Asian Financial Forum: Bankers call for greater international cooperation on climate change, fintech amid soft landing

Central and multilateral development bankers at the Asian Financial Forum (AFF) have urged greater international cooperation amid growing expectations of a soft economic landing, but struck a cautionary note about risks posed to the global economy by sticky inflation, geopolitical tensions and China's property downturn.

"There has been considerable progress on disinflation," said Thomas Helbling, deputy director of the Asia and Pacific department at the International Monetary Fund. "So you have almost this sort of soft landing achieved in the global economy. Going into 2024, we are on much firmer ground." He said the IMF is poised to release an update on its economic forecast next week.

The IMF has forecast that the global economy would slow down to 3.0 per cent in 2023 and 2.9 per cent in 2024 from 3.5 per cent in 2022, well below the average of 3.8 per cent in the past two decades.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

Bets on monetary easing in the US have been building up recently amid signs of cooling inflation, which has facilitated outflows to cheaper assets globally. However, Helbling warned that "core inflation can be sticky".

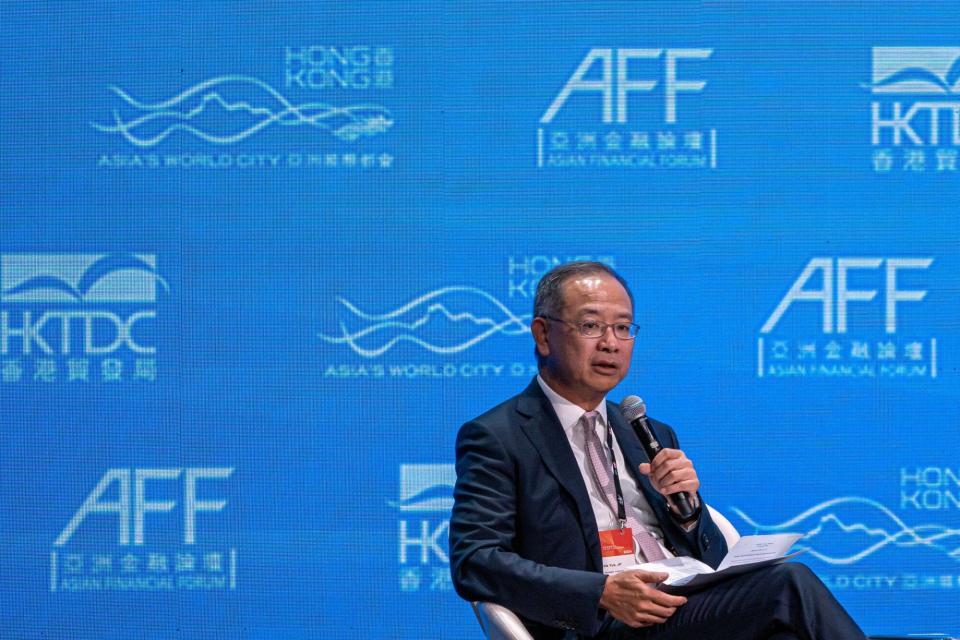

Eddie Yue, chief executive officer of the Hong Kong Monetary Authority (HKMA), during the Asian Financial Forum in Hong Kong, China, on Wednesday, Jan. 24, 2024. The forum runs through Jan. 25. Photo: Bloomberg alt=Eddie Yue, chief executive officer of the Hong Kong Monetary Authority (HKMA), during the Asian Financial Forum in Hong Kong, China, on Wednesday, Jan. 24, 2024. The forum runs through Jan. 25. Photo: Bloomberg>

He added that economic growth may be uneven across markets, and the property sector downturn in China could be stronger than expected. "We now also see upside risks if there is a comprehensive strategy to address property sector issues, and broader market-based reforms could lift growth. On the other hand, there are also prospects that the property sales downturn could still intensify before the situation in the sector finally improves."

Helbling and other experts who spoke at a panel discussion advocated stronger multilateral cooperation in several areas, with climate change being a focus.

Scott Morris, vice-president of East and Southeast Asia and the Pacific at the Asian Development Bank, said the bank's largest shareholders - Japan, the US, China and India - have been working jointly to mobilise multilateral financing for climate responses.

"We are committing to US$100 billion of our direct financing by 2030 directly to support climate goals," he said, adding that the bank is using its own capital to contribute an additional US$10 billion a year for the same purpose.

International cooperation in addressing climate change will be a big focus in times to come, while Hong Kong is well positioned to lead in financing sustainable development, speakers said.

There is also a need for regulatory cooperation in emerging areas such as fintech, digital assets and cryptocurrency.

"For those of us who feel that cryptocurrency needs to be regulated, at the moment, we've been flying blind, and therefore all the more reason for us regulators to speak to each other, cooperate, and learn from each other," said Ian Johnston, chief executive of Dubai Financial Services Authority (DFSA).

Eddie Yue, chief executive of the Hong Kong Monetary Authority (HKMA), said HKMA will jointly host a climate finance conference with DFSA. The conference will be organised in Hong Kong in October this year and in Dubai next year.

Separately, during the keynote luncheon at the AFF, Hong Kong financial secretary Paul Chan Mo-po and brokerage China International Capital Corporation's (CICC) president and chief financial officer Wu Bo said the city is ideally positioned to finance sustainable development.

"Massive funding is needed for green transformation, with estimates suggesting that more than US$66 trillion will be required in Asia alone over the next three decades," said Chan. "As an international financial centre, we are Asia's leader in green investment and financing."

As of September, the city had more than 200 registered ESG funds, with total assets under management of about US$160 billion, up 28 per cent from the previous year, Chan added.

With its advanced infrastructure and facilities for green and sustainable development, "we believe that Hong Kong will continue to be a global powerhouse for green innovation", CICC's Wu said.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance