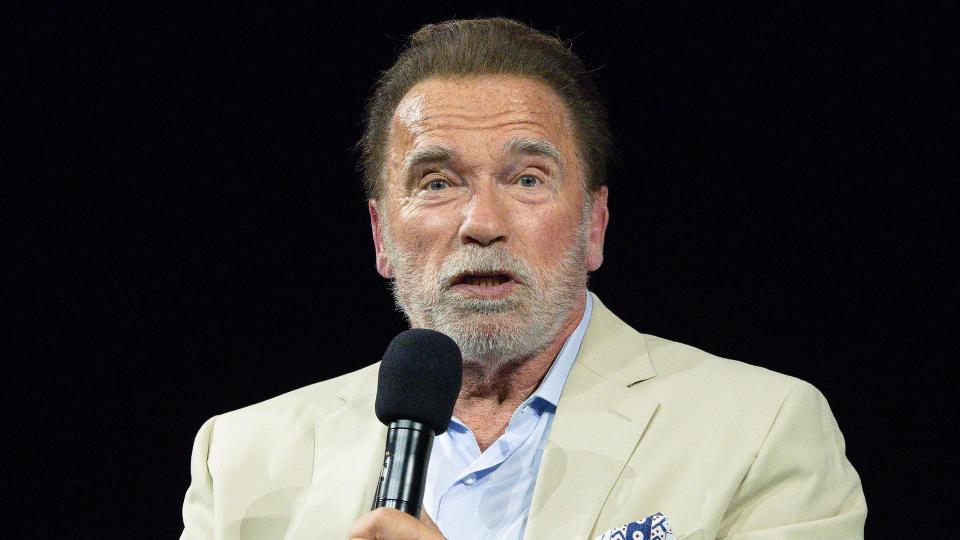

Become a Real Estate Tycoon: 15 Lessons From Arnold Schwarzenegger and Other Celebrity Investors

In addition to their acting careers, many of the world’s most successful celebrities have built massive wealth through real estate investing. From Oprah to Leo, Ellen to Arnie, stars leverage their fortunes to strategically purchase and develop properties. By studying their methods, you can take key lessons from these savvy actors to become a real estate tycoon yourself.

I’m a Luxury Real Estate Agent: These Are the 5 Home Features That Turn Buyers Away

Discover: 5 Reasons the Housing Market Is Reversing

Start Small To Learn the Ropes

When first getting started in real estate, look for affordable properties to gain experience before scaling up. For example, Leonardo DiCaprio purchased his first home in the late 90s in L.A.’s Silver Lake for $769,500, according to UpNest. Arnold Schwarzenegger began by buying a small apartment building in the ’70s that gave him stable rental income early on. Beginning with lower-priced homes or multi-units builds knowledge so you can confidently advance to bigger deals.

Seek Out Fixer-Uppers With Value-Add Potential

Target underpriced or rundown properties with opportunity to renovate and sell for major profits. Jennifer Aniston purchased a $13.5 million Beverly Hills home, renovated and expanded it, then sold it for $36 million. Ellen DeGeneres is known for buying celebrity homes needing work, improving them and flipping for gains of millions. Focus on homes with untapped potential you can unlock.

Convert Rentals Into Long-Term Assets

Owning rental properties provides ongoing income streams. But the real value comes from holding rentals for decades as they appreciate. Arnold Schwarzenegger still owns many of the apartment buildings purchased early on that now generate huge rental income. If possible, retain promising rental properties to accrue value over your lifetime.

Invest in Real Estate Markets With Strong Economic Tailwinds

When deciding where to purchase property, thoroughly research local market conditions and demand drivers. Oprah owns 70 acres in ritzy Montecito, California, where property values rose due to high-income residents and celebrity demand. She also owns homes in upscale pockets of Colorado and Washington. Choose locations poised for growth and capitalize on increasing property values over time.

