Eagers Automotive And 2 Other Undervalued Small Caps With Insider Actions In Australia

Amidst a backdrop of fluctuating global markets, the Australian ASX200 has shown resilience, closing up recently despite broader uncertainties. This environment prompts a closer look at undervalued small-cap stocks in Australia, where market dynamics and insider actions could highlight potential opportunities for informed investors.

Top 10 Undervalued Small Caps With Insider Buying In Australia

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Corporate Travel Management | 17.8x | 2.7x | 39.96% | ★★★★★★ |

Tabcorp Holdings | NA | 0.7x | 23.74% | ★★★★★★ |

Codan | 27.5x | 4.0x | 25.14% | ★★★★☆☆ |

GUD Holdings | 14.7x | 1.5x | 2.62% | ★★★★☆☆ |

Eagers Automotive | 10.0x | 0.3x | 27.55% | ★★★★☆☆ |

Orora | 18.3x | 0.6x | 36.99% | ★★★★☆☆ |

Dicker Data | 21.7x | 0.8x | -2.36% | ★★★☆☆☆ |

Smartgroup | 18.2x | 4.5x | 45.91% | ★★★☆☆☆ |

Gold Road Resources | 16.2x | 4.0x | 44.10% | ★★★☆☆☆ |

Coventry Group | 271.5x | 0.4x | -24.11% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Eagers Automotive

Simply Wall St Value Rating: ★★★★☆☆

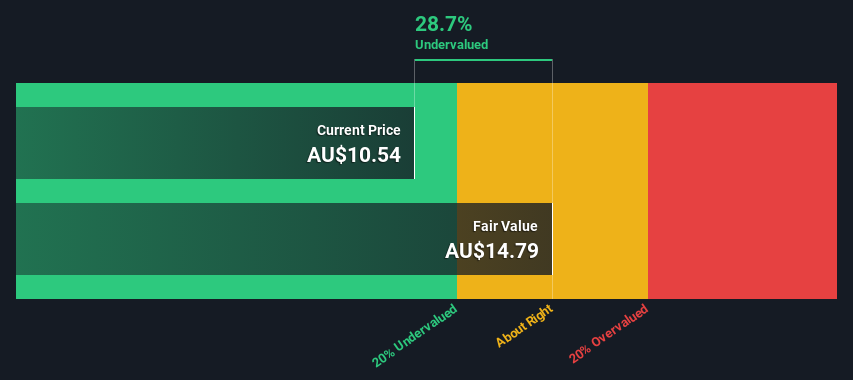

Overview: Eagers Automotive is an automotive retailer primarily involved in car retailing, with a market capitalization of approximately A$3.81 billion.

Operations: Car Retailing is the primary revenue generator, contributing A$9.85 billion, overshadowing the Property segment's A$39.68 million after adjustments for eliminations. The company has observed a gross profit margin trend that has fluctuated slightly but remained around 18% in recent periods, indicating a relatively stable cost of goods sold relative to revenue.

PE: 10.0x

Eagers Automotive, reflecting a strategic focus, recently announced a significant share repurchase program, planning to buy back 10% of its issued shares by mid-2025. This move underscores insider confidence in the company's value despite its high debt levels and forecasted slight earnings dip over the next three years. With insiders recently purchasing shares and actively seeking accretive mergers and acquisitions as part of their Next100 Strategy, Eagers is poised to potentially enhance shareholder value through disciplined execution and growth initiatives.

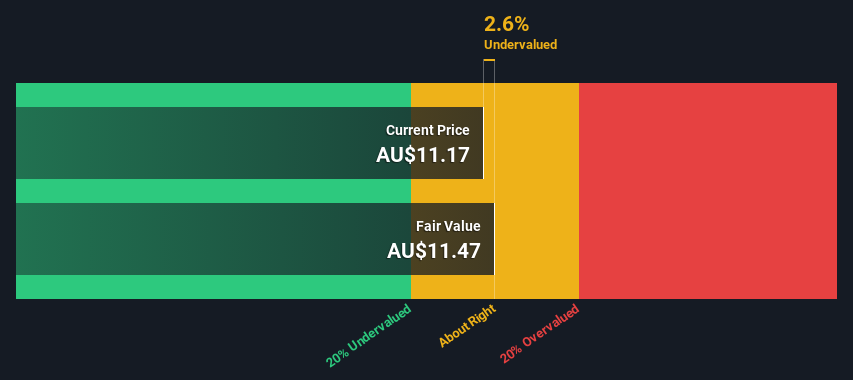

GUD Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: GUD Holdings is a diversified company that operates in the automotive and water products industries, with a market capitalization of approximately A$1.07 billion.

Operations: APG and Automotive are the primary revenue contributors, generating A$303.59 million and A$652.05 million respectively. The company's gross profit margin has shown a trend of fluctuation, with the most recent figure standing at 43.53%.

PE: 14.7x

GUD Holdings, a lesser-known entity in the Australian market, has demonstrated insider confidence through recent share purchases by executives. With earnings anticipated to grow by 6.51% annually, this company reflects potential overlooked by many. Despite relying entirely on external borrowing—posing a higher risk—its strategic decisions, including a proposed name change discussed at the upcoming extraordinary shareholders meeting on June 24, 2024, suggest a readiness for transformative growth. This mix of financial health and proactive corporate actions paints GUD as an intriguing prospect for those eyeing hidden gems in the market.

Get an in-depth perspective on GUD Holdings' performance by reading our valuation report here.

Understand GUD Holdings' track record by examining our Past report.

NRW Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: NRW Holdings is an Australian company specializing in civil construction and mining services with a market capitalization of approximately A$1.76 billion.

Operations: The company's gross profit margin has shown a trend of fluctuation, with a notable increase from 0.44388 in March 2020 to 0.47406 by December 2023. This change reflects an evolving efficiency in managing the cost of goods sold relative to revenue, which totaled A$2.76 billion by the latest recorded period.

PE: 16.1x

NRW Holdings, a lesser-known entity in Australia's market, recently saw insider confidence surge as they purchased shares, signaling strong belief in the company's prospects. With earnings expected to grow by 14% annually, NRW stands out for its reliance on external borrowing—posing a higher risk yet potentially higher rewards scenario. This financial structure might concern some but also points to possible significant upside if managed well. Moving forward, the firm’s strategic decisions will be crucial in realizing its perceived undervalued status.

Dive into the specifics of NRW Holdings here with our thorough valuation report.

Explore historical data to track NRW Holdings' performance over time in our Past section.

Where To Now?

Access the full spectrum of 26 Undervalued ASX Small Caps With Insider Buying by clicking on this link.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:APE ASX:GUD and ASX:NWH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance