Exploring Bytes Technology Group And Two More Undervalued Small Caps With Insider Actions In The United Kingdom

Amid a broader recovery, the UK stock market is showing signs of resilience with the FTSE 100 marking its fourth consecutive day of gains. This positive momentum in the market sets an intriguing backdrop for exploring undervalued small-cap stocks, such as Bytes Technology Group, which may offer potential opportunities in these improving conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Norcros | 7.5x | 0.5x | 41.91% | ★★★★★☆ |

Breedon Group | 12.6x | 0.9x | 45.59% | ★★★★★☆ |

THG | NA | 0.4x | 34.76% | ★★★★★☆ |

Ultimate Products | 9.4x | 0.7x | 19.63% | ★★★★☆☆ |

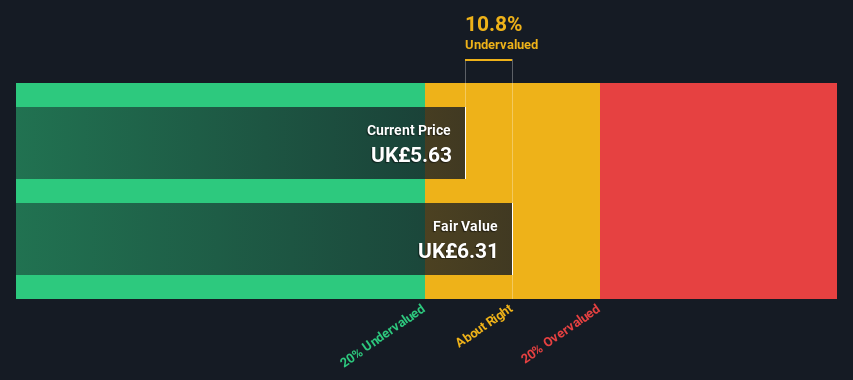

Bytes Technology Group | 29.2x | 6.6x | 10.75% | ★★★★☆☆ |

Eurocell | 14.2x | 0.4x | 25.57% | ★★★★☆☆ |

H&T Group | 7.7x | 0.7x | -8.95% | ★★★☆☆☆ |

Robert Walters | 20.6x | 0.3x | 35.48% | ★★★☆☆☆ |

Savills | 37.1x | 0.7x | 23.88% | ★★★☆☆☆ |

Hochschild Mining | NA | 1.7x | 35.98% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Bytes Technology Group

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bytes Technology Group is a provider of IT solutions, with a market capitalization of approximately £1.07 billion.

Operations: IT Solutions Provider achieved a gross profit margin of 70.42% in its latest reporting period, reflecting an increase from previous years. The company's revenue for the same period was £207.02 million, with a net income margin of 22.63%.

PE: 29.2x

Bytes Technology Group's recent financial performance highlights a robust upward trajectory, with sales climbing to £207.02 million and net income reaching £46.85 million for the fiscal year ending February 2024. This reflects a discernible growth from the previous year, accentuated by a significant increase in dividends, suggesting strong profit generation and shareholder returns. With insider confidence underscored by recent appointments of seasoned executives aimed at bolstering governance and strategic oversight, particularly in ESG initiatives, Bytes presents as an appealing prospect within the undervalued UK small-cap arena. Their financial health is further evidenced by reliance on external borrowing over customer deposits, positioning them distinctively in their funding strategy.

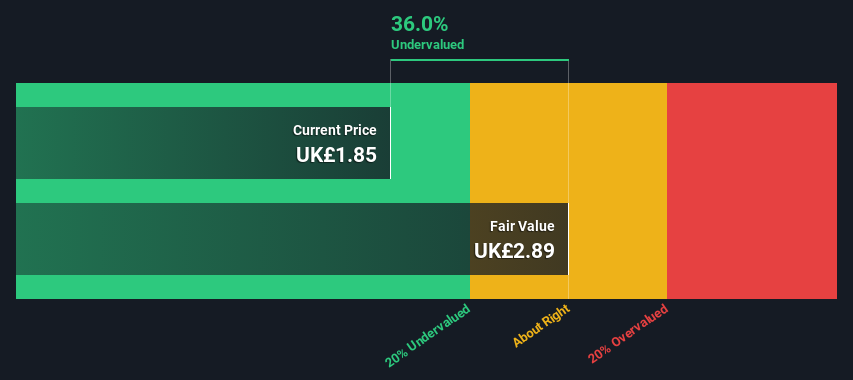

Hochschild Mining

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hochschild Mining is a precious metals company focused on the exploration, mining, and processing of silver and gold, primarily operating in the Americas with a market capitalization of approximately $1 billion.

Operations: San Jose, Inmaculada, and Pallancata are the primary revenue contributors for the entity, generating $242.46 million, $396.64 million, and $54.05 million respectively. The company's gross profit margin has fluctuated over recent periods, with a notable figure of 26.46% reported in the latest quarter of 2024.

PE: -21.9x

Recently, Eduardo Navarro demonstrated insider confidence in Hochschild Mining by acquiring 148,000 shares, signaling a robust belief in the company's potential. This move aligns with the firm's positive production outlook for 2024, expecting to yield between 343,000 and 360,000 gold equivalent ounces. Additionally, first-quarter results showed an increase in gold output year-over-year, underscoring operational strength despite a slight dip in silver production. These factors collectively suggest that Hochschild Mining might be positioned for growth amidst its current market valuation.

Dive into the specifics of Hochschild Mining here with our thorough valuation report.

Evaluate Hochschild Mining's historical performance by accessing our past performance report.

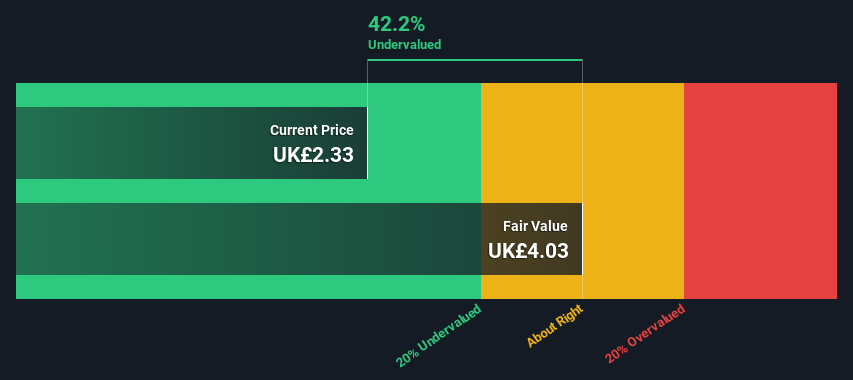

MONY Group

Simply Wall St Value Rating: ★★★★★★

Overview: MONY Group operates in various sectors including money, travel, cashback, insurance, and home services.

Operations: The entity generates a substantial portion of its revenue from the Insurance segment (£220 million), followed by Money services (£100.2 million). It has achieved a gross profit margin of approximately 67.67% as of the latest reporting period in 2024, reflecting an increase from earlier years.

PE: 17.2x

Recently rebranded as MONY Group, the company posted a revenue increase to £114.6 million in Q1 2024 from £106.3 million the previous year, signaling promising growth prospects. With earnings expected to rise annually by 10.29%, this highlights its potential amidst the UK's undervalued entities. Adding insider confidence, key executives have recently purchased shares, underscoring their belief in the company’s future performance. The appointment of Jonathan Bewes as Chair Designate further strengthens governance, poised to guide strategic decisions effectively.

Click to explore a detailed breakdown of our findings in MONY Group's valuation report.

Gain insights into MONY Group's past trends and performance with our Past report.

Seize The Opportunity

Access the full spectrum of 33 Undervalued Small Caps With Insider Buying by clicking on this link.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:BYIT LSE:HOC and LSE:MONY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance