Three TSX Growth Companies With At Least 19% Insider Ownership

Amidst a backdrop of cautious interest rate cuts by the Bank of Canada and a pause from the Federal Reserve, Canadian consumers are showing signs of fatigue even as spending remains robust. This mixed economic sentiment, marked by rising stock market and housing prices alongside increasing pressures on low-income consumers, sets a complex stage for investors. In such an environment, growth companies with high insider ownership can be particularly compelling as these insiders may be better positioned to navigate through uncertain economic terrains due to their vested interests and deep understanding of their companies.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Vox Royalty (TSX:VOXR) | 12.3% | 58.7% |

Payfare (TSX:PAY) | 15% | 46.7% |

goeasy (TSX:GSY) | 21.5% | 15.8% |

Propel Holdings (TSX:PRL) | 40% | 36.4% |

Allied Gold (TSX:AAUC) | 22.5% | 68.2% |

Aritzia (TSX:ATZ) | 19.1% | 51.2% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Ivanhoe Mines (TSX:IVN) | 13% | 66.3% |

Magna Mining (TSXV:NICU) | 10.6% | 95.1% |

Artemis Gold (TSXV:ARTG) | 32.1% | 48.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Allied Gold

Simply Wall St Growth Rating: ★★★★★☆

Overview: Allied Gold Corporation, operating in Africa, focuses on the exploration and production of mineral deposits with a market capitalization of approximately CA$0.75 billion.

Operations: The company's revenue is generated from three mines: Agbaou Mine at CA$141.39 million, Bonikro Mine at CA$192.71 million, and Sadiola Mine at CA$342.34 million.

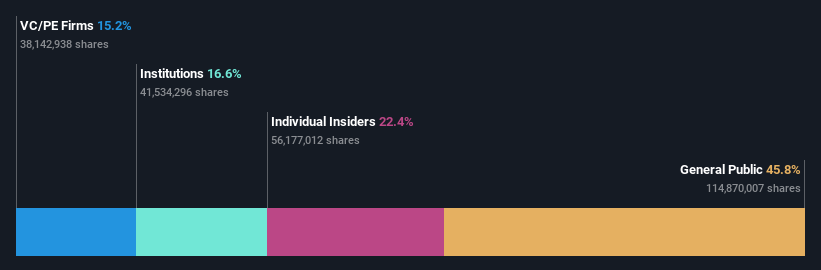

Insider Ownership: 22.5%

Allied Gold, with high insider ownership, is poised for notable growth. Recently, the company reaffirmed its production guidance for 2024 and projected significant increases through 2026. First quarter results showed a substantial improvement in earnings and a slight increase in gold sales year-over-year. Insider activity has been positive with more buying than selling over the past three months, indicating confidence from those closest to the company's operations. Analysts predict a strong rise in stock price and an above-average profit growth forecast over the next three years, underscoring Allied Gold's potential amid operational advancements and strategic exploration successes at key projects like Kurmuk.

Unlock comprehensive insights into our analysis of Allied Gold stock in this growth report.

Upon reviewing our latest valuation report, Allied Gold's share price might be too pessimistic.

Savaria

Simply Wall St Growth Rating: ★★★★☆☆

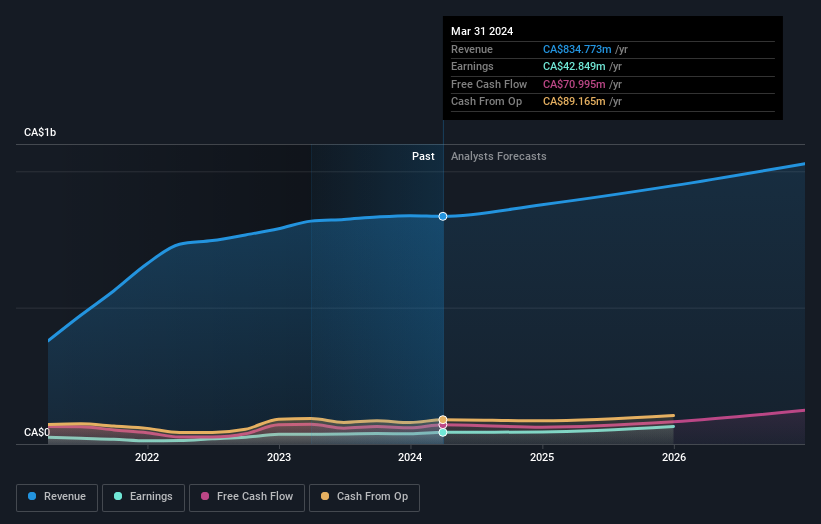

Overview: Savaria Corporation specializes in accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally, with a market capitalization of approximately CA$1.27 billion.

Operations: The company generates revenue primarily through its Patient Care segment, which accounted for CA$183.82 million.

Insider Ownership: 19.6%

Savaria, a growth company with high insider ownership in Canada, is demonstrating robust financial health and strategic board enhancements. The firm's earnings are projected to grow significantly at 24.9% annually over the next three years, outpacing the Canadian market forecast of 14.7%. Recent insider buying trends underscore confidence from within, complemented by a stable dividend policy as evidenced by consistent monthly declarations. Moreover, the addition of Pernilla Lindén to the board introduces valuable international financial expertise to support ongoing and future growth initiatives.

Click here and access our complete growth analysis report to understand the dynamics of Savaria.

Our expertly prepared valuation report Savaria implies its share price may be lower than expected.

Artemis Gold

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company engaged in identifying, acquiring, and developing gold properties, with a market capitalization of approximately CA$2.04 billion.

Operations: The company primarily generates revenue through the identification, acquisition, and development of gold properties.

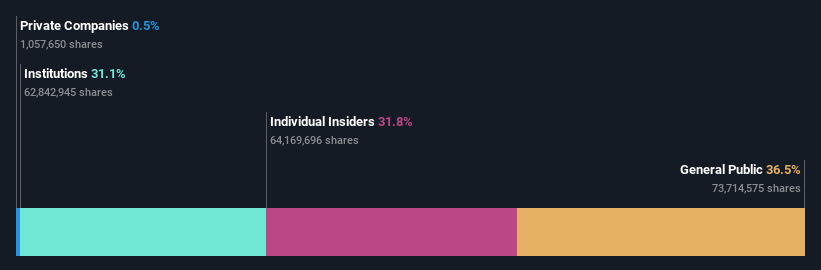

Insider Ownership: 32.1%

Artemis Gold, a Canadian growth company with high insider ownership, is navigating through financial challenges with a net loss of CA$6.65 million in Q1 2024 but remains on track with its Blackwater Mine project, which is 73% complete and fully funded within the initial budget of CA$730 to CA$750 million. Insider activities show more buying than selling, albeit not in substantial volumes. The company's revenue and earnings are expected to grow significantly over the next three years, outpacing market averages.

Seize The Opportunity

Click this link to deep-dive into the 29 companies within our Fast Growing TSX Companies With High Insider Ownership screener.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:AAUC TSX:SIS and TSXV:ARTG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance