Gartner (IT) Stock Rises 34% in a Year: What Should You Know?

Gartner IT had an impressive run over the past year. The stock has gained 33.9% compared with the 8.6% rally of the industry it belongs to and the 26.4% rise of the Zacks S&P 500 composite.

WCN has an expected long-term (three to five years) EPS growth rate of 9.9%. The company’s revenues for 2024 and 2025 are expected to increase 5.4% and 8.8%, respectively, year over year.Its earnings for 2024 and 2025 are anticipated to grow 1.9% and 11%, respectively.

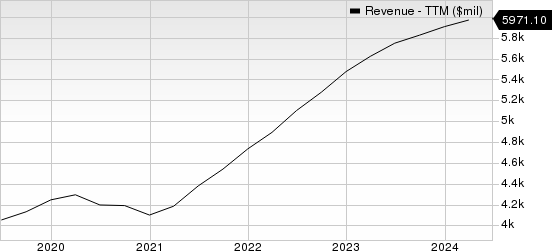

Gartner, Inc. Revenue (TTM)

Gartner, Inc. revenue-ttm | Gartner, Inc. Quote

Reasons for the Upside

Gartner’s earnings surpassed the Zacks Consensus Estimate in the trailing four quarters, delivering an average earnings surprise of 19.5%.

Over the years, the company’s research reports have become vital for diverse companies across different sectors, strengthening its leading position in the market. Gartner draws on unique data assets and deep domain expertise to provide key insights using advanced technologies and provides decision support solutions. These insights are typically drawn from a critical fact base, collated from interactions with clients in more than 15,000 distinct organizations worldwide.

IT's market strength is reinforced by the CEB acquisition. The company’s analyst-driven, syndicated research and advisory services, coupled with CEB’s best practice and talent management data across a range of business functions, are anticipated to provide a comprehensive and differentiated suite of services portfolio globally.

Gartner has a large and diverse addressable market with low customer concentration that reduces operating risks. The company has an integrated research and consulting team designed to best serve the requirements of its clients operating in an industry with low barriers. This allows it to have a competitive advantage against its rivals. Leveraging its intellectual capital, the company creates and distributes proprietary research content as broadly as possible via published reports, interactive tools, and many more. This allows a steadily improving stream of revenues for the company.

In 2023, 2022, and 2021, Gartner repurchased 3.9 million, 3.8 million, and 7.3 million shares for $600 million, $1 billion and $1.7 billion, respectively. Such moves indicate the company's commitment to creating value for shareholders and underline its business confidence. Also, these moves help instill investors' confidence in the stock and positively impact the bottom line.

Zacks Rank & Stocks to Consider

IT currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Booz Aptiv APTV and AppLovin APP.

Aptiv flaunts a Zacks Rank #1 (Strong Buy) at present. It has a long-term earnings growth expectation of 20.7%. You can see the complete list of today’s Zacks #1 Rank stocks here.

APTV delivered a trailing four-quarter earnings surprise of 12.2%, on average.

AppLovin is currently a Zacks #1 Ranked stock. It has a long-term earnings growth expectation of 20%.

APP delivered a trailing four-quarter earnings surprise of 60.9% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gartner, Inc. (IT) : Free Stock Analysis Report

AppLovin Corporation (APP) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance