Three Growth Stocks On SIX Swiss Exchange With Up To 17% Insider Ownership

The Swiss market experienced a downturn on Friday, with the SMI index closing lower amid widespread concerns about global economic growth. This recent pullback highlights the importance of focusing on fundamentally strong companies, particularly those with high insider ownership which can signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Switzerland

Name | Insider Ownership | Earnings Growth |

Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

VAT Group (SWX:VACN) | 10.2% | 21.2% |

Straumann Holding (SWX:STMN) | 32.7% | 21% |

Swissquote Group Holding (SWX:SQN) | 11.4% | 14.0% |

Temenos (SWX:TEMN) | 17.4% | 14.7% |

Sonova Holding (SWX:SOON) | 17.7% | 9.9% |

Partners Group Holding (SWX:PGHN) | 17.1% | 13.7% |

Sensirion Holding (SWX:SENS) | 20.7% | 79.9% |

SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Underneath we present a selection of stocks filtered out by our screen.

Swissquote Group Holding

Simply Wall St Growth Rating: ★★★★☆☆

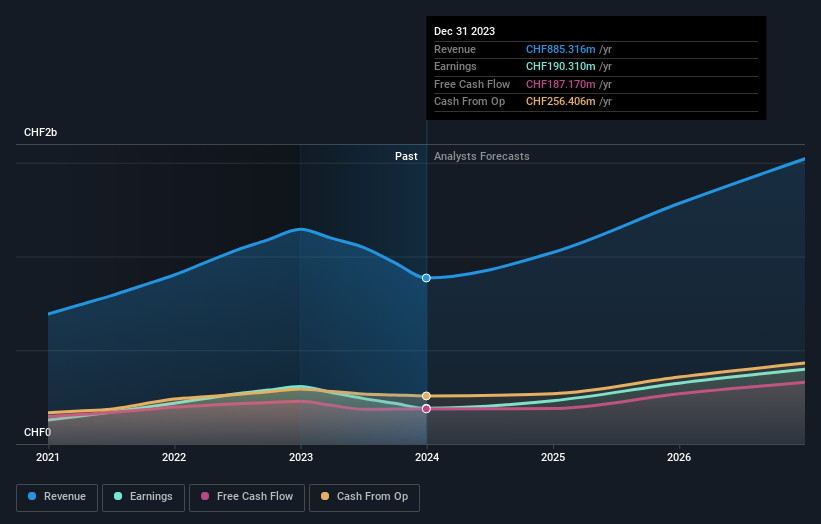

Overview: Swissquote Group Holding Ltd operates globally, offering a range of online financial services to retail, affluent, and professional institutional clients with a market capitalization of CHF 4.22 billion.

Operations: The company generates revenue primarily through leveraged Forex and securities trading, totaling CHF 101.09 million and CHF 429.78 million respectively.

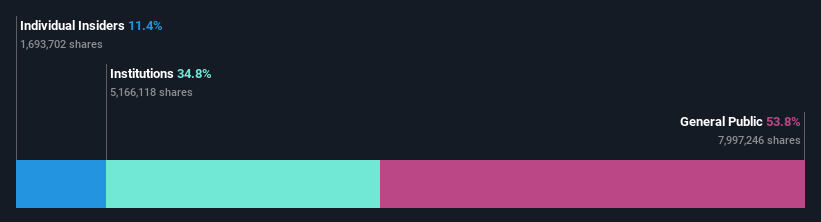

Insider Ownership: 11.4%

Swissquote Group Holding is poised for steady growth with earnings expected to increase by 13.96% annually and revenue forecasted to grow at 10.3% per year, outpacing the Swiss market's 4.4%. Despite trading at a 21.8% discount to its estimated fair value, the company's return on equity is projected to reach a robust 23.1% in three years, signaling strong profitability ahead. However, its annual profit growth, while above market average at 14%, isn't considered significantly high.

Temenos

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a global provider of integrated banking software systems to financial institutions, with a market capitalization of approximately CHF 4.42 billion.

Operations: The firm generates revenue by selling integrated banking software systems to financial institutions globally.

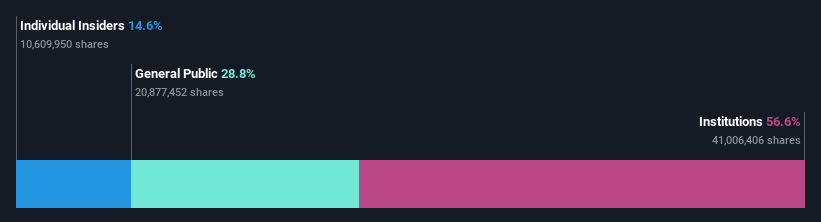

Insider Ownership: 17.4%

Temenos, a Swiss-based growth company with high insider ownership, recently announced a CHF 200 million share buyback program aimed at capital reduction, signaling confidence from management. The company is also enhancing its technological edge; it showcased significant sustainability improvements and efficiency in its cloud-native banking platforms. Despite these positive developments, Temenos's revenue growth forecast (7.6% per year) lags behind more aggressive market benchmarks. Moreover, while the firm maintains a strong projected return on equity of 25.9%, it faces challenges such as high debt levels and share price volatility which could impact investor sentiment.

Click to explore a detailed breakdown of our findings in Temenos' earnings growth report.

Upon reviewing our latest valuation report, Temenos' share price might be too pessimistic.

VAT Group

Simply Wall St Growth Rating: ★★★★★☆

Overview: VAT Group AG operates globally, focusing on the development, manufacture, and supply of vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows with a market capitalization of approximately CHF 14.98 billion.

Operations: The company generates CHF 782.74 million from its Valves segment and CHF 172.87 million from Global Service.

Insider Ownership: 10.2%

VAT Group, a Swiss growth company with high insider ownership, is poised for robust expansion with earnings expected to increase by 21.17% annually and revenue forecasted to grow at 15.5% per year, outpacing the Swiss market's average. Despite not reaching the high growth benchmark of 20% in revenue, its projected return on equity stands impressively at 39.1%. Recent activities include a presentation at the Berenberg European Conference and a Q1 sales statement call, underscoring active engagement and optimistic outlooks from management.

Click here and access our complete growth analysis report to understand the dynamics of VAT Group.

The valuation report we've compiled suggests that VAT Group's current price could be inflated.

Where To Now?

Discover the full array of 16 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership right here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SWX:SQN SWX:TEMN and SWX:VACN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance