Exploring Undervalued SGX Stocks With Discounts Ranging From 42.3% To 48.3%

As the global investment landscape adjusts to new trading technologies and their impacts, the Singapore market remains a focal point for those looking for value. With ongoing discussions about how gamification in trading platforms may influence investor behavior, identifying undervalued stocks becomes increasingly pertinent under current market conditions.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

Name | Current Price | Fair Value (Est) | Discount (Est) |

Singapore Technologies Engineering (SGX:S63) | SGD4.04 | SGD7.81 | 48.3% |

Hongkong Land Holdings (SGX:H78) | US$3.26 | US$5.65 | 42.3% |

Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD0.96 | SGD1.63 | 41% |

Seatrium (SGX:5E2) | SGD1.52 | SGD2.38 | 36.2% |

Digital Core REIT (SGX:DCRU) | US$0.595 | US$1.11 | 46.3% |

Nanofilm Technologies International (SGX:MZH) | SGD0.725 | SGD1.34 | 45.8% |

Here we highlight a subset of our preferred stocks from the screener

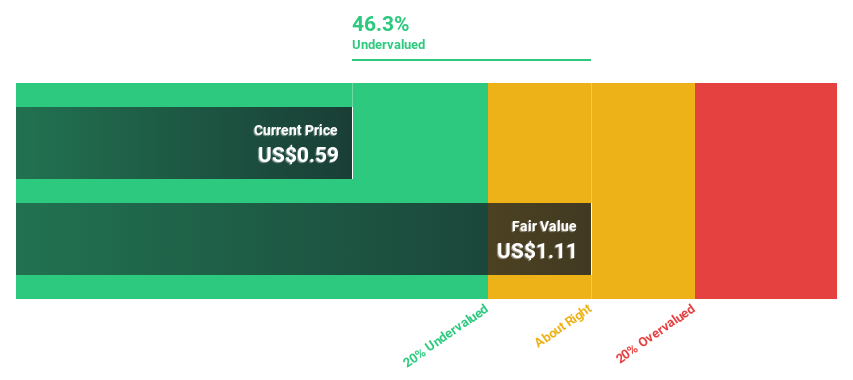

Digital Core REIT

Overview: Digital Core REIT (SGX: DCRU) operates as a Singapore-listed real estate investment trust specializing in data centers, backed by Digital Realty, and has a market capitalization of approximately $0.77 billion.

Operations: The REIT's revenue from commercial operations totals $71.10 million.

Estimated Discount To Fair Value: 46.3%

Digital Core REIT is perceived as undervalued based on cash flows, trading at a significant discount to its estimated fair value. Analysts expect an annual profit growth that outpaces the market, with revenue growth projections also above the Singapore market average. However, concerns include a low forecasted return on equity and an unstable dividend track record. Recent actions like share buybacks indicate management's confidence in improving shareholder value despite past earnings volatility and slight declines in quarterly sales figures.

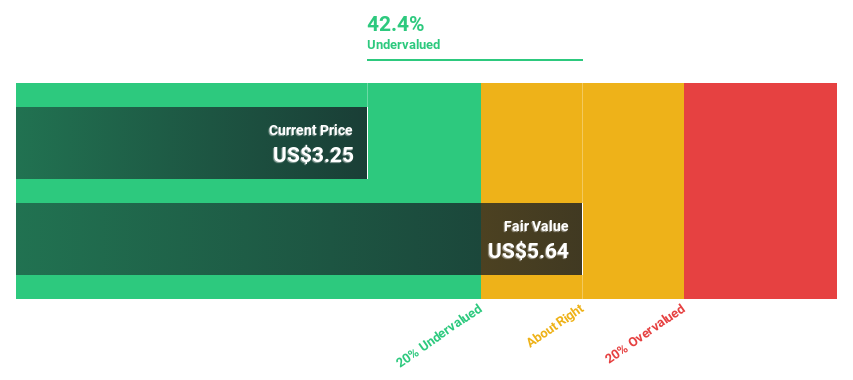

Hongkong Land Holdings

Overview: Hongkong Land Holdings Limited operates in the investment, development, and management of properties across Hong Kong, Macau, Mainland China, Southeast Asia, and other international locations with a market cap of approximately $7.19 billion.

Operations: The company generates revenue through two primary segments: Investment Properties, which brought in $1.08 billion, and Development Properties, contributing $0.76 billion.

Estimated Discount To Fair Value: 42.3%

Hongkong Land Holdings is seen as undervalued based on its current trading price of S$3.26 compared to a fair value estimate of S$5.65, reflecting a significant discount. While the company's revenue is expected to grow at 5.5% annually, outpacing Singapore's market average, its return on equity remains low at 2.4%. Recent performance shows stability in profits with an unchanged underlying profit from last year, supported by strong luxury retail and Singapore office segments despite weaker Hong Kong office contributions.

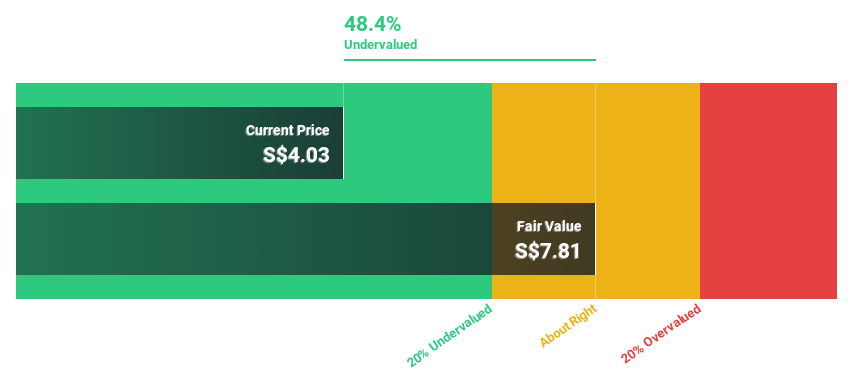

Singapore Technologies Engineering

Overview: Singapore Technologies Engineering Ltd is a global technology, defense, and engineering group with a market capitalization of SGD 12.60 billion.

Operations: The company's revenue is divided into three main segments: Commercial Aerospace (SGD 3.97 billion), Urban Solutions & Satcom (SGD 1.98 billion), and Defence & Public Security (SGD 4.29 billion).

Estimated Discount To Fair Value: 48.3%

Singapore Technologies Engineering, trading at S$4.04, appears undervalued with a fair value estimate of S$7.81. Despite a modest revenue growth forecast of 6.7% annually, its earnings are expected to outperform the Singapore market's average with an 11.54% annual increase. The company maintains a high forecasted return on equity at 27.4% in three years but carries a high level of debt and has an unstable dividend track record, recently affirming dividends and initiating share buybacks funded from internal sources.

Turning Ideas Into Actions

Reveal the 6 hidden gems among our Undervalued SGX Stocks Based On Cash Flows screener with a single click here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:DCRUSGX:H78 and SGX:S63

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance