SGX Dividend Stocks Offering Yields From 4.1% To 9.2%

In recent times, the Singapore market has shown resilience amidst global economic challenges, reflecting a robust financial environment that continues to attract investors. Given the current landscape where consumer fraud is on the rise, as evidenced by significant increases in reported losses, dividend stocks could be considered a potentially safer option for those looking to maintain steady income streams from their investments.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

BRC Asia (SGX:BEC) | 7.58% | ★★★★★☆ |

China Sunsine Chemical Holdings (SGX:QES) | 6.34% | ★★★★★☆ |

Civmec (SGX:P9D) | 6.07% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.58% | ★★★★★☆ |

Multi-Chem (SGX:AWZ) | 9.20% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.92% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.84% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.63% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.09% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.77% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

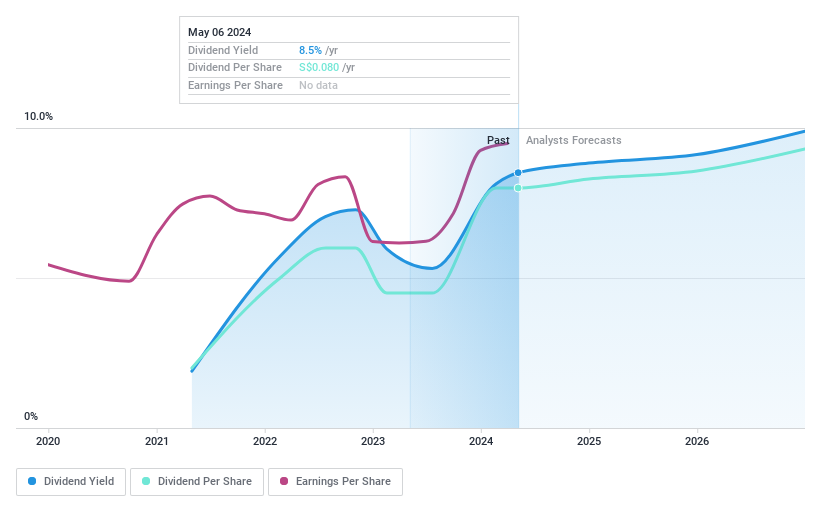

Aztech Global

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aztech Global Ltd. operates in the design, development, and manufacturing of IoT devices, data-communication products, and LED lighting products across various regions including Singapore, North America, China, and Europe with a market capitalization of approximately SGD 0.75 billion.

Operations: Aztech Global Ltd. generates its revenue primarily from the design and production of IoT devices, data-communication products, and LED lighting solutions.

Dividend Yield: 8.2%

Aztech Global recently declared a final dividend of SGD 0.05 per share for FY2023, reflecting a commitment to shareholder returns despite a challenging quarter with sales dropping to SGD 128.6 million from SGD 161.6 million year-over-year. However, the company's net income rose to SGD 15.9 million, supporting a sustainable dividend with earnings and cash flow coverage ratios at 61.7% and 77.9%, respectively. Yet, Aztech's dividend history over the past three years shows inconsistency, raising concerns about future reliability amidst modest earnings growth projections of 7.69% annually.

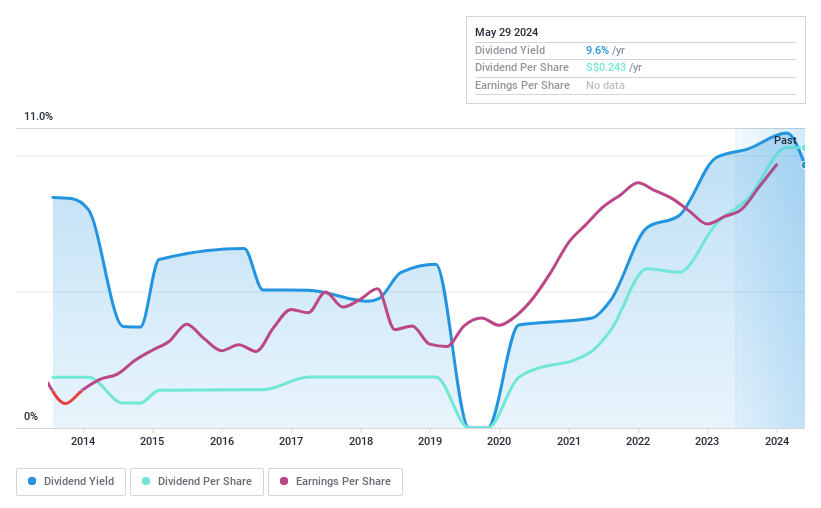

Multi-Chem

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited is an investment holding company that distributes information technology products across Singapore, Greater China, Australia, India, and other international markets with a market capitalization of SGD 231.54 million.

Operations: Multi-Chem Limited generates revenue from its IT business in Singapore (SGD 372.78 million), Australia (SGD 54.60 million), India (SGD 40.56 million), and Greater China (SGD 34.96 million), along with a smaller PCB business segment in Singapore contributing SGD 1.79 million.

Dividend Yield: 9.2%

Multi-Chem's dividend yield stands at a competitive 9.2%, ranking in the top quartile of Singaporean dividend payers. The company's dividends are well-supported by both earnings and cash flows, with payout ratios of 80.7% and 88.1% respectively, indicating a strong coverage that aligns with sustainable payment practices despite a volatile history over the last decade. Recent board changes, including the appointment of Chong Teck Sin as chairman, could signal strategic shifts or stability enhancements going forward.

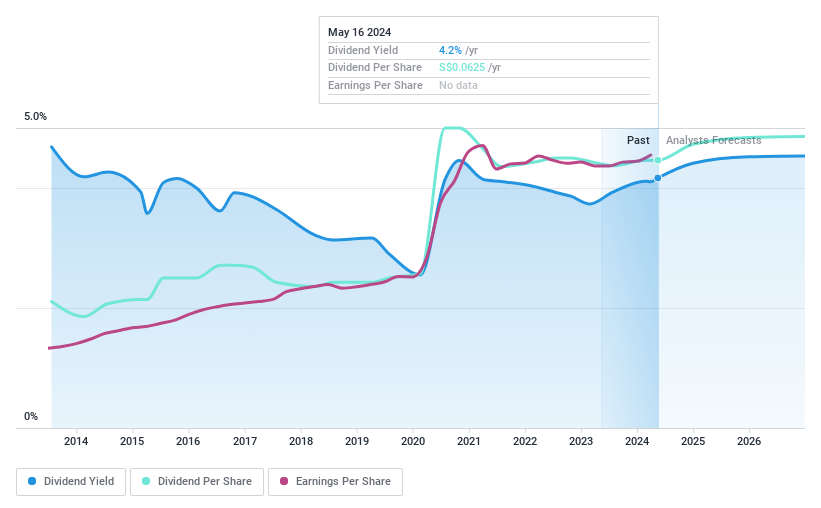

Sheng Siong Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore, with a market capitalization of approximately SGD 2.24 billion.

Operations: Sheng Siong Group Ltd primarily generates its revenue through supermarket operations, which amounted to SGD 1.39 billion from selling consumer goods.

Dividend Yield: 4.2%

Sheng Siong Group's recent financial performance shows a positive trend with first-quarter sales rising to SGD 376.19 million and net income increasing to SGD 36.32 million. The company declared a final dividend of 3.20 cents per share, reflecting a commitment to returning value to shareholders despite its historically unstable dividend track record and lower yield compared to the market's top dividend payers. Recent executive appointments could influence operational efficiency and future growth trajectories, potentially impacting its dividend sustainability and attractiveness as a dividend stock in Singapore's competitive landscape.

Turning Ideas Into Actions

Unlock more gems! Our Top SGX Dividend Stocks screener has unearthed 18 more companies for you to explore.Click here to unveil our expertly curated list of 21 Top SGX Dividend Stocks.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:8AZ SGX:AWZ and SGX:OV8.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance