Euronext Amsterdam Insights: Three Stocks Estimated To Be Below Their Fair Value In June 2024

As European markets show signs of recovery with indices like the STOXX Europe 600 gaining ground, investors are keenly observing shifts and opportunities within specific markets such as the Netherlands. In this context, identifying stocks that are potentially undervalued becomes particularly compelling, especially when considering how broader economic indicators and market movements can influence individual stock performance.

Top 5 Undervalued Stocks Based On Cash Flows In The Netherlands

Name | Current Price | Fair Value (Est) | Discount (Est) |

Majorel Group Luxembourg (ENXTAM:MAJ) | €29.45 | €55.97 | 47.4% |

PostNL (ENXTAM:PNL) | €1.339 | €2.63 | 49.2% |

InPost (ENXTAM:INPST) | €16.52 | €31.00 | 46.7% |

Ordina (ENXTAM:ORDI) | €5.70 | €10.64 | 46.4% |

Arcadis (ENXTAM:ARCAD) | €60.60 | €114.68 | 47.2% |

Alfen (ENXTAM:ALFEN) | €32.58 | €40.23 | 19% |

Ctac (ENXTAM:CTAC) | €3.14 | €3.83 | 18% |

Below we spotlight a couple of our favorites from our exclusive screener

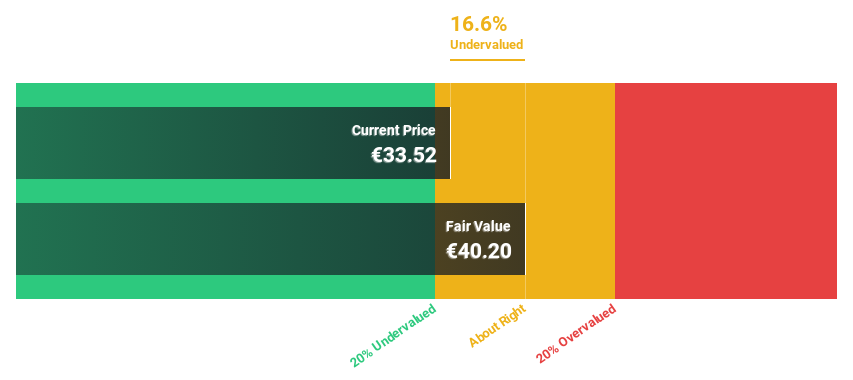

Alfen

Overview: Alfen N.V. specializes in smart grids, energy storage systems, and electric vehicle charging equipment, with a market capitalization of approximately €0.71 billion.

Operations: The company generates revenue through three primary segments: Smart Grid Solutions (€188.38 million), EV Charging Equipment (€153.12 million), and Energy Storage Systems (€162.98 million).

Estimated Discount To Fair Value: 19%

Alfen is trading at €32.58, below its estimated fair value of €40.23, suggesting undervaluation by 19%. The company's earnings are expected to grow by 20.13% annually, outpacing the Dutch market forecast of 16.3%. However, its current profit margin has declined to 5.9% from last year's 12.1%. Despite a highly volatile share price recently, Alfen's revenue growth and return on equity forecasts remain robust at 15.5% per year and an anticipated high of 23.2%, respectively.

The analysis detailed in our Alfen growth report hints at robust future financial performance.

Click here and access our complete balance sheet health report to understand the dynamics of Alfen.

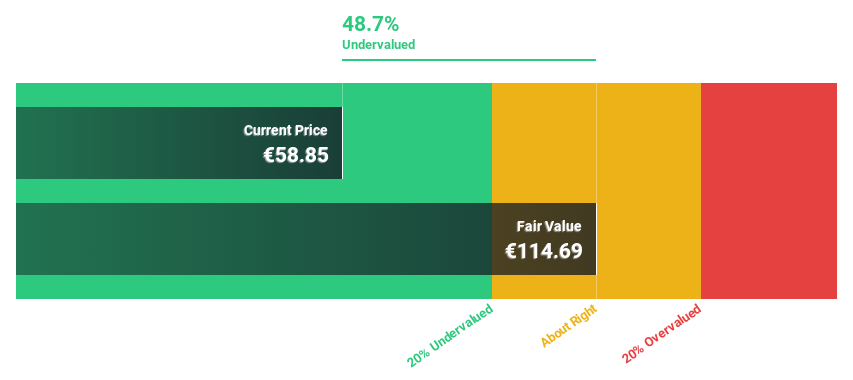

Arcadis

Overview: Arcadis NV is a global company providing design, engineering, and consultancy services for natural and built assets, with a market capitalization of approximately €5.45 billion.

Operations: The company generates revenue through various segments, with €1.94 billion from Places, €978.80 million from Mobility, €1.96 billion from Resilience, and €122.50 million from Intelligence.

Estimated Discount To Fair Value: 47.2%

Arcadis, priced at €60.6, is significantly below its fair value of €114.68, indicating a considerable undervaluation. Its earnings are expected to grow by 20.72% annually, surpassing the Dutch market's growth rate of 16.3%. Despite this strong profit growth and a recent significant contract in North America enhancing its digital asset management portfolio, Arcadis faces challenges with a high level of debt and slower revenue growth at 1.6% annually compared to the market's 9.5%.

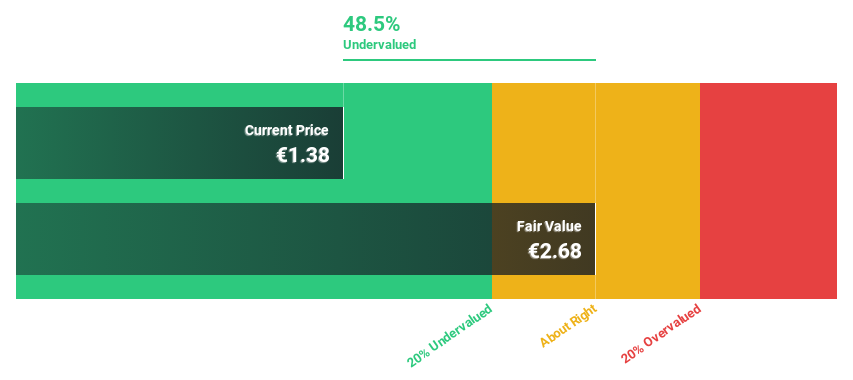

PostNL

Overview: PostNL N.V. offers postal and logistics services across the Netherlands, Europe, and globally, with a market capitalization of approximately €0.67 billion.

Operations: The company's revenue is primarily generated from two segments: Packages, which brought in €2.25 billion, and Mail in the Netherlands, contributing €1.35 billion.

Estimated Discount To Fair Value: 49.2%

PostNL, trading at €1.34, is significantly undervalued with its fair value estimated at €2.63. While its revenue growth of 3.4% annually lags behind the Dutch market's 9.5%, its earnings are set to increase notably by 24.23% per year over the next three years, outpacing the market's forecast of 16.3%. However, concerns persist due to its high debt levels and a recent shift to profitability this year amidst a volatile share price and an unstable dividend history.

Key Takeaways

Discover the full array of 7 Undervalued Euronext Amsterdam Stocks Based On Cash Flows right here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ALFEN ENXTAM:ARCAD and ENXTAM:PNL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance