3 Watch Market Data Tools Designed to Make You a Smarter Collector

The pre-owned watch market, projected to total around $30 billion in 2025, may soon account for half of global watch sales. One important factor behind the category’s spectacular growth over the past two decades has been access to pricing history online, enabling buyers and sellers to transact with a transparent view of what the market fairly bears. Now, thanks to a slew of new data-driven platforms that provide insights into pricing, the pre-owned market is poised to grow ever further.

Lately, we’ve been analyzing various watch market trends and reporting them out using data aggregators EveryWatch, WatchCharts, and Chrono24’s Chrono Pulse. These platforms crunch the numbers on everything from the spring auction results to downward trends in Rolex pricing, to market activity on specific models and references. We believe this data can be used to help collectors home in on the best investments and the best deals, as well as the best moment to strike.

More from Robb Report

Below, we offer a snapshot of those three data providers, a sense of what each is especially good at, and how to get started using them. There are free as well as paid subscriptions, designed for anyone keen to understand pricing trends or to dig deep into market analytics.

As you peruse the listings, remember that while it’s important to know what a given watch model is trading for on the open market, it’s also important to recognize that the timepiece in your hand—due to condition or provenance—may trade for a lot more, or less. This variance is especially true of vintage and neo-vintage pieces, which can range from pristine “case queens” to those that proudly wear battle scars or have achieved beautiful (or not so beautiful) patina.

Happy hunting!

EveryWatch

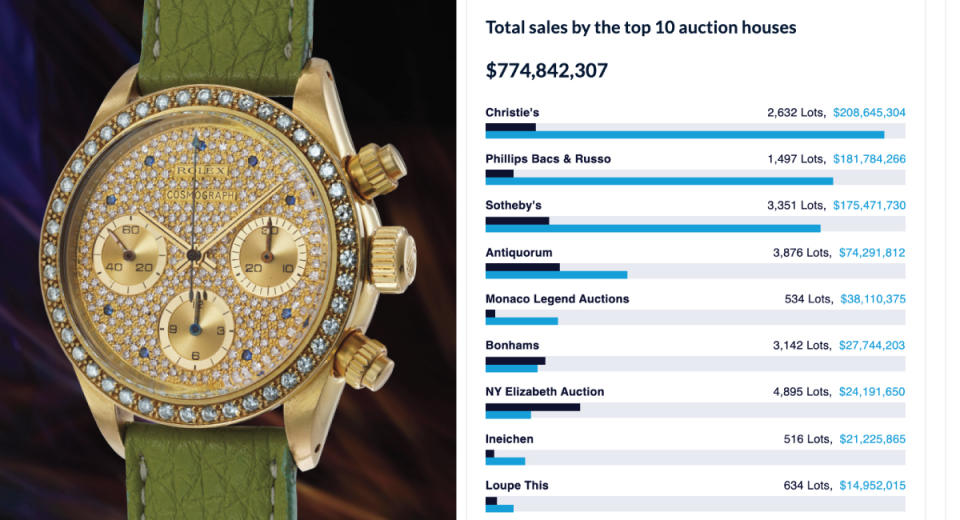

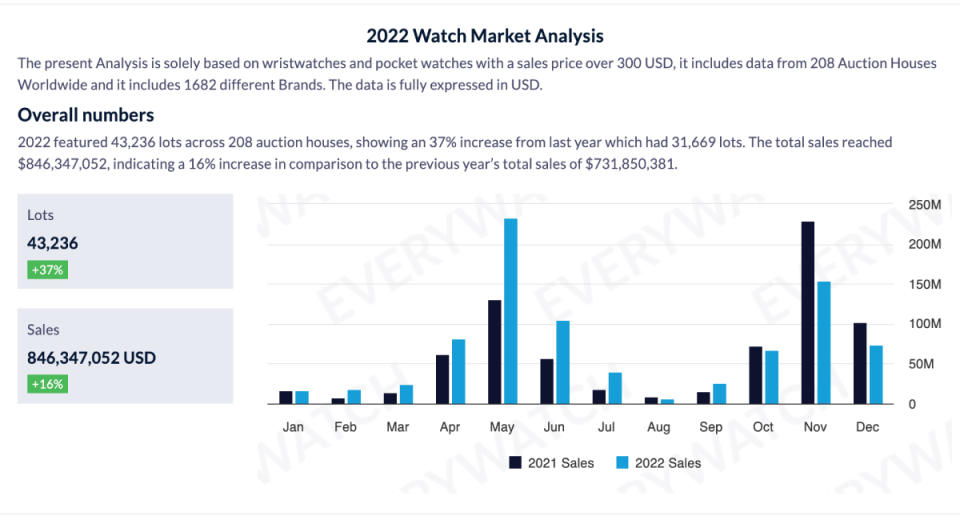

Introduced in November at Dubai Watch Week, EveryWatch uses A.I. to provide comprehensive pricing information about the luxury watch market, including historical prices, trends, and direct links to watches for sale from hundreds of marketplaces and auction houses globally.

“Our goal is to bring more clarity to the market,” Giovanni Prigigallo, co-founder of EveryWatch, tells Robb Report. “And with clarity comes stability and consolidated pricing, which we don’t have right now. Of course, conditions and provenance play a big role in pricing, and you’ll always have the outliers, but right now, you get a lot of fluctuations that are just basically dealers trying to max out their potential.”

The EveryWatch database covers more than a million pre-owned watches with a minimum value of $300. It tracks more than 260 marketplaces and dealers around the watch world, from big resellers such as the 1916 Company and Watchfinder & Co. to high-end specialists including S. Song in Kuala Lumpur and A Collected Man in London. Its database of information on watch auction sales—totaling more than 350 auction houses globally—goes back to 1989 and includes historical, current, and upcoming sale information with prices, sale listings, and dealer information. The A.I. steps in to help eliminate anomalously high results (often generated at charity auctions) that would otherwise skew the data.

The free version of EveryWatch allows access to marketplace listings, info about upcoming auctions, a comparison tool, saved search notifications, and notifications about watches you’ve followed with your account. “Basically, you’re able to compare all of the features of a watch, such as year of production, the condition, who’s selling the watch and where, the movement type, if it comes with box and papers, case materials, size, pretty much everything,” Prigigallo says. “And you’re able to do it on any upcoming auction watch. Of course, with the [paywall] limitations, you’re not going to see who’s selling it and when. But for the marketplace, you can compare any watch.”

Only paid subscribers have access to the full suite of EveryWatch’s analytical tools, including auction results. A subscription costs $49 per month or $444 for the year.

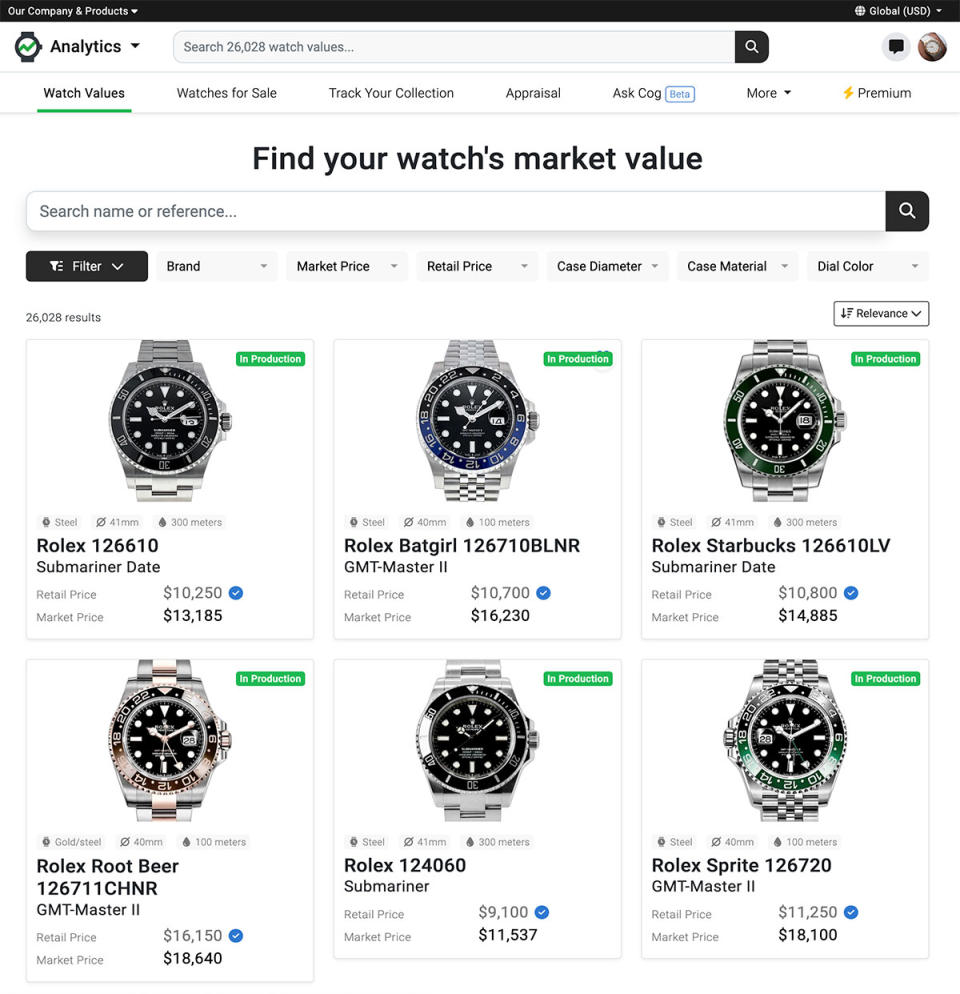

WatchCharts

WatchCharts got its start when founder Charles Tian was working at IBM and began buying watches as a hobby. As a value-driven collector, he kept track of prices in a spreadsheet, “and that spreadsheet snowballed into the company that we are today,” Hamza Masood, the company’s business development manager, tells Robb Report.

“We don’t see ourselves as a watch company,” he says. “We don’t make watches. We don’t buy watches. We don’t sell watches ourselves. And we don’t write about watches in the way that the media traditionally does. We see ourselves as a tech company. And the primary service we offer is data and insights about the secondary watch market.”

WatchCharts’ main business model is subscription-based, but a certain amount of information is available to users free of charge. “If you’re on the free version of the website, you can see the price [of a model],” Masood says. “You can see a one-year price history. And you can see that for a limited number of watches before we’ll ask you to sign in.”

An enthusiast-level subscription, which provides two years of price history, unlimited access to the website, and some advanced features, costs $160 a year. The professional membership, which costs $800 a year, offers unlimited access to the entire site, plus five years of price history and access to some additional analytical tools.

From the homepage, users can type in the name of the model they’re interested in. “What you’ll see is essentially listings,” Masood says. “They’re going to be all over the place in terms of price, but they’re also going to be all over the place in terms of condition, location, whether or not they have boxes and papers, and then whether they’re being listed by a dealer or by a collector for sale in a peer-to-peer context. Each of those variables is something we model prices for.”

“We publish daily updated prices based on our analysis of what we think sells and what in some cases we know has sold and what gets listed every day. The market price that we publish is really our best guess at what the valuation for that watch would be.”

Chrono Pulse

Last fall, Chrono24, the online marketplace for pre-owned watches, introduced ChronoPulse, a free watch pricing tool based on sales data accumulated over the marketplace’s 20-year history. The index uses sales prices from 140 watch models—the top 10 bestselling and most important models made by the pre-owned watch market’s 14 bestselling brands over the last three years—to come up with a data set reflecting actual transaction prices.

“Chrono24 has long been the default resource for watch dealers, collectors, and enthusiasts seeking pricing information and value trajectories for individual references over time,” Chrono24 founder and Chairman of the Board, Tim Stracke said in a statement. “In our 20-year history, we’ve amassed a treasure trove of trusted, real data that offers an unbeatable representation of the pre-owned watch market.”

The ChronoPulse index factors in more than 4.6 million data points and is updated daily, according to Chrono24. The selection and weighting of specific makers and models, on the other hand, is adjusted every six months. The brands represented on the platform are Rolex, Omega, Patek Philippe, Audemars Piguet, Breitling, Cartier, IWC, Panerai, TAG Heuer, Tudor, Jaeger LeCoultre, Grand Seiko, Hublot and Vacheron Constantin.

Best of Robb Report

Sign up for Robb Report's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo Finance

Yahoo Finance