Louisiana-Pacific's (LPX) Stock Rallies 21% YTD: Here's Why

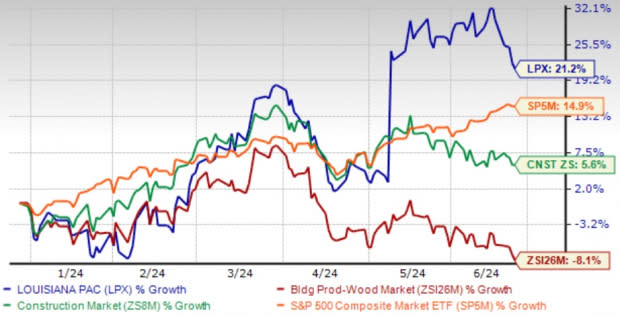

Louisiana-Pacific Corporation LPX or LP’s stock has rallied so far this year despite the industry’s collective decline. The company’s shares have gained 21.2% in the year-to-date period against the Zacks Building Products – Wood industry’s 8.1% decline.

The Zacks Construction sector and S&P 500 Index gained 5.6% and 14.9%, respectively, in the year-to-date period.

LP’s efforts to increase penetration of Siding products in repair/remodeling and the rollout of SmartSide products are major boosts to the company’s recent performance.

Image Source: Zacks Investment Research

The company’s strategic business transformation efforts, effective cash management and inorganic moves are added positives despite persistent inflationary pressure and higher marketing costs.

A Quick Glance at Estimates & Historical Performance

Earnings per share (EPS) estimates for 2024 have moved up to $5.79 from $4.47 in the past 60 days, reflecting 79.8% year-over-year growth. Revenues are also estimated to grow 17% from the previous year.

The company also has an impressive earnings surprise history, having topped the consensus estimate in three of the trailing four quarters and missed once, with an average of 18.6%.

In the last reported quarter, both EPS and net sales beat their respective Zacks Consensus Estimate and rose on a year-over-year basis. The impressive first-quarter 2024 performance was primarily propelled by several key factors. Notably, there was a prominent surge in demand for Siding and OSB, highlighted by a significant increase in volume. Record-breaking volumes for ExpertFinish and BuilderSeries were achieved, underscoring the robust market appetite. Moreover, higher commodity prices and enhanced operational efficiency drove margins during this period.

Adding more to the blissfulness, LP has a Momentum Score of A, which means the company will continue to outperform its industry in the future.

Let's discuss the factors that are supporting these impressive numbers and future outperformance in detail.

Solid Siding Demand to Aid Business

LP has been increasing the penetration of Siding products in repair/remodeling and rolling out SmartSide products. Siding is less sensitive to new housing market cyclicality as more than 50% of Siding Solutions’ demand comes from other markets like sheds and repair and remodeling. LP believes that long-term market trends and demographics indicate continued growth in demand for sustainable engineered wood siding in these markets.

The company has been witnessing higher-than-expected demand for Smooth SmartSide and ExpertFinish. It also exited the fiber product line to focus on higher-margin SmartSide strand products.

Under the unit, the ExpertFinish product witnessed 9% volume growth in the first quarter of 2024, the same as the prior-year quarter. During the International Builders' Show in Las Vegas in February 2024, LP showcased its newly launched products, including Brushed Smooth, Trim and Siding, Pebbled Stucco Panels and Nickel Gap, to name a few. The inclusion of these products into its product portfolio will add to the ongoing price mix uplift of ExpertFinish and help drive growth in new residential construction and Repair & Remodel.

The steadfast demand for SmartSide and Structural Solutions has persisted into the second quarter of 2024, further bolstering the positive outlook. LP is confidently revising its projections upward for both the second quarter and full-year 2024, reflecting the substantial momentum derived from these driving forces.

Solid Q2 & 2024 Guidance

For the second quarter of 2024, the company expects Siding Solutions’ revenues to grow 20-25% from the year-ago period. It anticipates a consolidated adjusted EBITDA of $220-$240 million, of this, $95-$105 million is likely to be contributed by Siding, and $125-$135 million is likely to be added by OSB.

For 2024, the company now expects Siding Solutions’ revenues to rise 11-13% from 2023 versus an earlier projection of 8-10%. LP now projects a consolidated adjusted EBITDA of $655-$685 million, of this, $340-$360 million is likely to be contributed by Siding, and $315-$325 million is likely to be added by OSB. Earlier, LP had expected a consolidated adjusted EBITDA of $495-$525 million, of this, $280-$300 million was from Siding, and $215-$225 million from OSB.

Cost Saving & Business Expansion Initiatives

LP is gradually transforming from a commodity producer to a more stable, cash-generative business by increasing revenues and EBITDA mix. On that note, it has been increasing the efficiency of its mills by improving productivity, run time and quality through overall equipment effectiveness or OEE initiatives, applying best practices to the supply chain and optimizing infrastructure costs.

LP achieved $1.2 billion growth in adjusted EBITDA from 2019 to 2022. Owing to the improving trend, for 2024, LP now expects adjusted EBITDA between $655 million and $685 million, notably up from the prior expected range of $495-$525 million.

Louisiana-Pacific’s business banks on acquisitions, business combinations and divestitures of low-profitable businesses. LP inked a deal with Forex to acquire the Wawa OSB mill. Post-completion, Wawa will become LP’s largest single-line siding mill, adding nearly 400 million square feet of capacity. This will bring the total siding capacity to about 2.7 billion square feet. LP believes this deal will generate solid returns in the future.

Impressive Shareholders’ Return

Louisiana-Pacific has been consistently enhancing shareholders’ returns through share repurchases and dividends. During the first quarter of 2024, the company’s board of directors authorized an additional $250 million to repurchase its common stock, thereby bringing the total authorization for stock repurchases to $400 million. Furthermore, in the first quarter, LP paid a total of $19 million in cash dividends.

On Feb 9, 2024, it hiked quarterly cash dividends by 8.3% to 26 cents per share. The company had committed to return over time to its shareholders at least 50% of cash flow from operations in excess of capital expenditures to sustain core business, as well as grow Siding and value-added OSB.

Zacks Rank and Other Key Picks

Currently, Louisiana-Pacific sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks from the Zacks Construction sector:

EMCOR Group, Inc. EME presently flaunts a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 32%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for EME’s 2024 EPS indicates an improvement of 20.7% from the prior-year levels. The estimated figure moved up to $16.10 from $14.50 over the past 60 days.

Granite Construction, Inc. GVA, a Zacks Rank #1 company, is the largest diversified infrastructure firm in the United States. It has a trailing four-quarter earnings surprise of 24.7%, on average.

The consensus estimate for GVA’s 2024 EPS is expected to climb 51.6% year over year. The estimated figure moved up to $4.76 from $4.29 over the past 60 days.

Primoris Services Corporation PRIM currently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 152.4%, on average.

The consensus estimate for PRIM’s 2024 EPS is expected to decline 6.3% year over year. Nonetheless, the estimated figure moved up to $2.67 from $2.61 over the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Louisiana-Pacific Corporation (LPX) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Primoris Services Corporation (PRIM) : Free Stock Analysis Report

Granite Construction Incorporated (GVA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance