High Insider Ownership Growth Companies On KRX June 2024

The South Korean stock market has recently experienced a downturn, with the KOSPI index showing a decline in two consecutive sessions and technology stocks facing continued profit-taking pressures. Amid these market conditions, companies with high insider ownership can offer unique investment appeal as insiders' substantial equity stakes often align their interests closely with those of shareholders, potentially fostering greater confidence even in turbulent times.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

HANA Micron (KOSDAQ:A067310) | 19.9% | 93.4% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

Devsisters (KOSDAQ:A194480) | 26.7% | 67.5% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

We're going to check out a few of the best picks from our screener tool.

Global Standard Technology

Simply Wall St Growth Rating: ★★★★☆☆

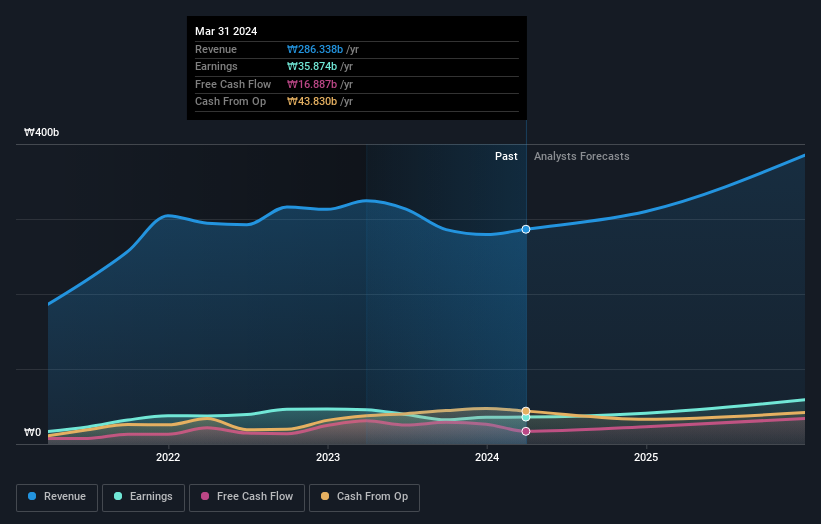

Overview: Global Standard Technology, Limited operates in the environmental and energy sectors both domestically in South Korea and internationally, with a market capitalization of approximately ₩415.57 billion.

Operations: The company's revenue primarily stems from its semiconductor manufacture equipment segment, generating ₩286.34 billion.

Insider Ownership: 23.2%

Return On Equity Forecast: N/A (2027 estimate)

Global Standard Technology, a South Korean company, is set to surpass local market expectations with its revenue growth at 17.5% annually and earnings anticipated to increase by 29.7% each year. Despite its highly volatile share price over the past three months, the stock trades at 25.1% below estimated fair value, presenting a potentially attractive entry point for investors focused on growth companies with high insider ownership in South Korea. However, it has an unstable dividend track record and lacks recent insider trading data.

Dive into the specifics of Global Standard Technology here with our thorough growth forecast report.

Samwha ElectricLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Samwha Electric Co., Ltd. specializes in the production of electrolytic capacitors, serving both South Korean and international markets, with a market capitalization of approximately ₩525.80 billion.

Operations: The company generates its revenue primarily from the electronic components and parts segment, totaling ₩206.44 billion.

Insider Ownership: 23%

Return On Equity Forecast: 32% (2027 estimate)

Samwha Electric Ltd. is poised for significant growth with its earnings expected to increase by 50.57% annually, outpacing the broader South Korean market's 28.7% forecasted growth. The company's revenue is also set to grow at 19% per year, surpassing the national average of 10.5%. Additionally, a high forecasted return on equity of 31.6% in three years underscores strong profitability potential. However, the stock has experienced high volatility recently and lacks recent insider trading activity to gauge internal confidence levels directly.

Shinsung E&GLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shinsung E&G Ltd. specializes in providing solar modules and systems both domestically in Korea and internationally, with a market capitalization of approximately ₩416.29 billion.

Operations: The company generates revenue primarily from the sale of solar modules and systems across both domestic and international markets.

Insider Ownership: 19.2%

Return On Equity Forecast: N/A (2027 estimate)

Shinsung E&G Ltd. is navigating a challenging landscape with a notable dip in net profit margins from 8.2% to 0.7%. Despite this, the company's earnings are projected to surge by 87.94% annually, significantly outpacing the South Korean market average of 28.7%. Revenue growth forecasts at 19.3% annually also exceed the market's expectation of 10.5%. However, financial stability is under scrutiny as earnings do not adequately cover interest payments, and large one-off items have skewed recent financial results.

The valuation report we've compiled suggests that Shinsung E&GLtd's current price could be inflated.

Next Steps

Investigate our full lineup of 84 Fast Growing KRX Companies With High Insider Ownership right here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A083450 KOSE:A009470 and KOSE:A011930.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance