Best Pacific International Holdings And 2 Other SEHK Stocks That Could Be Trading Below Their True Value

As global markets navigate through fluctuating economic signals, the Hong Kong stock market presents a landscape of potential opportunities, particularly in undervalued stocks. In this context, identifying stocks that trade below their intrinsic value could be advantageous for investors looking to capitalize on discrepancies between current market prices and underlying business fundamentals.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

Name | Current Price | Fair Value (Est) | Discount (Est) |

Best Pacific International Holdings (SEHK:2111) | HK$2.12 | HK$3.82 | 44.4% |

Bairong (SEHK:6608) | HK$9.03 | HK$15.81 | 42.9% |

China Cinda Asset Management (SEHK:1359) | HK$0.71 | HK$1.29 | 45% |

Super Hi International Holding (SEHK:9658) | HK$13.20 | HK$25.97 | 49.2% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | HK$10.10 | HK$19.08 | 47.1% |

REPT BATTERO Energy (SEHK:666) | HK$14.34 | HK$27.33 | 47.5% |

Zhaojin Mining Industry (SEHK:1818) | HK$13.40 | HK$24.88 | 46.1% |

Innovent Biologics (SEHK:1801) | HK$37.95 | HK$66.90 | 43.3% |

CGN Mining (SEHK:1164) | HK$2.59 | HK$4.83 | 46.4% |

Vobile Group (SEHK:3738) | HK$1.19 | HK$2.12 | 43.8% |

Here we highlight a subset of our preferred stocks from the screener

Best Pacific International Holdings

Overview: Best Pacific International Holdings Limited operates in the manufacturing, trading, and selling of elastic fabric, elastic webbing, and lace with a market capitalization of approximately HK$2.20 billion.

Operations: The company generates revenue primarily through two segments: manufacturing and trading of elastic webbing, which brought in HK$834.34 million, and the production and sales of elastic fabric and lace, contributing HK$3.37 billion.

Estimated Discount To Fair Value: 44.4%

Best Pacific International Holdings, trading at HK$2.12, significantly below its estimated fair value of HK$3.82, appears undervalued based on cash flow analysis. The company's earnings are expected to grow by 24.29% annually over the next three years, outpacing the Hong Kong market's growth. Despite a volatile share price and unstable dividend track record, recent increases in dividends suggest improving financial health. However, its forecasted Return on Equity of 19.4% suggests potential challenges in achieving higher profitability levels.

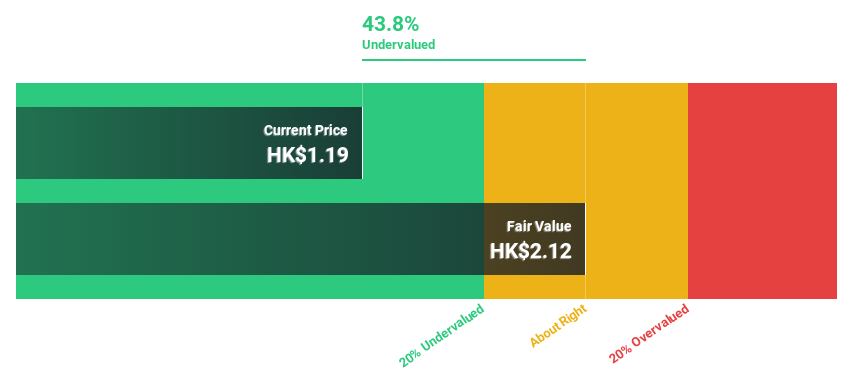

Vobile Group

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content assets protection and transaction across the United States, Japan, Mainland China, and other international markets, with a market capitalization of approximately HK$2.69 billion.

Operations: The company generates HK$2.00 billion in revenue primarily through its SaaS offerings focused on digital content assets protection and transactions.

Estimated Discount To Fair Value: 43.8%

Vobile Group, priced at HK$1.19, is trading significantly under its estimated fair value of HK$2.12, suggesting it's undervalued based on cash flow metrics. Despite a recent net loss, the company's revenue is expected to grow by 22.7% annually, outperforming the Hong Kong market forecast of 7.8%. However, shareholder dilution occurred over the past year and its forecasted Return on Equity in three years is relatively low at 6.6%, indicating potential future profitability challenges despite current growth trajectories.

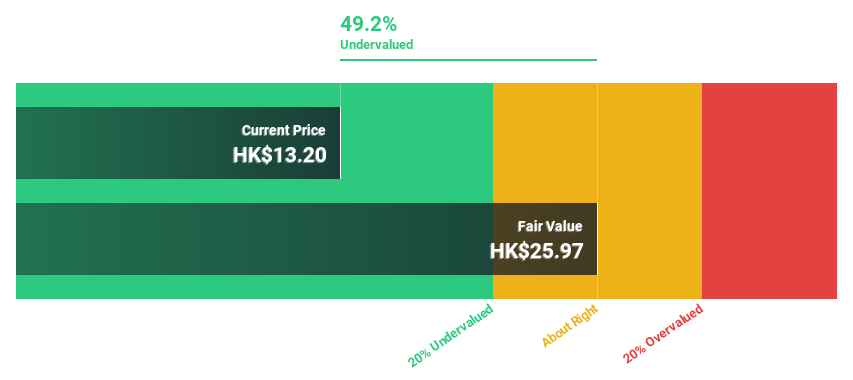

Super Hi International Holding

Overview: Super Hi International Holding Ltd. operates Haidilao branded Chinese cuisine restaurants across Asia, North America, and other international locations, with a market capitalization of approximately HK$8.58 billion.

Operations: The company generates its revenue primarily from its Haidilao branded Chinese cuisine restaurants, totaling $712.07 million.

Estimated Discount To Fair Value: 49.2%

Super Hi International Holding, currently priced at HK$13.2, is significantly below its estimated fair value of HK$25.97, indicating potential undervaluation based on cash flow analysis. The company's earnings are expected to grow significantly by 67% annually over the next three years, outpacing the Hong Kong market's forecasted growth. However, recent financials show a net loss of US$4.46 million for Q1 2024 and shareholder dilution has occurred in the past year, presenting some investment risks despite strong growth prospects and a new CEO appointment poised to drive future strategy.

Key Takeaways

Click this link to deep-dive into the 41 companies within our Undervalued SEHK Stocks Based On Cash Flows screener.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:2111 SEHK:3738 and SEHK:9658.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance