Exploring Three Swedish Exchange Stocks Estimated To Be Up To 49.2% Below Intrinsic Value

Amidst a backdrop of political uncertainty and fluctuating market conditions across Europe, Sweden's exchange presents a unique landscape for investors seeking value. In this context, identifying stocks that appear undervalued relative to their intrinsic worth could offer potential opportunities for discerning investors.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

Name | Current Price | Fair Value (Est) | Discount (Est) |

Björn Borg (OM:BORG) | SEK55.10 | SEK101.89 | 45.9% |

Boule Diagnostics (OM:BOUL) | SEK10.70 | SEK21.00 | 49.1% |

Nordic Waterproofing Holding (OM:NWG) | SEK162.00 | SEK296.26 | 45.3% |

RaySearch Laboratories (OM:RAY B) | SEK141.60 | SEK278.55 | 49.2% |

Nolato (OM:NOLA B) | SEK60.15 | SEK114.59 | 47.5% |

Net Insight (OM:NETI B) | SEK5.09 | SEK9.51 | 46.5% |

MilDef Group (OM:MILDEF) | SEK68.30 | SEK132.09 | 48.3% |

Humble Group (OM:HUMBLE) | SEK9.72 | SEK19.44 | 50% |

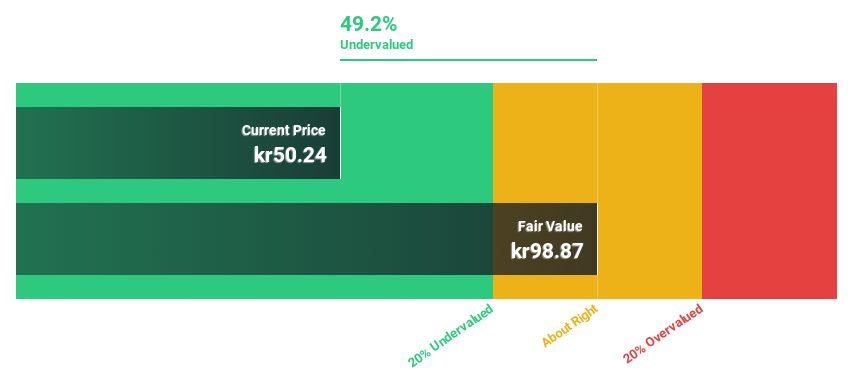

Hexatronic Group (OM:HTRO) | SEK50.24 | SEK98.87 | 49.2% |

Enea (OM:ENEA) | SEK74.40 | SEK147.83 | 49.7% |

Here's a peek at a few of the choices from the screener

Hexatronic Group

Overview: Hexatronic Group AB, along with its subsidiaries, focuses on the development, manufacturing, marketing, and sales of fiber communication solutions across various global regions including Sweden, Europe, North America, Asia Pacific, and the UK; it has a market capitalization of approximately SEK 10.20 billion.

Operations: The company generates its revenue primarily from fiber optic communication solutions, totaling SEK 7.82 billion.

Estimated Discount To Fair Value: 49.2%

Hexatronic Group, despite a downturn in Q1 2024 with sales dropping to SEK 1.78 billion from SEK 2.12 billion year-over-year and net income falling significantly to SEK 62 million from SEK 224 million, remains a candidate for undervalued status based on cash flows. The substantial one-off items have skewed recent financial results, suggesting the potential for undervaluation when these are excluded. Recent board and executive team enhancements could stabilize and steer future strategic directions effectively.

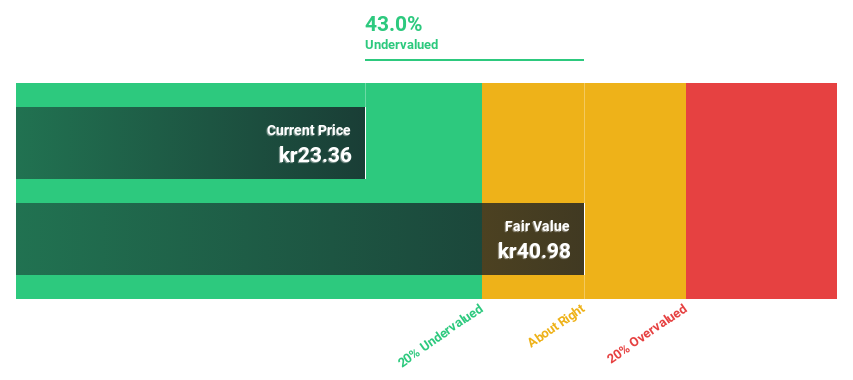

Sinch

Overview: Sinch AB operates globally, offering cloud communications services and solutions to enterprises and mobile operators, with a market capitalization of SEK 19.71 billion.

Operations: The company's revenue is derived from providing cloud communications services and solutions across various global markets.

Estimated Discount To Fair Value: 43%

Sinch's financials reflect a challenging Q1 2024, with sales decreasing to SEK 6.89 billion from SEK 7.02 billion and a widening net loss of SEK 89 million, up from SEK 78 million year-over-year. Despite these figures, the company's strategic focus on mergers and acquisitions signals potential for future value creation. Additionally, the establishment of a SEK 6 billion MTN program could enhance Sinch’s financial flexibility, supporting its inorganic growth strategy through potential accretive acquisitions.

Make It Happen

Delve into our full catalog of 48 Undervalued Swedish Stocks Based On Cash Flows here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:HTROOM:SINCH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance