Exploring Three High Growth Japanese Companies With Substantial Insider Ownership On The Tokyo Stock Exchange

Amid a backdrop of mixed weekly returns and ongoing speculation about monetary policy normalization, Japan's stock market presents a complex yet intriguing landscape for investors. In this environment, examining companies with high insider ownership might offer valuable insights, as these firms often exhibit alignment between management's interests and those of shareholders, potentially fostering greater resilience and long-term growth in challenging market conditions.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 27.2% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.3% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 80.2% |

Money Forward (TSE:3994) | 21.4% | 63.6% |

Soracom (TSE:147A) | 17.2% | 54.1% |

freee K.K (TSE:4478) | 24% | 82.6% |

Here we highlight a subset of our preferred stocks from the screener.

Mercari

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mercari, Inc. is a company that plans, develops, and operates the Mercari marketplace applications in Japan and the United States, with a market capitalization of approximately ¥342.29 billion.

Operations: The company generates revenue primarily from its marketplace applications active in Japan and the United States.

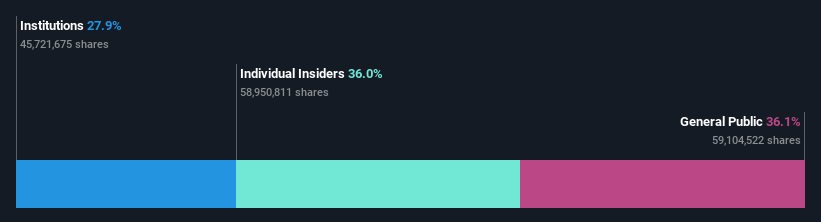

Insider Ownership: 36%

Mercari, a prominent Japanese growth company with significant insider ownership, recently revised its corporate guidance, projecting substantial revenue and profit increases for 2024. The firm anticipates revenues of JPY 190 billion and an operating profit of JPY 16.5 billion. Innovatively eliminating selling fees across its U.S. platform distinguishes Mercari in a competitive market, potentially boosting user engagement and sales volume. Despite these positives, Mercari's share price remains volatile, and while earnings are expected to grow by 19.1% annually—outpacing the Japanese market—the rate does not surpass the high-growth threshold of 20% per year.

Delve into the full analysis future growth report here for a deeper understanding of Mercari.

Our valuation report here indicates Mercari may be overvalued.

Rakuten Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors serving users globally, with a market capitalization of approximately ¥1.79 trillion.

Operations: The company generates revenue through its operations in online retail, financial services, digital media, and telecommunications.

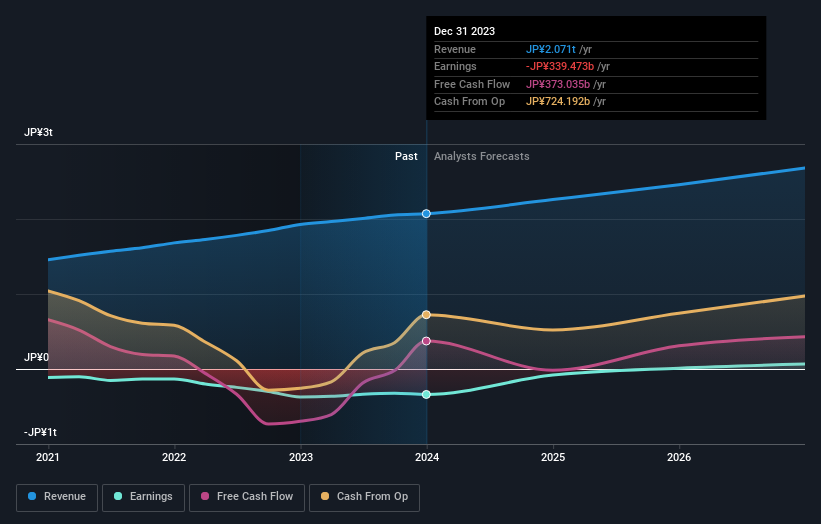

Insider Ownership: 17.3%

Rakuten Group, positioned in Japan's competitive e-commerce landscape, anticipates double-digit revenue growth for 2024, excluding its volatile securities sector. Although not leading in insider ownership dynamics, the company is set to turn profitable within three years with projected earnings growth substantially outpacing the market. Recent activities include a substantial $1.99 billion fixed-income offering aimed at bolstering financial flexibility. However, its forecasted return on equity remains modest at 8.8%, reflecting some underlying performance challenges.

Capcom

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is a Japanese company engaged in the planning, development, manufacturing, selling, and distribution of home video games, online games, mobile games, and arcade games globally with a market capitalization of approximately ¥1.26 trillion.

Operations: The company generates revenue through the sale and distribution of home video games, online games, mobile games, and arcade games across various global markets.

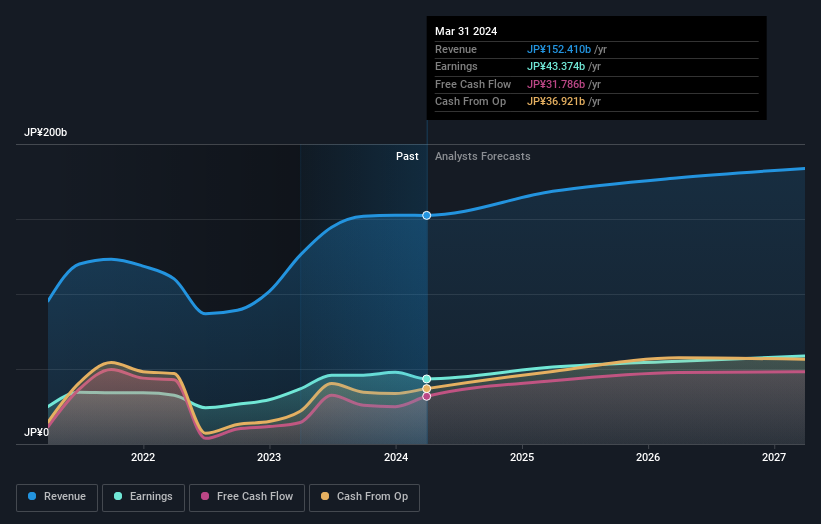

Insider Ownership: 11.5%

Capcom, a Japanese growth company with significant insider ownership, reported an 18.1% increase in earnings last year and expects continued growth at 8.75% annually. With revenue projected to grow at 5.8% per year—outpacing the Japanese market average of 4%—and a robust forecasted return on equity of 20.7%, Capcom is positioned for solid performance. However, its earnings growth is not considered high by industry standards, aligning closely with the broader market's expectations.

Dive into the specifics of Capcom here with our thorough growth forecast report.

Upon reviewing our latest valuation report, Capcom's share price might be too optimistic.

Where To Now?

Click this link to deep-dive into the 105 companies within our Fast Growing Japanese Companies With High Insider Ownership screener.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:4385 TSE:4755TSE:9697 and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance