High Insider Ownership Growth Companies On SEHK June 2024

Amidst a backdrop of fluctuating global markets, the Hong Kong stock market has shown resilience with the Hang Seng Index posting modest gains. This environment underscores the potential stability offered by growth companies with high insider ownership on the SEHK, which may appeal to investors looking for aligned interests between company management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

Fenbi (SEHK:2469) | 32.5% | 43% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

Tian Tu Capital (SEHK:1973) | 33.9% | 70.5% |

DPC Dash (SEHK:1405) | 38.2% | 89.7% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 76.5% |

Beijing Airdoc Technology (SEHK:2251) | 28.2% | 83.9% |

Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

Let's review some notable picks from our screened stocks.

BYD

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited operates in the automobile and battery sectors across China, including Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$745.91 billion.

Operations: The company generates revenue primarily from its automobile and battery sectors across various regions.

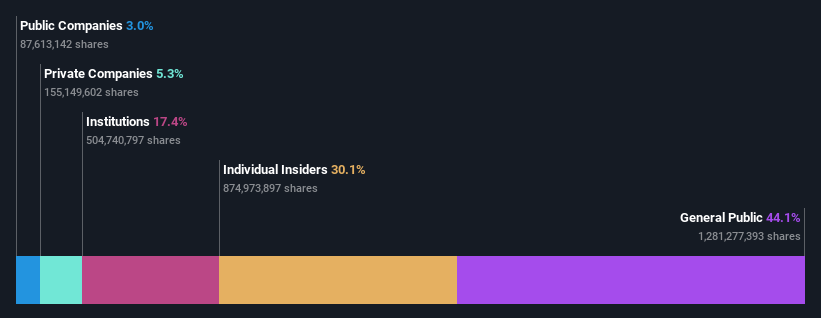

Insider Ownership: 30.1%

Revenue Growth Forecast: 14.1% p.a.

BYD, a prominent growth company in Hong Kong with substantial insider ownership, has demonstrated robust performance and strategic initiatives. Recently, it reported significant year-over-year increases in monthly and annual production and sales volumes, indicating strong operational momentum. The company also increased dividends and approved amendments to its bylaws enhancing corporate governance. These developments reflect a positive trajectory but are balanced by earnings forecasts that suggest moderate future growth compared to the broader market expectations.

Meitu

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meitu, Inc. is an investment holding company that develops image, video, and design products to promote digitalization in the beauty industry, operating both in the People’s Republic of China and internationally, with a market capitalization of HK$12.11 billion.

Operations: The company generates revenue primarily through its Internet Business segment, which amounted to CN¥2.70 billion.

Insider Ownership: 36.6%

Revenue Growth Forecast: 17.7% p.a.

Meitu, a growth-oriented firm in Hong Kong with considerable insider ownership, faces mixed prospects. Despite no substantial insider buying recently and some shareholder dilution last year, Meitu's earnings are expected to grow significantly at 28.9% annually over the next three years, outpacing the local market's 11.6%. However, its forecasted revenue growth at 17.7% annually lags behind the desired 20% benchmark for high-growth entities. Recent board changes and bylaw amendments indicate a focus on strengthening governance and strategic direction.

Adicon Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Adicon Holdings Limited, with a market cap of HK$6.95 billion, operates medical laboratories across the People's Republic of China.

Operations: The company generates CN¥3.30 billion from its healthcare facilities and services segment.

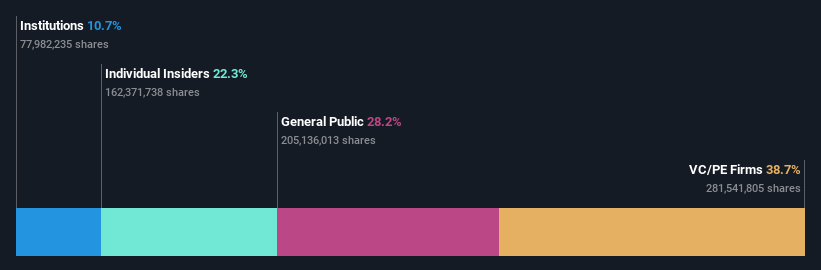

Insider Ownership: 22.3%

Revenue Growth Forecast: 15.2% p.a.

Adicon Holdings, a growth-focused company in Hong Kong with high insider ownership, is set to expand significantly. The company's earnings are expected to grow by 29.6% annually over the next three years, surpassing the local market's forecast of 11.6%. Despite a recent drop in profit margins from 14% to 7.1%, Adicon has initiated a share repurchase program which could enhance shareholder value by potentially increasing net asset value and earnings per share. This strategic move aligns with its robust revenue growth projections of 15.2% annually, outpacing the Hong Kong market average of 7.9%.

Seize The Opportunity

Click through to start exploring the rest of the 50 Fast Growing SEHK Companies With High Insider Ownership now.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:1357 and SEHK:9860.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance