Exploring Three Chinese Exchange Stocks With Estimated Discounts Ranging From 11.9% To 17.9%

Amidst a backdrop of deflationary pressures and subdued consumer confidence in China, the broader market has shown resilience with strategic measures from Beijing aimed at stabilizing economic conditions. In this environment, identifying undervalued stocks on Chinese exchanges becomes particularly compelling, as they may offer potential for appreciation when aligned with careful analysis and current economic initiatives.

Top 10 Undervalued Stocks Based On Cash Flows In China

Name | Current Price | Fair Value (Est) | Discount (Est) |

YanKer shop FoodLtd (SZSE:002847) | CN¥47.63 | CN¥94.36 | 49.5% |

Xiamen Amoytop Biotech (SHSE:688278) | CN¥57.76 | CN¥110.84 | 47.9% |

Xi'an Manareco New MaterialsLtd (SHSE:688550) | CN¥25.58 | CN¥47.27 | 45.9% |

DaShenLin Pharmaceutical Group (SHSE:603233) | CN¥15.64 | CN¥30.38 | 48.5% |

ShenZhen Click TechnologyLTD (SZSE:002782) | CN¥11.28 | CN¥21.96 | 48.6% |

Zhejiang Taihua New Material Group (SHSE:603055) | CN¥10.43 | CN¥19.95 | 47.7% |

TianJin 712 Communication & Broadcasting (SHSE:603712) | CN¥19.63 | CN¥38.32 | 48.8% |

China Film (SHSE:600977) | CN¥11.00 | CN¥20.16 | 45.4% |

Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥21.31 | CN¥40.67 | 47.6% |

Quectel Wireless Solutions (SHSE:603236) | CN¥48.98 | CN¥90.23 | 45.7% |

Let's uncover some gems from our specialized screener

Jiangsu Sinopep-Allsino Biopharmaceutical

Overview: Jiangsu Sinopep-Allsino Biopharmaceutical Co., Ltd. is a biomedical company in China, specializing in the R&D, production, sales, and technical services of peptides and small molecule drugs, with a market cap of CN¥15.52 billion.

Operations: The company generates revenue primarily through its medicine manufacturing segment, which reported earnings of CN¥1.18 billion.

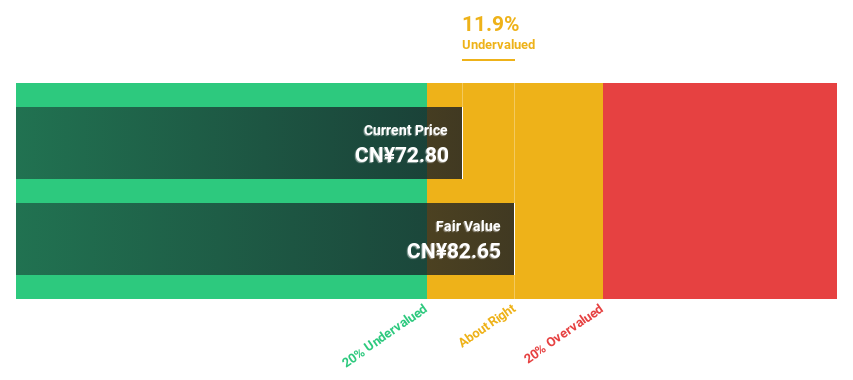

Estimated Discount To Fair Value: 11.9%

Jiangsu Sinopep-Allsino Biopharmaceutical is currently trading at CN¥72.8, which is 11.9% below the estimated fair value of CN¥82.65, indicating it may be undervalued based on discounted cash flow analysis. The company's revenue and earnings are expected to grow by 30.6% and 30.1% per year respectively, outpacing the Chinese market averages significantly. However, its forecasted Return on Equity in three years is a modest 13.5%. Recent financial results show substantial growth with Q1 revenue reaching CN¥355.82 million and net income at CN¥66.33 million, both showing significant increases from the previous year.

3Peak

Overview: 3Peak Incorporated is a fabless semiconductor company that specializes in offering a range of analog products and technologies, with a market capitalization of approximately CN¥14.43 billion.

Operations: The company generates revenue primarily from the integrated circuit industry, totaling CN¥0.99 billion.

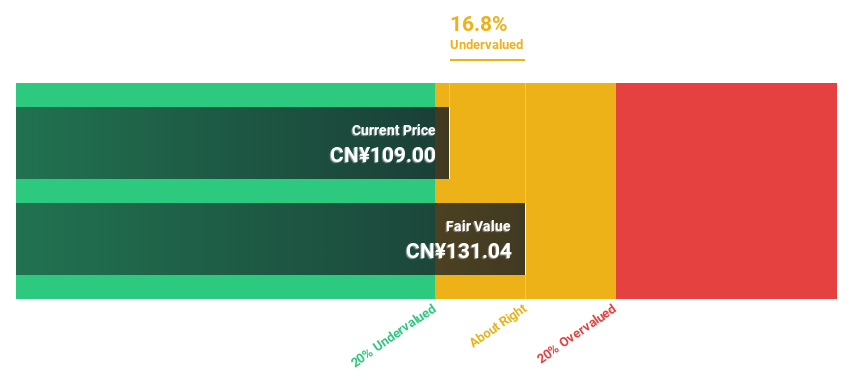

Estimated Discount To Fair Value: 16.8%

3Peak, with a current trading price of CN¥109, is positioned below the calculated fair value of CN¥131.04, hinting at potential undervaluation based on cash flow assessments. Despite a recent downturn in Q1 2024 earnings—reporting a loss of CN¥49.17 million compared to last year's profit—the company is anticipated to pivot towards profitability within three years, supported by robust revenue growth projections (35.3% annually). However, concerns linger due to shareholder dilution over the past year and a low forecasted Return on Equity (6.8%).

Insights from our recent growth report point to a promising forecast for 3Peak's business outlook.

Take a closer look at 3Peak's balance sheet health here in our report.

Shandong Sinocera Functional Material

Overview: Shandong Sinocera Functional Material Co., Ltd. is a company specializing in the development and manufacturing of ceramic functional materials, with a market capitalization of approximately CN¥18.57 billion.

Operations: The revenue segments for the company are not specified in the provided text.

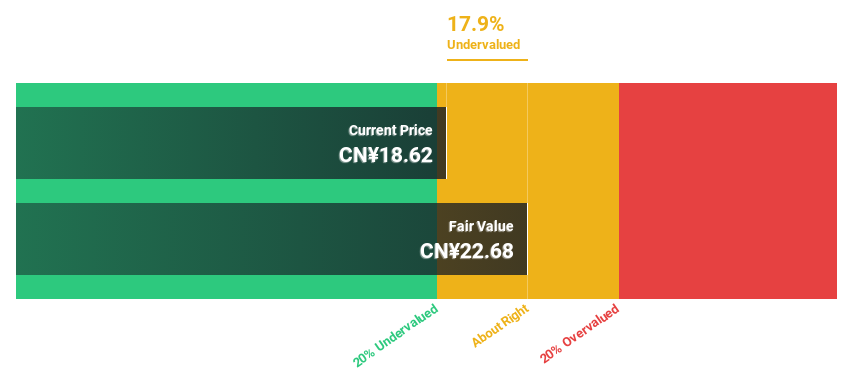

Estimated Discount To Fair Value: 17.9%

Shandong Sinocera Functional Material, trading at CN¥18.62, is below our CN¥22.68 fair value estimate, suggesting undervaluation based on discounted cash flows. The company's revenue and earnings growth are robust, with a 17.5% annual increase in revenue and significant earnings growth expected at 25.33% annually over the next three years. However, its Return on Equity is forecasted to be low at 13%, indicating potential concerns about efficiency in generating shareholder returns from equity investments.

Where To Now?

Discover the full array of 96 Undervalued Chinese Stocks Based On Cash Flows right here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:688076 SHSE:688536 and SZSE:300285.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance