3 Leading Dividend Stocks In India With Yields Up To 3.5%

In the past year, India's market has shown robust growth with a 46% increase, despite a flat performance in the last week. In this context of promising earnings growth forecasted at 16% annually, dividend stocks can be particularly appealing for investors seeking both stability and steady income.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 4.00% | ★★★★★★ |

Bhansali Engineering Polymers (BSE:500052) | 3.17% | ★★★★★★ |

D. B (NSEI:DBCORP) | 4.30% | ★★★★★☆ |

Castrol India (BSE:500870) | 3.62% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.25% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.58% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.52% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.68% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.32% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.78% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Gulf Oil Lubricants India

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gulf Oil Lubricants India Limited is a company that manufactures, markets, and trades lubricants for the automobile and industrial sectors in India, with a market capitalization of approximately ₹56.60 billion.

Operations: Gulf Oil Lubricants India Limited generates its revenue primarily from the lubricants segment, totaling approximately ₹33.01 billion.

Dividend Yield: 3.5%

Gulf Oil Lubricants India has shown a robust performance with a 32.6% earnings growth over the past year, and forecasts suggest an 11.64% annual growth moving forward. Despite its volatile share price recently, it trades at a favorable P/E ratio of 18.4x compared to the broader Indian market's 32.5x. The dividend yield stands at 3.48%, higher than the market's average, supported by a sustainable payout ratio of 57.4% and cash payout ratio of 62.7%. However, its dividend track record has been unstable over the past decade, reflecting some inconsistency in payments despite recent increases.

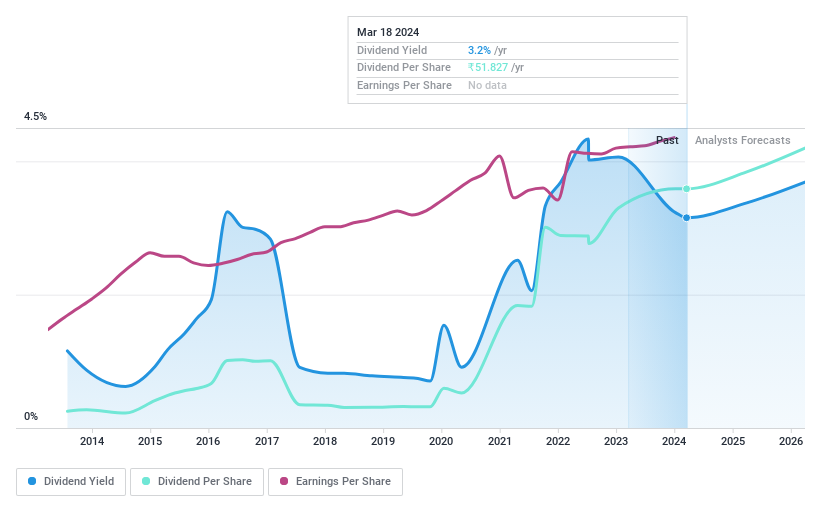

HCL Technologies

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HCL Technologies Limited is a global company that provides software development, business process outsourcing, and infrastructure management services, with a market capitalization of approximately ₹3.92 trillion.

Operations: HCL Technologies Limited generates revenue primarily through three segments: HCL Software at $1.41 billion, IT and Business Services at $9.80 billion, and Engineering and R&D Services at $2.12 billion.

Dividend Yield: 3.6%

HCL Technologies, with a dividend yield of 3.58%, ranks in the top quartile of Indian dividend payers. The company's dividends are supported by a cash payout ratio of 65.1% and an earnings payout ratio of 89.1%. Despite this, HCLTech's dividend history has been marked by volatility over the last decade, raising concerns about the reliability and sustainability of its payouts. Recent strategic expansions and alliances, such as new offices in North America and partnerships for advanced AI solutions, underscore its commitment to growth and innovation in key markets.

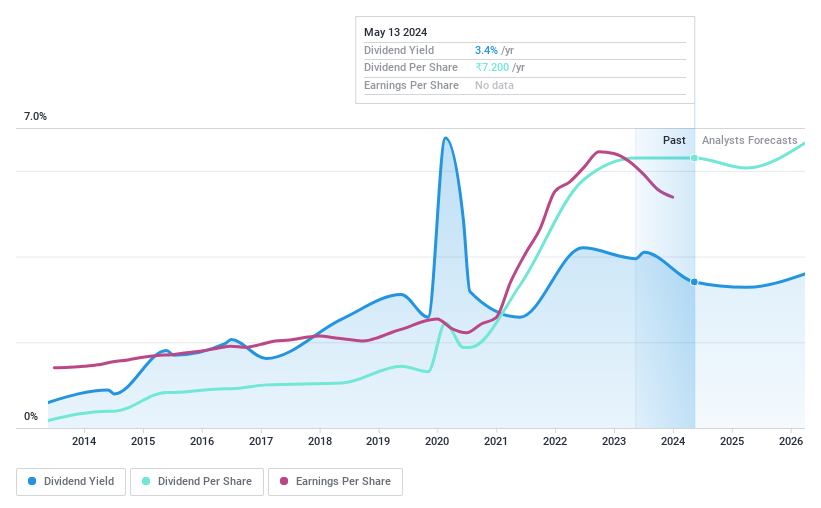

Redington

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Redington Limited operates as a supply chain solutions provider in both India and international markets, with a market capitalization of approximately ₹169.63 billion.

Operations: Redington Limited generates its revenue from providing supply chain solutions across various global markets.

Dividend Yield: 3.3%

Redington Limited, despite a recent dividend of INR 6.20 per share, shows a mixed track record in dividend reliability and stability over the past decade. The company's dividends are supported by an earnings payout ratio of 40.4% and a cash payout ratio of 58.8%, indicating reasonable coverage by both earnings and cash flows. However, its dividends have experienced volatility, reflecting some level of unpredictability in payouts. Financial performance for FY2024 showed an increase in sales to INR 893.46 billion but a drop in net income to INR 12.19 billion from the previous year’s INR 13.93 billion, suggesting potential challenges ahead for sustaining dividend growth despite current adequate coverage ratios.

Next Steps

Click this link to deep-dive into the 19 companies within our Top Dividend Stocks screener.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:GULFOILLUB NSEI:HCLTECH and NSEI:REDINGTON.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance