Hongkong Land and tenants to invest over US$1 bil to transform The Landmark

Mainboard-listed Hongkong Land will invest over US$400 million to expand and upgrade its retail portfolio at The Landmark.

Mainboard-listed Hongkong Land H78 will invest over US$400 million ($542.39 million) to expand and upgrade its retail portfolio at The Landmark over three years, starting 3Q2024.

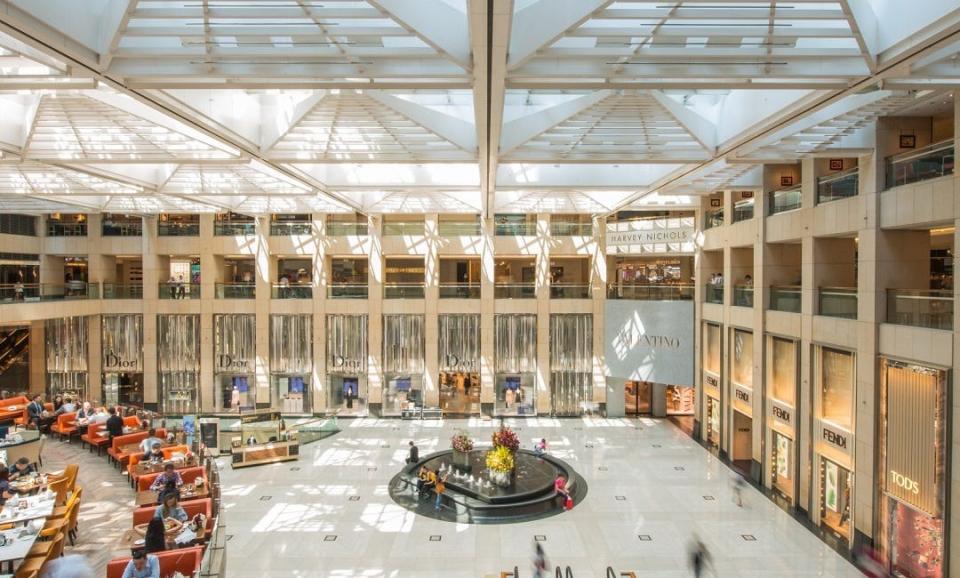

The Landmark is a commercial complex owned by Hongkong Land in Central, Hong Kong. In a June 26 announcement, Hongkong Land says 10 of its retail tenants will contribute an additional estimated US$600 million to design and create the new offerings.

The retail tenants investing in this redevelopment are global luxury fashion brands, such as Cartier, Chanel, Dior, Louis Vuitton, Prada, Saint Laurent, Sotheby’s, Tiffany & Co. and Van Cleef & Arpels.

These brands are long-standing tenants at The Landmark. These anchor tenants will more than double their footprints to over 220,000 sq ft, elevating their retail concepts across two-to-eight storey Maison destinations, some of which will be the largest globally.

This will bring the total investment into the transformation of The Landmark to over US$1 billion. Hongkong Land did not disclose the exact amount of total investment or the exact amount invested by the individual fashion houses.

Hongkong Land says the capital expenditure will be funded over three years. As at March 31, the group’s gearing stands at 16% and committed liquidity is US$3.1 billion.

The group acknowledges that there will be a “temporary and moderate reduction of rental income” during the upgrading. But it expects the investment to deliver “stronger growth” in tenant sales and retail income thereafter.

To accommodate the growth of retail areas, the group is converting the two lowest levels of office space in Prince’s Building and Gloucester Tower. The group will also relocate the bar and lobby of The Landmark Mandarin Oriental, Hong Kong.

All affected office tenants are expected to be relocated within the Central Portfolio, says Hongkong Land.

Executives from Hongkong Land unveiled details of the plan at a media briefing in Hong Kong on June 26. Hongkong Land claims the upgrade will lift its regional market share and leadership in the luxury goods segment. Post-transformation, The Landmark will house over 200 tenants.

Michael Smith, CEO of Hongkong Land, says: “The considerable investments Hongkong Land and its strategic partners are marking are not only a powerful endorsement of Central’s enduring role as the city’s iconic business and lifestyle hub but also demonstrate our shared, unwavering confidence in Hong Kong’s future as a global financial centre.”

Ten new ‘Maison destinations’

Hongkong Land rolled out The Landmark in a 2012 rebrand, renaming its four interconnected shopping arcades at The Landmark, Alexandra House, Chater House and Prince's Building.

As part of the upcoming project, titled “Tomorrow’s CENTRAL”, Hongkong Land says 10 “world-class, multi-storey Maison destinations” will be created across these four arcades.

Three of such destinations will be created in each of Landmark Atrium, Landmark Alexandra and Landmark Prince’s; while one will be developed in Landmark Chater. This will double the retail areas of the 10 luxury brands to over 220,000 sq ft, or 21,000 sq m.

After the transformation project, the Central Portfolio will boast a total of 260,000 sq ft of F&B space and over 30 new and refreshed concepts. In total, The Landmark will house more than 100 F&B offerings, including its existing 15 Michelin stars and 1 Michelin Green Star stable of restaurants.

Hongkong Land claims the project will include “extensive use” of green building materials, including 100% low-carbon concrete, 100% green rebar and 100% sustainable timber.

In addition, Hongkong Land says 80% of construction plant and equipment used in the project will be electric, in a bid to reduce emissions.

Upon completion, The Landmark aims to secure “several” of the highest green certifications, including LEED Commercial Interiors, BEAM Plus Interiors and WELL.

China portfolio

Hongkong Land has an extensive portfolio in China. On June 24, Hongkong Land announced that The Ring, Chengdu opened on June 22. The Ring is Hongkong Land’s first wholly-owned commercial property in the city and the second in the series development after The Ring, Chongqing opened in 2021.

However, Hongkong Land had warned of an impairment for its China residential property portfolio on May 23.

“As a result of these deteriorating market conditions, an extensive review of the group's projects is being undertaken. Where projected sales prices are lower than development costs, the investment carrying value will be impaired,” the developer said.

This is expected to result in a non-cash impairment charge of US$200 million to US$300 million which will be reflected in the company’s 1HFY2024 results for the six months to end-June. “Accordingly, underlying earnings in the period will be significantly lower than in the same period in 2023,” the May 23 statement added.

The company’s investment properties segment is likely to perform better due to its luxury retail portfolio across the region and the Singapore office segment, said Hongkong Land.

As at 4.09pm, shares in Hongkong Land are trading 1 US cent lower, or 0.31% down, at US$3.18.

Photo: Samantha Chiew/The Edge Singapore

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Hedge fund firm Dymon Asia Capital signs lease for office in Hongkong Land’s Edinburgh Tower

Jardine Matheson steps up share buybacks; Hongkong Land directors commit to buy shares

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance