Copper and Nickel Face Cooling Demand

Via Metal Miner

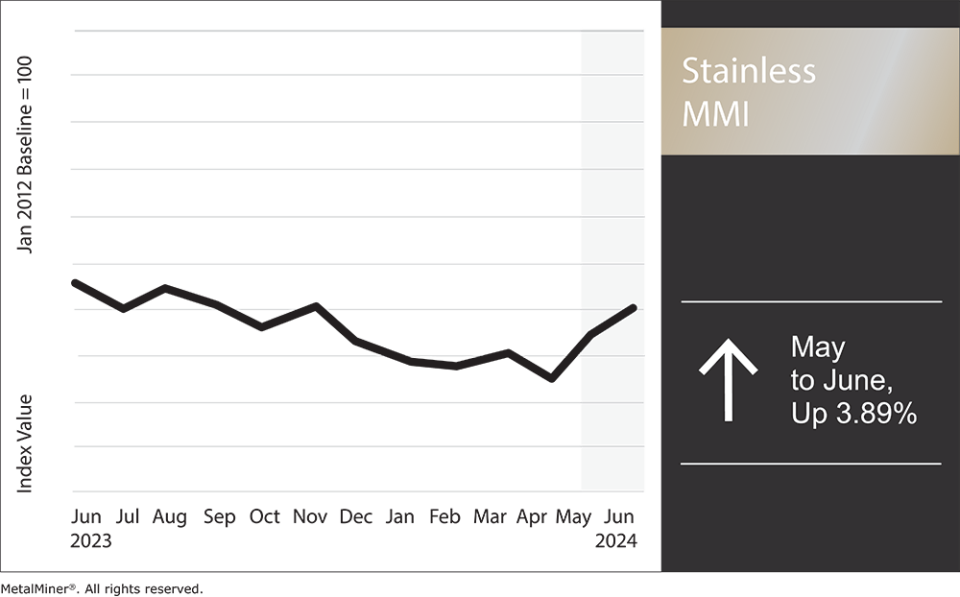

Overall, the Stainless Monthly Metals Index (MMI) rose 3.89% from May to June.

The nickel price mirrored other base metals, finding a peak on May 20 before inverting to the downside. By the close of June 20, nickel prices had fallen over 19%, returning to their lowest level since early April. That said, they remain 4.24% above their Q1 close.

Stainless Market Rolls into Summer with Slow Demand

Market sources showed little optimism about the current state of the stainless market as demand for 304 cold rolled stainless steel reportedly slowed, with no expectation of a turnaround in the short term.

Although the summer months typically experience more muted conditions relative to the rest of the year, brokers and distributors characterized demand as “especially challenged.” While buying activity historically begins to pick up again around August, market participants are not optimistic that things will turn around by then. Buyers continued to show no interest in building out inventories amid high interest rates and uncertainty related to the upcoming election.

NAS Finds New Method to Calculate Ferrochrome Price

In late May, Merafe surprised markets by canceling the quarterly European Ferrochrome Benchmark (EUBM) price. European mills and a South African supplier previously negotiated the EUBM each quarter. However, due to its premium over spot prices and opaque negotiation process, the benchmark began to lose liquidity over recent years, becoming increasingly irrelevant within the market. Stainless steel producers like NAS and Outokumpu remained among the few holdouts still using EUBM as part of their surcharge calculation.

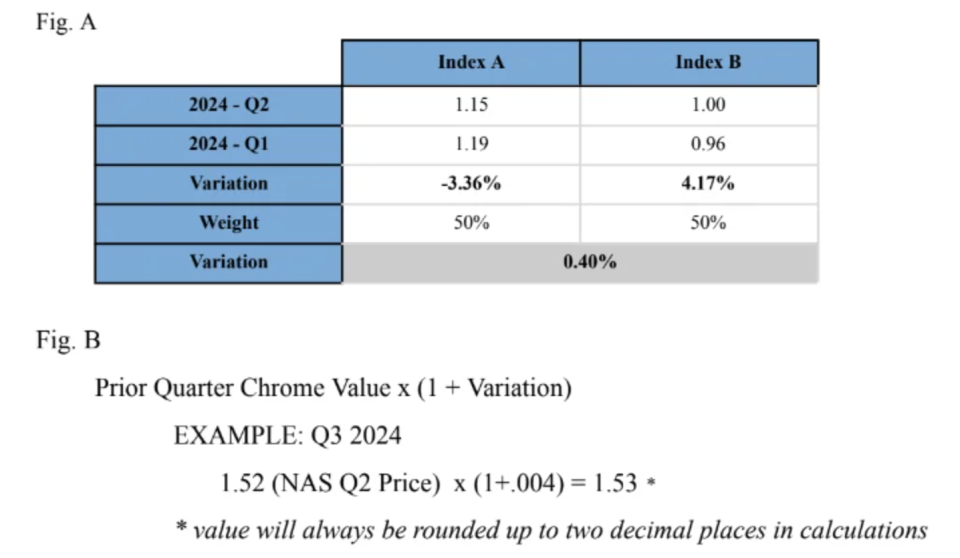

Within a month, NAS settled on a new method for determining the ferrochrome charge. Using two separate indexes that tracked closely with the now discontinued EUBM, NAS will average the quarter-over-quarter change from the previous two quarters to determine the charge for the next quarter.

Source: North American Stainless

Equally weighted, NAS will use the mid-points of ferrochrome, high carbon, 6-8.5% C, basis 60-64.9% Cr, max 3% Si, CIF Europe index, ferrochrome 50% Cr import, and the CIF main Chinese ports index. China remains the leading consumer of ferrochrome, which likely explains the use of Chinese pricing.

For Q3, the ferrochrome price for NAS surcharges rose a mere 0.66% from $1.52 per pound in Q2 to $1.53 per pound. As of June 21, Outokumpu made no announcements as to how it would handle ferrochrome pricing for its surcharge calculations.

New Approach Likely to Benefit Buyers

Despite the most recent increase, the new methodology appears beneficial to buyers. For one, maintaining the quarterly cadence of the price change will likely mitigate increased volatility within the surcharge, which would have been a risk if the NAS had chosen to update prices more frequently. Secondly, using price action from the previous two quarters of the two designated indexes will also allow more visibility into what’s ahead for the next quarter.

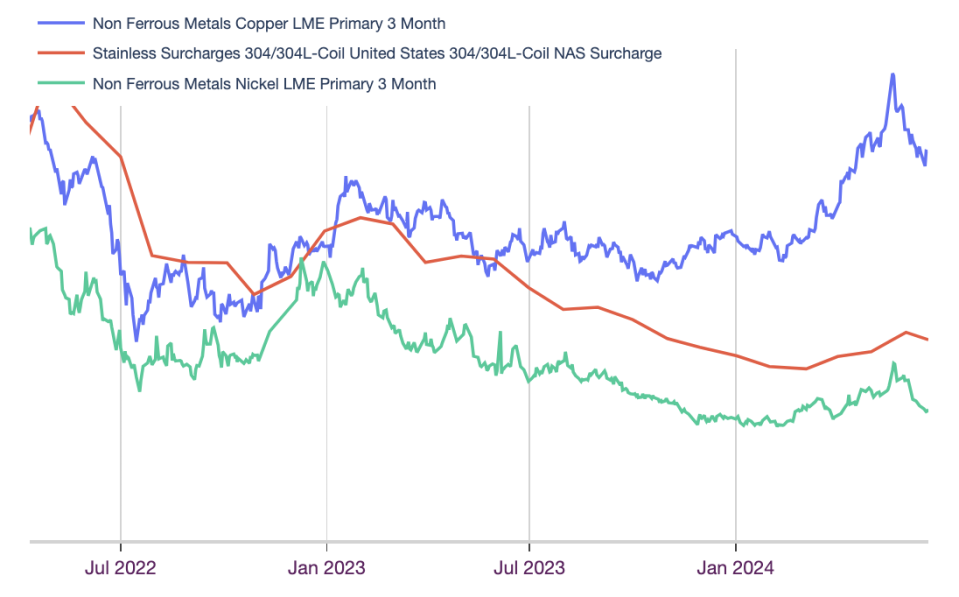

Source: MetalMiner Insights, Chart & Correlation Analysis Tool

However, the overall impact may prove minimal, as the ferrochrome price does not boast a particularly strong correlation to the surcharge, at just 71.23%. While not entirely irrelevant, other components of the surcharge will remain more influential to its overall direction.

Base Metal Reversals See NAS 304 Surcharge Decline

Following three consecutive increases, the NAS 304 surcharge retreated in July. After hitting its highest level since October 2023 at the close of Q2, the surcharge fell over 4.7% in July to $0.9499 per pound.

Although they likely tempered the overall decline, the surcharge shrugged off bullish molybdenum, titanium, and manganese prices as well as the modest quarterly increase in ferrochrome prices. Meanwhile, falling nickel and copper prices, which hold the strongest correlation to the 304 surcharge, remained the leading drivers of July’s surcharge decline.

Both copper and nickel prices remain in search of new bottoms. That said, the short-term outlook for both metals appears bearish, as the speculative rallies witnessed throughout Q2 continue to unravel. One source noted concern that an explosion at one of PT Indonesia Tsingshan Stainless Steel’s nickel smelters could trigger a bullish nickel price reaction. However, there appears to be little indication that such an increase will materialize in any sustained way. The nickel market remains oversupplied, with LME inventories on a steady climb up since mid-2023. This will likely overshadow the temporary supply disruption.

Source: MetalMiner Insights, Chart & Correlation Analysis ToolSource: MetalMiner Insights, Chart & Correlation Analysis Tool

By Nichole Bastin

More Top Reads From Oilprice.com:

Yahoo Finance

Yahoo Finance