Mosaic's (MOS) April and May Sales Volume and Revenues Down

The Mosaic Company MOS disclosed its combined sales volumes and revenues by business unit for April and May 2024. During this period, potash sales volume reached 1,314,000 tons, down from 1,617,000 tons reported in the year-ago period. Revenues dropped to $371 million from $672 million posted a year ago.

For the second quarter, potash sales volumes are expected to be between 2.2 and 2.4 million tons, with MOP prices at the mine projected to range from $210 to $250 per ton.

In April and May 2024, phosphate sales volume totaled 932,000 tons, down from 1,329,000 tons recorded during the same period in 2023. Revenues for phosphates also fell, reaching $671 million compared with $948 million in the previous year.

For the second quarter, phosphate sales volumes are anticipated to be between 1.6 and 1.8 million tons, with DAP prices at the mine expected to be in the range of $530-$580 per ton.

Mosaic Fertilizantes experienced a decline in sales volumes from 1,305,000 tons in April and May 2023 to 1,237,000 tons in the same period of 2024. Revenues dropped from $791 million to $606 million.

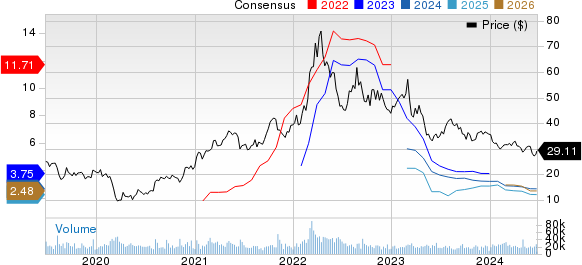

Shares of Mosaic have lost 15.3% in the past year compared with an 18.7% decline of the industry.

Image Source: Zacks Investment Research

Mosaic reported earnings of 14 cents per share in first-quarter 2024, down from $1.28 recorded in the same quarter last year. Excluding one-time items, adjusted earnings per share were 65 cents, surpassing the Zacks Consensus Estimate of 60 cents. However, net sales fell nearly 26% year over year to $2,679.4 million, missing the Zacks Consensus Estimate of $2,825.7 million.

In the Potash segment, net sales declined nearly 29% to $643 million, despite a 16% increase in sales volumes to 2.2 million tons. The Phosphate division’s net sales fell 14% to $1.2 billion, with sales volumes plunging to 1.6 million tons from 1.8 million tons a year ago. The Mosaic Fertilizantes segment experienced a 32% drop in net sales to $886 million, with sales volume nosediving 19% to 1.7 million tons.

The Mosaic Company Price and Consensus

The Mosaic Company price-consensus-chart | The Mosaic Company Quote

Zacks Rank & Key Picks

Mosaic currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS, ATI Inc. ATI and Ecolab Inc. ECL. While Carpenter Technology and ATI each sport a Zacks Rank #1 (Strong Buy), Ecolab carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CRS’s current-year earnings is pegged at $4.31, indicating a year-over-year surge of 278%. CRS’ earnings beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, the average earnings surprise being 15.1%. The company’s shares have soared 90% in the past year.

ATI’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average earnings surprise being 8.34%, on average. The stock has rallied 34.8% in the past year.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59, indicating a rise of 26.5% from the year-ago levels. ECL beat the consensus estimate in each of the last four quarters, the average earnings surprise being 1.3%. The stock has rallied nearly 35.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance