenue entirely from these core services.

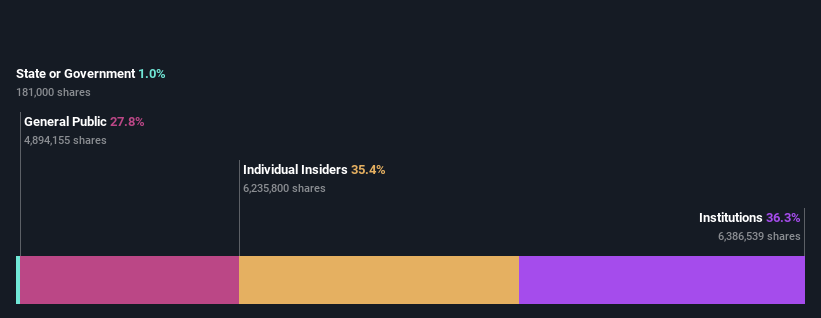

Insider Ownership: 35.4%

Earnings Growth Forecast: 26.8% p.a.

SHIFT Inc. demonstrates strong growth potential with earnings expected to increase significantly, projected at a 26.82% annual rate. Despite a highly volatile share price recently, analysts believe it is undervalued by 25.1%, anticipating a substantial rise of 91.9%. The company's revenue growth also outpaces the Japanese market significantly, with forecasts suggesting an annual increase of 21.9%. Additionally, its Return on Equity is predicted to be robust at 26.5% in three years, underscoring efficient management and potentially lucrative returns for high insider ownership stakeholders.

Click here and access our complete growth analysis report to understand the dynamics of SHIFT.

Our valuation report here indicates SHIFT may be undervalued.

Mercari

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mercari, Inc. operates a marketplace application in Japan and the United States, focusing on the buying and selling of goods, with a market capitalization of approximately ¥358.10 billion.

Operations: The company generates its revenue through the operation of marketplace applications focused on the buying and selling of goods in both Japan and the United States.

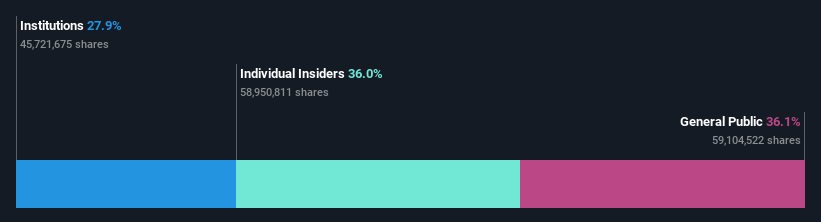

Insider Ownership: 36%

Earnings Growth Forecast: 19.1% p.a.

Mercari's earnings are poised to outpace the Japanese market with a forecasted annual growth of 19.1%, alongside revenue growth predictions of 9.9% per year. Despite lacking significant insider transactions in the past three months, recent strategic shifts like eliminating selling fees could enhance its market position and appeal to users. The company has also projected substantial profits and revenue for FY 2024, indicating robust financial health and potential for sustained growth under high insider ownership.

Take a closer look at Mercari's potential here in our earnings growth report.

Our valuation report unveils the possibility Mercari's shares may be trading at a premium.

Micronics Japan

Simply Wall St Growth Rating: ★★★★★★

Overview: Micronics Japan Co., Ltd. specializes in developing, manufacturing, and selling testing and measurement equipment for semiconductors and LCD testing systems globally, with a market capitalization of approximately ¥236.50 billion.

Operations: The company generates revenue primarily through the sale of semiconductor and LCD testing equipment.

Insider Ownership: 15.3%

Earnings Growth Forecast: 39.7% p.a.

Micronics Japan is set to experience robust growth with earnings projected to increase by 39.73% annually, significantly outpacing the Japanese market's 8.7%. Revenue is also expected to grow at a strong rate of 23.3% per year, well above the market average of 4%. However, its profit margins have declined from last year’s 16.7% to 10.6%. Despite this downturn and a highly volatile share price recently, the stock trades at a substantial discount of 41.1% below its estimated fair value, suggesting potential upside if it can stabilize and maintain its growth trajectory.

Seize The Opportunity

Access the full spectrum of 104 Fast Growing Japanese Companies With High Insider Ownership by clicking on this link.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:3697 TSE:4385 and TSE:6871.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance