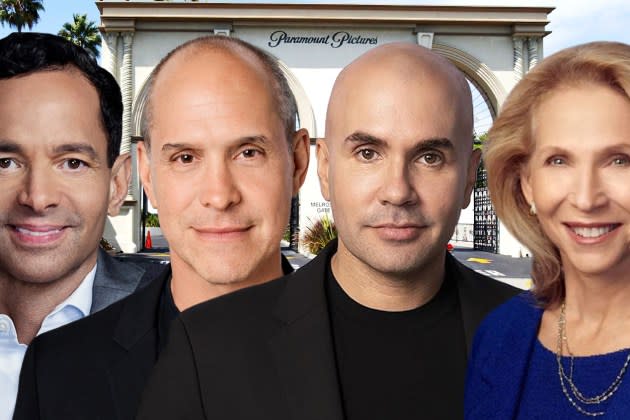

Paramount Global Co-CEOs Reveal Bankers Hired To Sell Assets; Discuss Path Forward At Town Hall

After rejecting Skydance’s offer to merge two weeks ago, Paramount Global new co-CEO troika of Brian Robbins, George Cheeks and Chris McCarthy told a packed company town hall of 500 at the studio’s Melrose Lot Paramount Theater what progress has been made since the annual shareholders meeting three weeks ago, and what the company’s path will be going forward. In sum, bankers have been hired to explore the sale of “certain Paramount owned assets” per Cheeks, while layoffs are on the horizon as the conglom looks to achieve a half billion in cost savings.

Paramount Global controlling shareholder Shari Redstone was not part of today’s town hall, we hear, which clocked about an hour with 15 to 20 minutes of Q&A.

More from Deadline

The Town Hall was originally scheduled three weeks ago but was delayed when it appeared the entertainment conglomerate was seriously weighing an offer from David Ellison’s Skydance.

At the top of today’s town hall, Robbins exclaimed, “We’d like to take a moment to acknowledge the challenges of all the M&A speculation surrounding our company. We know what a difficult and disruptive period it has been. And while we cannot say that the noise will disappear, we are here today to lay out a go-forward plan that can set us up for success no matter what path the company chooses to go down.”

The trio were frank with employees about cuts and the elimination of duplicated jobs that will occur. This was one of the three pillars of Paramount Global’s plan to ratchet up profits. The conglom says it is transforming the cost base of the company with work underway across corporate functions like legal and corporate marketing. The execs trumpeted that while revenue spiked by 13% between 2018 and 2023, OIBDA declined 61% over the same period.

McCarthy added, “Let me be clear….a 61% decline in profits is simply unacceptable…..we need to act now to reverse this trend.”

Cheeks emphasized that the conglom has definite plans to unload “certain Paramount owned assets” and has “already hired bankers to assist us in this process – and we’ll use the proceeds to help pay down debt and strengthen our balance sheet.” The no-brainer in regards of a sale is BET, which we’ve heard has operated largely autonomously from the rest of Paramount Global.

RELATED: Paramount’s Shari Redstone Juggling Skydance, Other Suitors As Deal Saga Continues

The trio echoed what they mentioned earlier at the annual shareholders meeting: that a plan is underway to find a strategic partner for Paramount+, especially as they try to make up for linear declines at the company. In regards to accomplishments made since that announcement, McCarthy specified that was in “International – we are advancing talks with potential partners that will significantly transform the scale and economics of the service making it profitable and driving long term value. This approach could also serve as a model for the U.S.”

Former Paramount Global CEO Bob Bakish was acknowledged at the town hall for his efforts at the company.

There’s been a lot going on in Paramount land. This Friday, the studio releases the third installment in their blockbuster A Quiet Place series, A Quiet Place: Day One with an eye at a $42M, possibly even $50M start. The world premiere for that John Krasinski production is tomorrow in New York City.

Amid news following the shareholder meeting earlier this month that the studio is looking for a joint venture partner on streaming service Paramount+, it was announced that a price hike would take effect, with and without a Showtime tier, later this summer. In sum, the Showtime plan upticks by a buck to $12.99/month for both existing and new customers, while the monthly cost of the Paramount+ Essential plan will shoot up $2 to $7.99/month for all new subscribers. The Paramount+ Limited Commercial Plan is increasing $1 to $7.99 for current subs.

Comments today by the three co-CEOS echoed and expanded on talk at the company’s recent shareholders meeting and a memo to staff where they described plans, including streamlining, cost cuts, divesting some businesses and prioritizing others.

The town hall had been delayed in the midst of merger talks. It comes after Paramount recently emerged from an M&A scrum with David Ellison’s Skydance that had staff and senior executives on edge for months. Protracted negotiations ended with a thud earlier in June when Par’s controlling shareholder Shari Redstone pulled out at the eleventh hour and her family holding company National Amusements saying the sides hadn’t been able to reach mutually acceptable terms. Paramount shares hit an all-time low in the wake, falling below $9. They’ve perked up a bit since and are changing hands today at about $10.

Redstone didn’t address the troops today.

The Skydance deal proved complicated since it involved a sale of her controlling stake in Par, then a merger of the two companies. Shareholders put up a fuss. There were said to be other issues beyond the economic terms of the deal, like whether Paramount should hold a vote of minority shareholders, and how the company would be run until the transaction closed.

RELATED: Paramount Global Non-Exec Chair Shari Redstone Touts Office Of CEO During Annual Shareholder Meeting

Redstone is now said to be considering two simpler options that would involve only a change in control, with her selling her National Amusements stake. Edgar Bronfman Jr., backed by Bain Capital, had expressed interest, as had a consortium of investors led by producer Steven Paul.

Whether and when Redstone makes a move depends in large part on NAI’s finances. The holding company took a hit when Paramount reduced its dividend. And it also owns the National Amusement movie theater chain, which has been struggling with the rest of the industry and selling off real estate.

NAI has about $200 million outstanding on its term loan following a $35 million prepayment in March. Big ratings agency S&P last month estimated adjusted EBITDA of negative $40 million in 2024 and FOCF of negative $50 million (respectively, earnings before interest, taxes, depreciation and amortization, and free operating cash flow). “We believe this means the company’s capital structure is currently unsustainable due to roughly $18 million in annual cash interest payments,” it said.

“If there is no transaction consummated at Paramount before the maturity of NAI’s term loan at the beginning of May 2025, we expect the company would likely need to sell a portion of its Paramount stock to repay the debt or extend its maturity.”

Some Wall Streeters speculated that Redstone might sell a chunk of her Paramount holding, but not all, to raise cash to make debt repayments.

Best of Deadline

Hollywood & Media Deaths In 2024: Photo Gallery & Obituaries

2024 Premiere Dates For New & Returning Series On Broadcast, Cable & Streaming

Sign up for Deadline's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo Finance

Yahoo Finance