Build a Diverse Portfolio Across Property Types and Locations

Don’t put all your eggs in one basket. Diversify your real estate assets across residential, commercial, retail and other property types. Hold real estate in multiple thriving global markets, too. Robert De Niro owns homes in New York and London along with restaurants and resort properties across marquee cities to spread risk and take advantage of different property cycles.

Learn From Experienced Mentors To Avoid Costly Mistakes

Amateur real estate investing often leads to subpar returns or losses. Find a mentor who knows what they’re doing when it comes to accurately assessing deals and minimizing risk. Early on, Arnold Schwarzenegger learned from a heavyweight real estate investor who showed him the ropes and helped him purchase wisely. Take the time to learn valuation techniques, market analysis, financing and regulations.

Target Niche Opportunities and Emerging Trends

Look for undervalued or up-and-coming real estate niches primed for growth. For instance, David Charvet’s Charvet Estates home-building company targets demand for luxury sustainable homes. Keep an eye on emerging trends and changing buyer preferences to find and ride new real estate waves early.

Use Properties To Generate Multiple Income Streams

Maximize income from your real estate in different ways. Ellen DeGeneres earns profits by flipping homes she renovates. She also has rented out unsold investments to generate cash flow. And she banks on rising property values over time as markets appreciate. Utilize each asset for immediate returns plus long-term portfolio growth.

Hold Properties Long Term Whenever Possible

Flipping houses can be risky if markets shift suddenly. When possible, buy and hold properties long term to benefit from decades of appreciation. Arnold Schwarzenegger still owns commercial buildings purchased early on that are now worth astronomical sums thanks to long-term market growth. Resist flipping in volatile markets, and build wealth through patience.

Look Into Commercial Developments For Added Income

In addition to residential properties, consider investing in income-producing commercial real estate like restaurants, hotels, malls and office buildings. This strategy has worked extremely well for Robert De Niro and Brad Pitt. Gain experience with commercial markets and build real estate assets through partnerships if needed.

Capitalize on Your Existing Fame and Fortune

Well-known actors often have an advantage in luxury real estate markets. Their celebrity boosts interest when listing homes, like Rupert Grint leveraging his “Harry Potter” fame in the U.K. Plus, high existing net worth allows purchasing ultra high-end properties. If you have any sphere of influence, utilize it to gain access to deals.

Partner With Other Investors To Share Risk and Resources

When you find an investing partner to share money and knowledge with, you both succeed. Brad Pitt partnered with an entrepreneur to purchase a Las Vegas casino development. By teaming up, you lower the chances of losing everything by spreading your investments around, and you can work on bigger and more complex projects.

Think Big With Custom Designs When Opportunity Allows

For ultra high net worth individuals, custom-built dream projects can provide huge payoffs. If money is no object, build passion projects like Leonardo DiCaprio’s eco-resort island in Belize. For the elite, one-of-a-kind trophy properties attract interest and can fetch top dollar when sold.

Time Your Projects and Purchases To Maximize Market Cycles

Keep a pulse on real estate cycles and adjust strategies accordingly. Economic ups and downs create profit opportunities. Robert De Niro developed a resort in Barbuda that will capitalize on the island’s recovery from damage suffered in Hurricane Irma. Buy when markets slump and sell when they surge.

Pursue Projects Aligned With Your Passions and Lifestyle

The most successful real estate tycoons own assets they’re passionate about that support their lifestyle vision. David Charvet built luxury sustainable homes reflecting his values. Ellen DeGeneres flips beautiful homes of her taste and design aesthetic. Invest in ways that bring personal joy and enrichment beyond just profits.

By applying lessons from the world’s savviest celebrity real estate moguls, you, too, can build an impressive property empire. Start small, take calculated risks, leverage your strengths and work with reliable partners. With the right properties, team and strategies, lucrative real estate success can become reality.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Become a Real Estate Tycoon: 15 Lessons From Arnold Schwarzenegger and Other Celebrity Investors

Yahoo Finance

Yahoo Finance