Swedish Exchange Highlights: Lime Technologies And Two More Stocks Seemingly Priced Below Estimated True Value

As global markets exhibit mixed signals with regions like Europe showing signs of economic stabilization and Asia facing varied challenges, Sweden's market presents unique opportunities for investors seeking value. In this context, identifying undervalued stocks such as Lime Technologies becomes crucial, especially when broader market trends suggest a potential for overlooked gems in stable economies.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

Name | Current Price | Fair Value (Est) | Discount (Est) |

Björn Borg (OM:BORG) | SEK55.60 | SEK102.20 | 45.6% |

Boule Diagnostics (OM:BOUL) | SEK10.80 | SEK21.06 | 48.7% |

Nordic Waterproofing Holding (OM:NWG) | SEK161.80 | SEK297.13 | 45.5% |

Alleima (OM:ALLEI) | SEK70.60 | SEK127.84 | 44.8% |

Net Insight (OM:NETI B) | SEK5.02 | SEK9.84 | 49% |

Nolato (OM:NOLA B) | SEK58.35 | SEK111.73 | 47.8% |

MilDef Group (OM:MILDEF) | SEK68.50 | SEK132.01 | 48.1% |

Humble Group (OM:HUMBLE) | SEK10.11 | SEK19.51 | 48.2% |

Hexatronic Group (OM:HTRO) | SEK49.85 | SEK98.83 | 49.6% |

Gigasun (OM:GIGA) | SEK3.95 | SEK7.58 | 47.9% |

We'll examine a selection from our screener results

Lime Technologies

Overview: Lime Technologies AB specializes in providing SaaS-based customer relationship management (CRM) solutions across the Nordic region, with a market capitalization of approximately SEK 4.36 billion.

Operations: The company generates its revenue primarily from selling and implementing CRM systems, amounting to SEK 601.83 million.

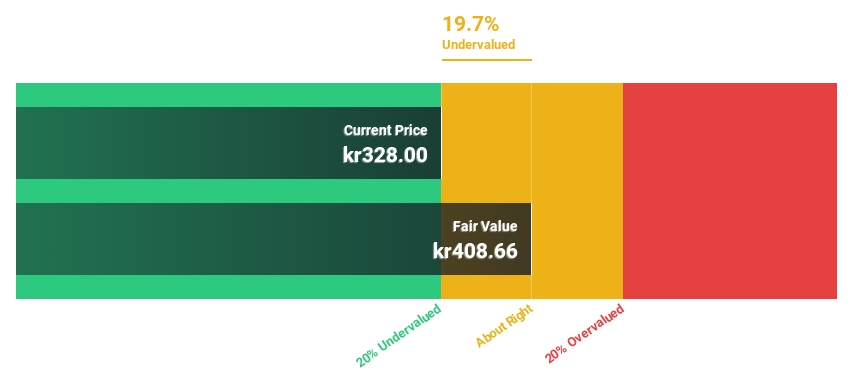

Estimated Discount To Fair Value: 19.7%

Lime Technologies, priced at SEK 328, is currently trading below its estimated fair value of SEK 408.66, suggesting undervaluation. The company's earnings have demonstrated robust growth of 17.6% annually over the past five years and are expected to increase by 21.52% per year moving forward. Despite this strong growth trajectory and a forecasted return on equity significantly higher than the market average, concerns persist due to its high level of debt which could impact financial stability.

Vitrolife

Overview: Vitrolife AB (publ) specializes in offering products for assisted reproduction, with a market capitalization of approximately SEK 23.68 billion.

Operations: The company generates revenue through three primary segments: Consumables (SEK 1.56 billion), Technologies (SEK 649 million), and Genetic Services (SEK 1.29 billion).

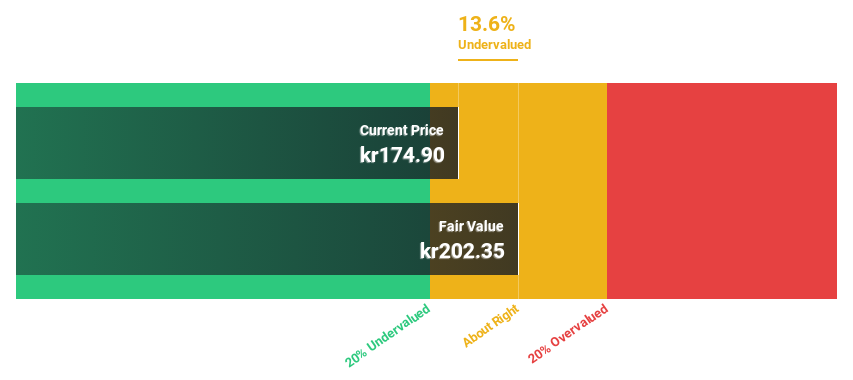

Estimated Discount To Fair Value: 13.6%

Vitrolife, priced at SEK 174.9, trades below its fair value of SEK 202.35, indicating potential undervaluation. Analysts forecast a significant earnings growth and expect the company to become profitable within three years, with revenue growth projections outpacing the Swedish market average. However, its forecasted return on equity remains low at 5%, suggesting potential challenges in generating shareholder returns relative to equity used. Recent dividends and positive earnings updates underscore its financial improvements yet highlight areas for caution.

Xvivo Perfusion

Overview: Xvivo Perfusion AB is a Sweden-based medical technology company specializing in machines and solutions for evaluating and maintaining transplantable organs, with operations spanning across the Americas, Europe, the Middle East, Africa, Asia Pacific, and Oceania; it has a market capitalization of SEK 13.34 billion.

Operations: The company generates revenue through its Services segment (SEK 81.13 million), Thoracic segment (SEK 414.34 million), and Abdominal segment (SEK 147.49 million).

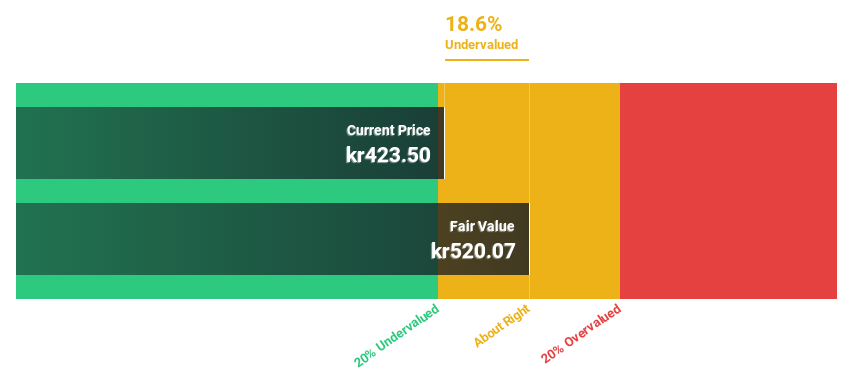

Estimated Discount To Fair Value: 18.6%

Xvivo Perfusion, with a current price of SEK 423.5 against a fair value estimate of SEK 520.07, appears undervalued based on cash flows. The company's earnings are expected to grow by 36.3% annually, outpacing the Swedish market forecast of 13.9%. Despite this strong growth projection, its return on equity is anticipated to be low at 8.6% in three years, which may concern equity investors looking for higher returns on invested capital.

Taking Advantage

Reveal the 46 hidden gems among our Undervalued Swedish Stocks Based On Cash Flows screener with a single click here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:LIME OM:VITR and OM:XVIVO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance