Exploring Value Opportunities With Frasers Logistics & Commercial Trust And Two Other SGX Stocks

In recent times, the Singapore market has shown resilience amidst global economic fluctuations, maintaining a steady performance that continues to attract investor interest. Given the current emphasis on enhancing financial security and fraud prevention as seen with initiatives like the Federal Reserve's ScamClassifier model, investors might find value in stocks that demonstrate strong governance and transparent operations.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

Name | Current Price | Fair Value (Est) | Discount (Est) |

Singapore Technologies Engineering (SGX:S63) | SGD4.10 | SGD7.81 | 47.5% |

Hongkong Land Holdings (SGX:H78) | US$3.21 | US$5.65 | 43.1% |

Digital Core REIT (SGX:DCRU) | US$0.58 | US$1.11 | 47.6% |

Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD0.96 | SGD1.63 | 41% |

Seatrium (SGX:5E2) | SGD1.48 | SGD2.38 | 37.9% |

Nanofilm Technologies International (SGX:MZH) | SGD0.715 | SGD1.34 | 46.4% |

Let's review some notable picks from our screened stocks

Frasers Logistics & Commercial Trust

Overview: Frasers Logistics & Commercial Trust is a Singapore-listed real estate investment trust specializing in industrial and commercial properties, with a portfolio valued at approximately S$6.4 billion and operations across Australia, Germany, Singapore, the United Kingdom, and the Netherlands; its market capitalization stands at approximately S$3.61 billion.

Operations: The trust's revenue is derived from its industrial and commercial properties located in Australia, Germany, Singapore, the United Kingdom, and the Netherlands.

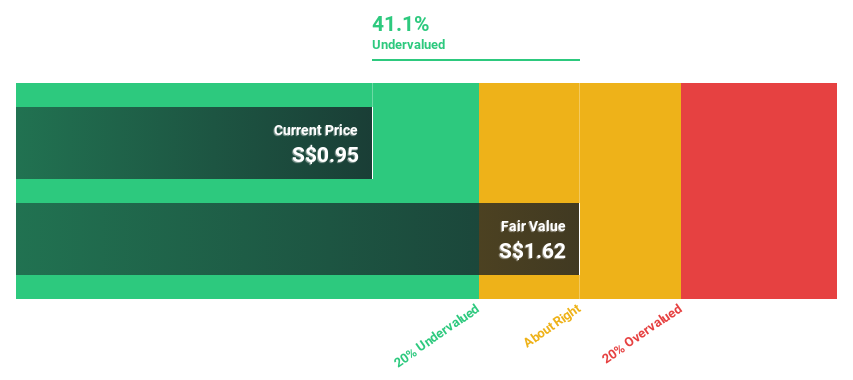

Estimated Discount To Fair Value: 41%

Frasers Logistics & Commercial Trust is trading at SGD0.96, significantly below its estimated fair value of SGD1.63, indicating a potential undervaluation based on discounted cash flow analysis. Despite a forecasted revenue growth of 6.1% per year outpacing the Singapore market average of 3.6%, concerns arise from an unstable dividend track record and debt not being well covered by operating cash flow. The trust's return on equity is expected to remain low at 6%. Recent financials show a decline in net income from SGD 118.07 million to SGD 93.59 million for the half-year ended March 31, 2024, which could raise caution among investors looking for stable returns.

Digital Core REIT

Overview: Digital Core REIT (SGX: DCRU) operates as a pure-play data center real estate investment trust in Singapore, sponsored by Digital Realty, and has a market capitalization of approximately $0.77 billion.

Operations: The company generates its revenue primarily from commercial real estate investments in data centers, totaling $71.10 million.

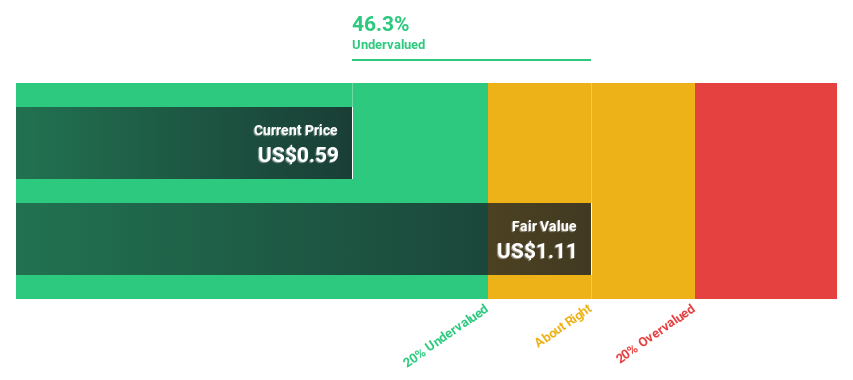

Estimated Discount To Fair Value: 47.6%

Digital Core REIT, trading at S$0.58, is assessed far below its fair value of S$1.11 based on discounted cash flow analysis. Despite a recent drop from the S&P Global BMI Index and a decline in sales from US$26.78 million to US$24.58 million in Q1 2024, the company shows promise with an expected revenue growth of 8.1% annually—surpassing Singapore's market average of 3.6%. However, investors should be cautious due to its unstable dividend history and a forecasted low return on equity of 4.9% in three years.

Singapore Technologies Engineering

Overview: Singapore Technologies Engineering Ltd is a global technology, defense, and engineering group with a market capitalization of SGD 12.60 billion.

Operations: The company's revenue is generated from three primary segments: Commercial Aerospace (SGD 3.97 billion), Urban Solutions & Satcom (SGD 1.98 billion), and Defence & Public Security (SGD 4.29 billion).

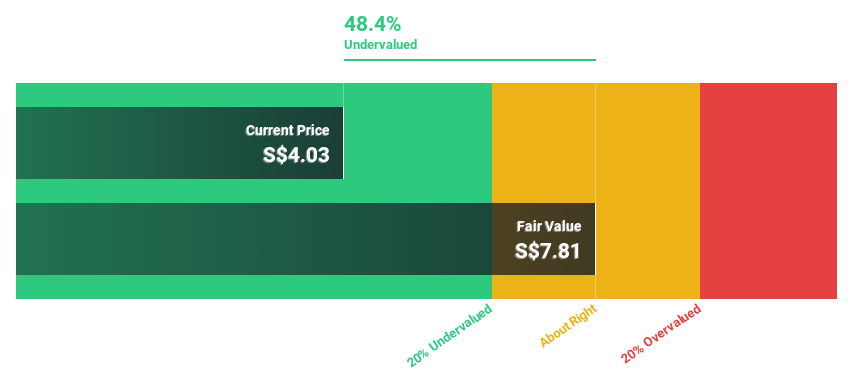

Estimated Discount To Fair Value: 47.5%

Singapore Technologies Engineering, valued at SGD4.1, is significantly undervalued with a fair value estimation of SGD7.81. Its earnings are set to grow by 11.5% annually, outpacing the Singapore market's 9.1%, and revenue growth is projected at 6.7% per year, also above the market average of 3.6%. However, its high debt levels and unstable dividend record present risks despite trading at a compelling 47.5% below its estimated fair value based on discounted cash flow analysis.

Summing It All Up

Get an in-depth perspective on all 6 Undervalued SGX Stocks Based On Cash Flows by using our screener here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:BUOU SGX:DCRU and SGX:S63.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance