Centerra Gold And 2 Other Undervalued Small Caps With Insider Actions In Canada

Amidst a backdrop of cautious interest rate cuts by the Bank of Canada and a pause from the Federal Reserve, Canadian markets are navigating through an intriguing phase. Consumer sentiment remains tepid despite strong economic indicators like low unemployment and sustained consumer spending, which could influence market dynamics and investment opportunities. In this environment, identifying undervalued small-cap stocks with insider actions can offer potential for astute investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Small Caps With Insider Buying In Canada

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Dundee Precious Metals | 8.1x | 2.8x | 46.89% | ★★★★★★ |

Nexus Industrial REIT | 2.3x | 2.9x | 19.76% | ★★★★★☆ |

Calfrac Well Services | 2.1x | 0.2x | 6.42% | ★★★★★☆ |

Primaris Real Estate Investment Trust | 11.2x | 2.9x | 36.04% | ★★★★★☆ |

Guardian Capital Group | 10.5x | 4.1x | 31.82% | ★★★★☆☆ |

Sagicor Financial | 1.2x | 0.4x | -97.05% | ★★★★☆☆ |

Westshore Terminals Investment | 14.1x | 3.8x | 1.33% | ★★★☆☆☆ |

Bragg Gaming Group | NA | 1.4x | 18.32% | ★★★☆☆☆ |

Gear Energy | 19.0x | 1.3x | 32.13% | ★★★☆☆☆ |

Freehold Royalties | 14.9x | 6.5x | 48.75% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Centerra Gold

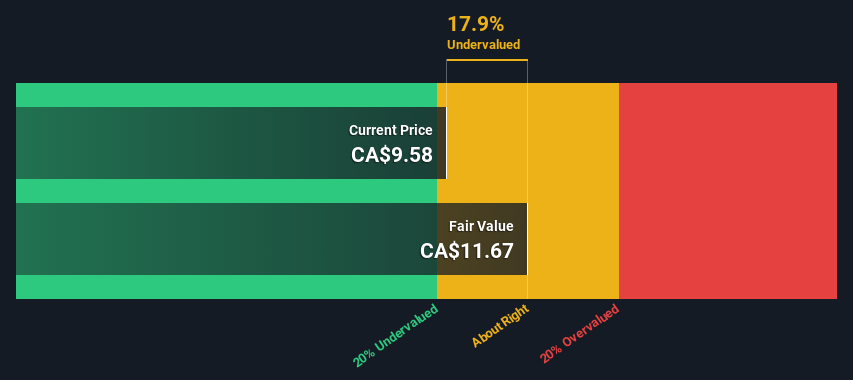

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Centerra Gold is a gold mining company with operations primarily focused on extracting and processing molybdenum and gold, boasting a market capitalization of approximately CA$1.17 billion.

Operations: Mount Milligan and Molybdenum segments significantly contribute to the revenue, generating $416.79 million and $254.54 million respectively. The gross profit margin has exhibited fluctuations, reaching a high of 58.82% in a recent quarter, highlighting variability in profitability across different periods.

PE: 25.3x

Centerra Gold, reflecting a promising trajectory in the Canadian market, recently showcased a significant turnaround with first-quarter sales soaring to US$305.88 million from US$226.53 million year-over-year and net income reaching US$66.43 million, reversing a prior loss of US$73.45 million. This resurgence is underscored by robust production guidance for 2024 and an active share repurchase program where they bought back 1,783,800 shares for $10 million in early 2024. Adding to investor confidence, insiders have recently purchased shares, signaling belief in the company's prospects amidst its strategic initiatives like the confirmed quarterly dividend of CAD 0.07 per share payable in June 2024.

Click here to discover the nuances of Centerra Gold with our detailed analytical valuation report.

Review our historical performance report to gain insights into Centerra Gold's's past performance.

Chemtrade Logistics Income Fund

Simply Wall St Value Rating: ★★★★★★

Overview: Chemtrade Logistics Income Fund operates in the production and supply of industrial chemicals, with a focus on sulphur and water chemicals and electrochemicals, maintaining a market capitalization of approximately CA$1.10 billion.

Operations: EC and SWC are the primary revenue contributors, generating CA$756.10 million and CA$1045.42 million respectively. The gross profit margin has shown a notable increase, reaching 0.24% in the most recent period reviewed.

PE: 5.1x

Chemtrade Logistics Income Fund, grappling with a forecasted earnings decline of 24.1% annually over the next three years and burdened by high debt levels, still demonstrates financial resilience through its consistent dividend payments, recently affirming a monthly distribution of CAD$0.055 per unit. Notably, insider confidence is reflected in their recent authorization of a significant share repurchase program starting June 2024, targeting nearly 10% of issued capital. This move underscores a strategic commitment to enhancing shareholder value amidst challenging conditions.

Dundee Precious Metals

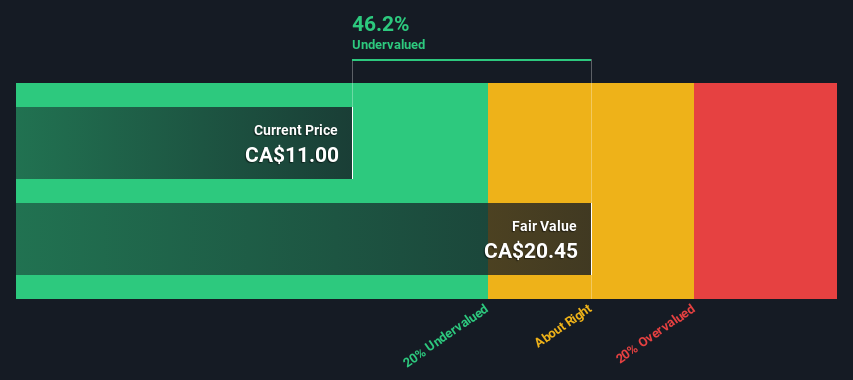

Simply Wall St Value Rating: ★★★★★★

Overview: Dundee Precious Metals is a Canadian-based international mining company primarily involved in the extraction and processing of precious metals, with significant operations at its Ada Tepe and Chelopech mines.

Operations: Ada Tepe and Chelopech generated revenues of $243.33 million and $274.18 million respectively, with a notable gross profit margin reaching 52.79% in the latest quarter, reflecting robust operational efficiency in metal extraction and processing activities.

PE: 8.1x

Dundee Precious Metals, a lesser-known yet intriguing player in the Canadian market, recently appointed W. John DeCooman Jr. as Executive Vice President, enhancing its strategic capabilities with his extensive background in corporate development. Despite facing a forecasted earnings decline of 8.6% annually over the next three years, insider confidence remains strong with recent share purchases signaling belief in the company's intrinsic value and prospects. This aligns with their reaffirmed production guidance for 2024 and ongoing dividends, underpinning a commitment to shareholder returns even amidst challenges.

Take a closer look at Dundee Precious Metals' potential here in our valuation report.

Explore historical data to track Dundee Precious Metals' performance over time in our Past section.

Next Steps

Reveal the 33 hidden gems among our Undervalued TSX Small Caps With Insider Buying screener with a single click here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:CG TSX:CHE.UN and TSX:DPM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance