B2Gold (BTG) Sells 10% Stake in Calibre Mining for C$139M

B2Gold Corp. BTG announced that it sold 79 million common shares of Calibre Mining Corp, generating gross proceeds of C$139.04 million ($102 million). This move lowered its stake in Calibre to less than 10%. This decision was taken based on investment considerations, such as price, market conditions, capital allocation goals and the company's overall strategy.

Prior to the sale, B2Gold owned 110,950,333 common shares of Calibre. This accounted for 14.1% of Calibre. As a result of the current sale, B2Gold's holding in Calibre's issued and outstanding common shares has come down to around 4%. B2Gold currently has no plans to make any further changes to its stake in Calibre.

B2Gold is no longer subject to Insider Reporting Requirements under National Instrument 55-104.

In the March-end quarter, B2Gold recorded a consolidated gold production of 214,339 ounces, down 14.5% year over year. The total consolidated gold production for first-quarter 2024 was 225,716 ounces (including 11,377 ounces of attributable production from Calibre), down 15.4% from the prior-year quarter.

The company reported adjusted earnings per share of 6 cents for first-quarter 2024, beating the Zacks Consensus Estimate of 5 cents. The bottom line fell 10% year over year. B2Gold generated revenues of $461 million in first-quarter 2023 compared with the prior-year quarter’s $474 million.

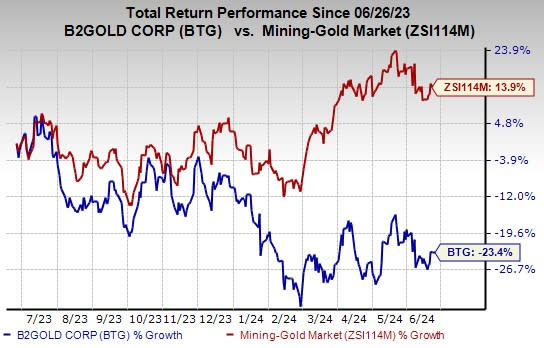

Price Performance

In the past year, B2Gold’s shares have lost 23.4% against with the industry’s growth of 13.9%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

B2Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Ero Copper Corp. ERO, Ecolab Inc. ECL and ATI Inc. ATI. ERO sports a Zacks Rank #1 (Strong Buy) at present, and ECL and ATI have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ero Copper’s 2024 earnings is pegged at $1.66 per share. The consensus estimate for 2024 earnings has moved 20.3% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 53.9%. ERO shares have gained 9.5% in a year.

The Zacks Consensus Estimate for Ecolab’s 2024 earnings is pegged at $6.59 per share, indicating an increase of 26.5% from the prior year’s reported number. It has an average trailing four-quarter earnings surprise of 1.3%. ECL shares have gained 34.5% in a year.

The Zacks Consensus Estimate for ATI’s 2024 earnings is pegged at $2.41 per share. The Zacks Consensus Estimate for ATI’s current-year earnings has been revised 3% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 8.3%. The company’s shares have rallied 65.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

B2Gold Corp (BTG) : Free Stock Analysis Report

Ero Copper Corp. (ERO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance