Top German Dividend Stocks For June 2024

As political uncertainty and economic challenges continue to shape the European markets, Germany's DAX index has not been immune, reflecting a cautious sentiment among investors. In such times, dividend stocks can be particularly appealing for their potential to offer steady income streams amidst market volatility.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.31% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.85% | ★★★★★★ |

Brenntag (XTRA:BNR) | 3.26% | ★★★★★☆ |

Talanx (XTRA:TLX) | 3.14% | ★★★★★☆ |

Südzucker (XTRA:SZU) | 6.55% | ★★★★★☆ |

INDUS Holding (XTRA:INH) | 4.79% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.36% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.29% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.24% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.11% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

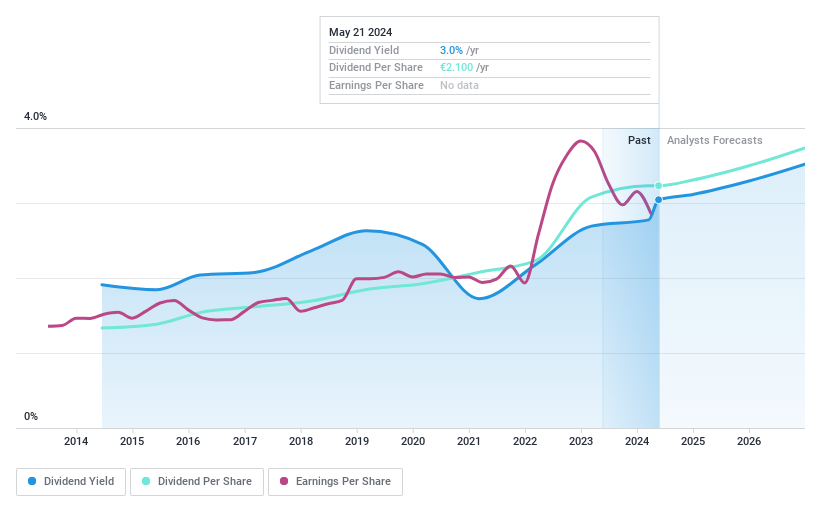

Brenntag

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brenntag SE is a global distributor of industrial and specialty chemicals and ingredients, operating across regions including Germany, Europe, the Middle East, Africa, the Americas, and the Asia Pacific, with a market capitalization of approximately €9.31 billion.

Operations: Brenntag SE generates revenue through its Brenntag Essentials segment, with sales in North America amounting to €4.28 billion, Europe, Middle East & Africa (EMEA) contributing €3.34 billion, Asia Pacific (APAC) at €0.71 billion, and Latin America at €0.67 billion.

Dividend Yield: 3.3%

Brenntag SE maintains a stable dividend with a yield of 3.26%, supported by earnings and cash flows, with payout ratios at 48.9% and 28.1% respectively, indicating sustainability. Despite consistent growth in dividend payments over the past decade, its yield remains below the top quartile in Germany's market (4.76%). Recent activities include regular dividends paid on May 24, 2024, and significant share buybacks totaling €750 million, enhancing shareholder value but reflecting a substantial decrease in Q1 earnings year-over-year.

Click here and access our complete dividend analysis report to understand the dynamics of Brenntag.

Our valuation report here indicates Brenntag may be undervalued.

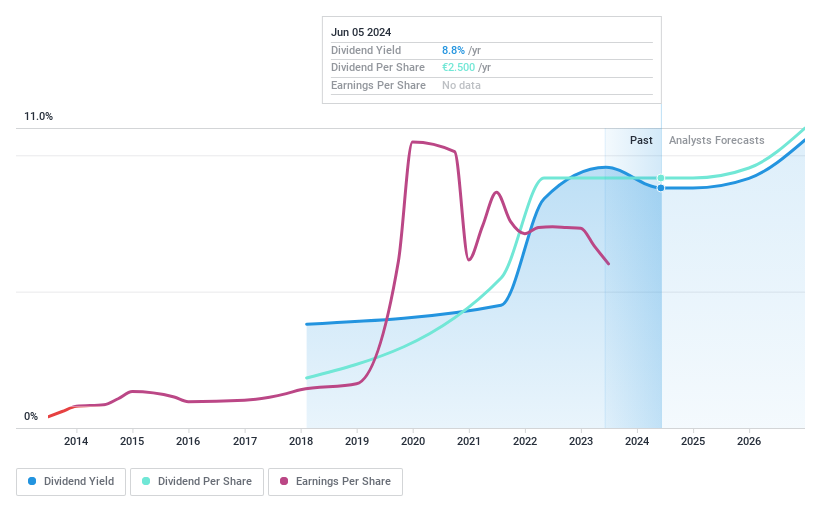

CR Energy

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CR Energy AG is an investment company focusing on technology firms in Germany, with a market capitalization of approximately €0.16 billion.

Operations: CR Energy AG generates revenue primarily through its real estate rental segment, totaling €68.57 million.

Dividend Yield: 9%

CR Energy AG, despite a brief history of dividend payments over six years, offers a robust yield at 9.03%, placing it well within the top 25% of German dividend payers. The dividends are securely covered by both earnings and cash flows, with payout ratios of 22.4% and 62.6% respectively, ensuring sustainability despite recent financial setbacks as evidenced by a decline in annual revenue to €68.64 million and net income to €65.78 million from higher figures the previous year.

Get an in-depth perspective on CR Energy's performance by reading our dividend report here.

The valuation report we've compiled suggests that CR Energy's current price could be quite moderate.

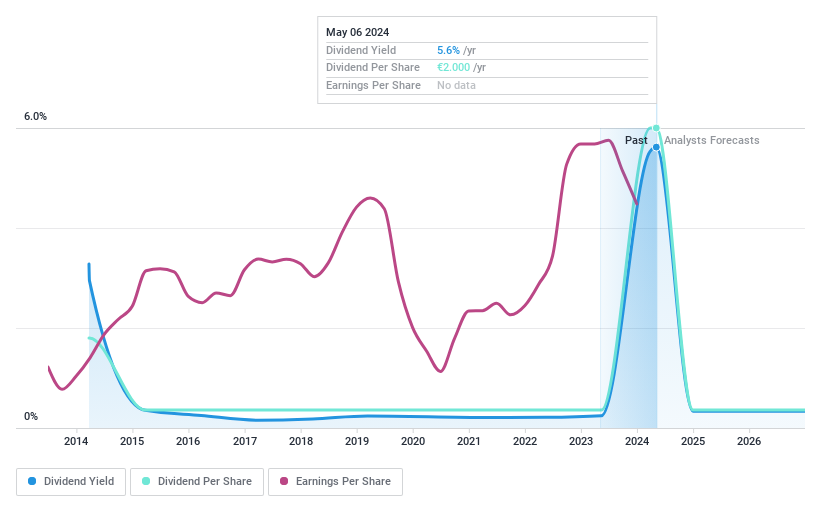

DATA MODUL Produktion und Vertrieb von elektronischen Systemen

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DATA MODUL Aktiengesellschaft, Produktion und Vertrieb von elektronischen Systemen operates in the development, manufacture, and distribution of flatbed displays, monitors, electronic subassemblies, and information systems globally with a market capitalization of approximately €112.13 million.

Operations: DATA MODUL Produktion und Vertrieb von elektronischen Systemen generates revenue primarily through two segments: €98.96 million from Systems and €175.39 million from Displays.

Dividend Yield: 6.3%

DATA MODUL's recent financial performance shows a dip in quarterly and annual sales and net income, with first-quarter sales falling to €63.53 million from €72.41 million year-over-year, and net income decreasing to €2.74 million from €3.31 million. Despite this downturn, the company maintains a dividend of €0.12 per share, supported by a 50.7% payout ratio and 26.9% cash payout ratio, indicating reasonable coverage by earnings and cash flows respectively. However, its dividend history is marked by volatility and unreliability over the past decade.

Key Takeaways

Get an in-depth perspective on all 32 Top Dividend Stocks by using our screener here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:BNRXTRA:CRZK and XTRA:DAM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance