Top Dividend Stocks In Hong Kong For June 2024

As global markets navigate through mixed economic signals, Hong Kong's market shows resilience, marked by a modest uptick in the Hang Seng Index and robust retail sales growth. In such an environment, dividend stocks in Hong Kong could offer investors a blend of stability and potential income amid prevailing uncertainties.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.38% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.88% | ★★★★★★ |

China Construction Bank (SEHK:939) | 7.44% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 8.84% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 8.40% | ★★★★★☆ |

Playmates Toys (SEHK:869) | 9.09% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.62% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.46% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.10% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.75% | ★★★★★☆ |

Click here to see the full list of 92 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

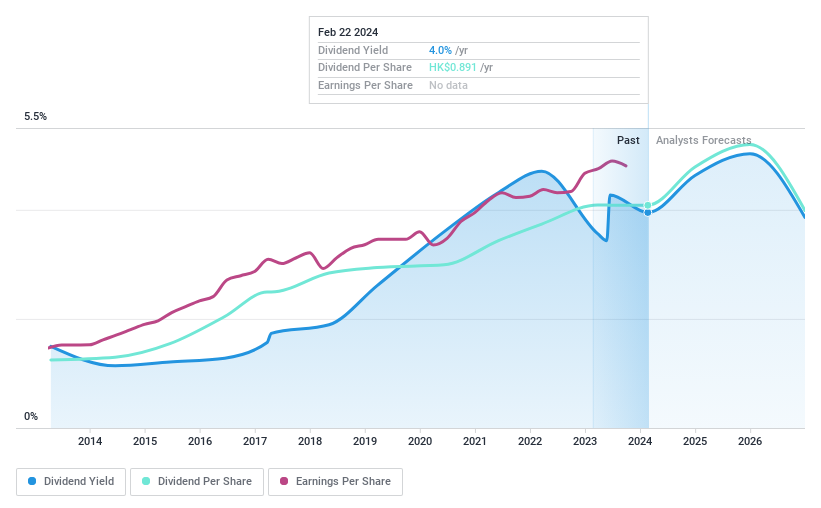

Sinopharm Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sinopharm Group Co. Ltd. operates primarily in the wholesale and retail of pharmaceuticals, medical devices, and healthcare products across the People's Republic of China, with a market capitalization of approximately HK$68.34 billion.

Operations: Sinopharm Group Co. Ltd. generates its revenue primarily from the sale of pharmaceuticals, medical devices, and healthcare products throughout China.

Dividend Yield: 4.1%

Sinopharm Group, a notable player in the Hong Kong dividend stock arena, declared a final dividend of RMB 0.87 per share for FY 2023, with payment due on 13 August 2024. Despite a slight dip in Q1 2024 net income to CNY 1.42 billion from CNY 1.59 billion year-over-year, the company maintains robust annual sales growth and a stable dividend history over the past decade. The dividends are well-covered by earnings and cash flows, with payout ratios of approximately 30.6% and cash payout ratios around 31.8%, respectively, signaling sustainable payouts despite competitive pressures and market volatility.

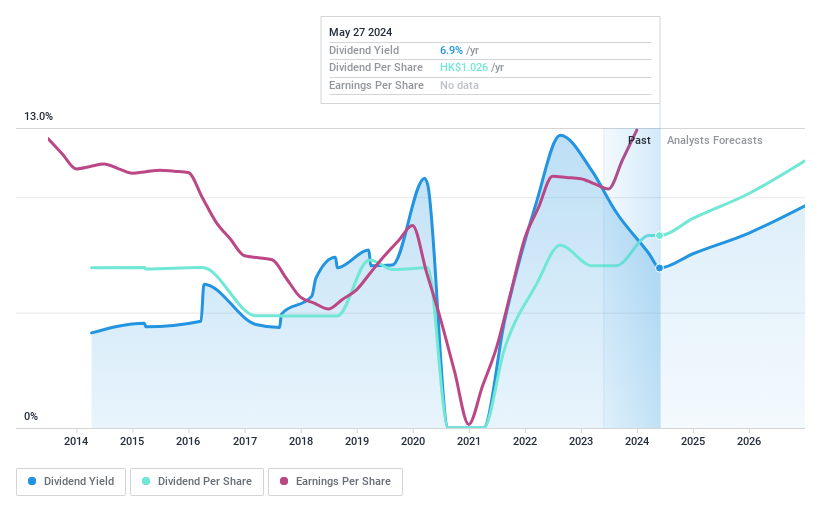

Stella International Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Stella International Holdings Limited is an investment holding company that specializes in the development, manufacture, and sale of footwear products and leather goods across North America, Europe, Asia, and other international markets, with a market capitalization of approximately HK$11.44 billion.

Operations: Stella International Holdings Limited generates revenue primarily through its manufacturing segment, which accounted for $1.49 billion, and a smaller contribution from retailing and wholesaling at $4.61 million.

Dividend Yield: 6.8%

Stella International Holdings, while trading 20.2% below estimated fair value, exhibits a mixed dividend profile. The company's dividends are supported by a payout ratio of 74.1% and a cash payout ratio of 61.6%, indicating reasonable coverage by earnings and cash flows respectively. However, its dividend history over the past decade has been volatile, with unreliable payment patterns that may concern conservative dividend investors seeking stability. Recent activities include presentations at the Macquarie Asia Conference and an AGM in April 2024, highlighting ongoing corporate engagements.

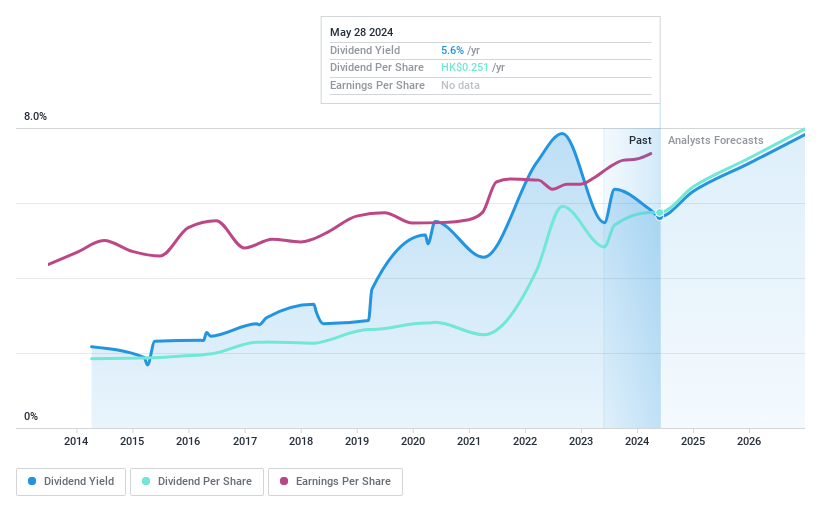

China Telecom

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Telecom Corporation Limited operates primarily in the People's Republic of China, offering wireline and mobile telecommunications services through its subsidiaries, with a market capitalization of approximately HK$547.27 billion.

Operations: China Telecom Corporation Limited generates CN¥512.75 billion from its integrated telecommunications business.

Dividend Yield: 5.7%

China Telecom, with a recent dividend proposal of RMB 0.09 per share, shows a mixed picture for reliability in its dividend history, marked by volatility over the past decade. Despite this, dividends are reasonably covered by both earnings and cash flows, with payout ratios of 68.7% and 52.9% respectively. The company's earnings have grown by 9.5% over the past year and are expected to increase further at an annual rate of 7.41%. Recent executive changes and active participation in industry conferences underscore ongoing operational shifts and market engagement.

Make It Happen

Gain an insight into the universe of 92 Top Dividend Stocks by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1099SEHK:1836SEHK:728 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance