3 High-Yield Dividend Stocks In The UK With Up To 4.8% Yield

Amidst a backdrop of cautious global markets and specific economic uncertainties, the United Kingdom's FTSE 100 has shown resilience, though it faces pressures from both domestic and international fronts. In such an environment, high-yield dividend stocks could offer investors a semblance of stability and predictable income streams, making them particularly appealing in times of market volatility.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.25% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 6.87% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.53% | ★★★★★☆ |

DCC (LSE:DCC) | 3.51% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.90% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.85% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.76% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.37% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.22% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.79% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

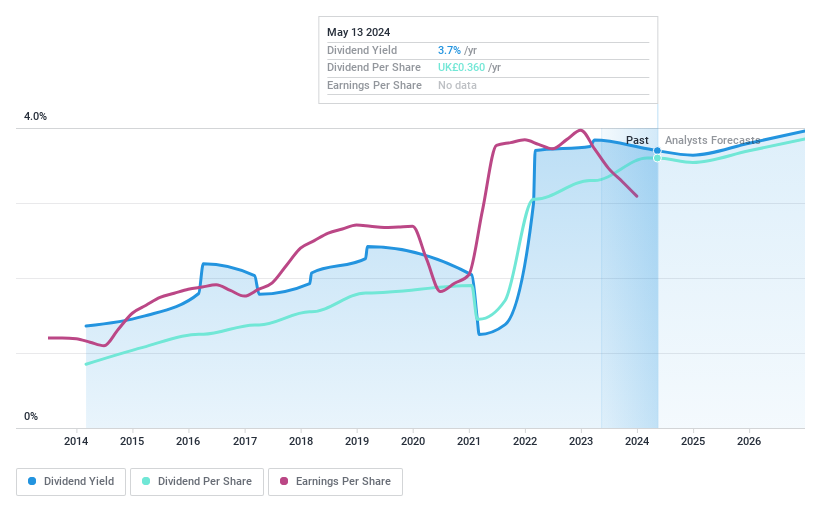

Grafton Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Grafton Group plc operates in distribution, retailing, and manufacturing across Ireland, the Netherlands, Finland, and the United Kingdom with a market capitalization of approximately £1.92 billion.

Operations: Grafton Group plc generates revenue through various segments, including retailing at £258.20 million, manufacturing at £135.30 million, and distribution activities in the UK (£818.11 million), Ireland (£631.03 million), Finland (£139.78 million), and the Netherlands (£351.47 million).

Dividend Yield: 3.8%

Grafton Group's dividend yield sits at 3.76%, below the top UK payers, yet its sustainability is supported by a payout ratio of 51.8% and a cash payout ratio of 32.7%. Dividends have been consistent over the past decade, with recent approval for a final dividend of £0.26 per share as of May 2024. Despite this reliability, earnings are projected to grow modestly at 1.96% annually, and recent reports indicate a revenue decline of 5% year-over-year as of April 2024.

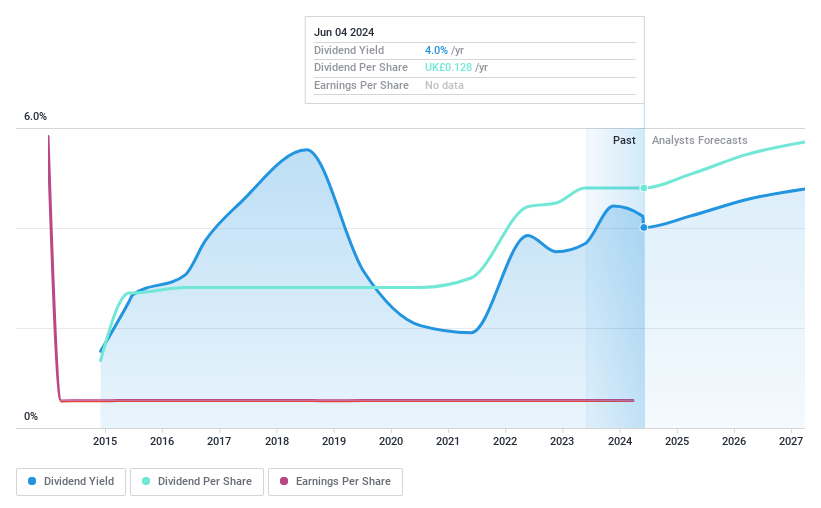

Pets at Home Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Pets at Home Group Plc is a specialist omnichannel retailer based in the United Kingdom, offering pet food, related products, and accessories with a market capitalization of approximately £1.39 billion.

Operations: Pets at Home Group Plc generates revenue primarily through two segments: £1.33 billion from its retail operations and £146.50 million from its veterinary services.

Dividend Yield: 4.3%

Pets at Home Group Plc, despite a year-over-year earnings dip, maintains a steady dividend with a final payout of 8.3 pence per share for a total annual dividend of 12.8 pence. The dividends are supported by an earnings coverage ratio of 77.2% and cash flows covering 36.6%, aligning with their strategy to adjust the payout ratio toward 50%. While the dividend yield is modest at 4.26%, lower than the UK market's top quartile, it benefits from stability and incremental growth over the past decade, suggesting reliability in its returns to shareholders amidst recent executive board enhancements aimed at bolstering governance and sustainability initiatives.

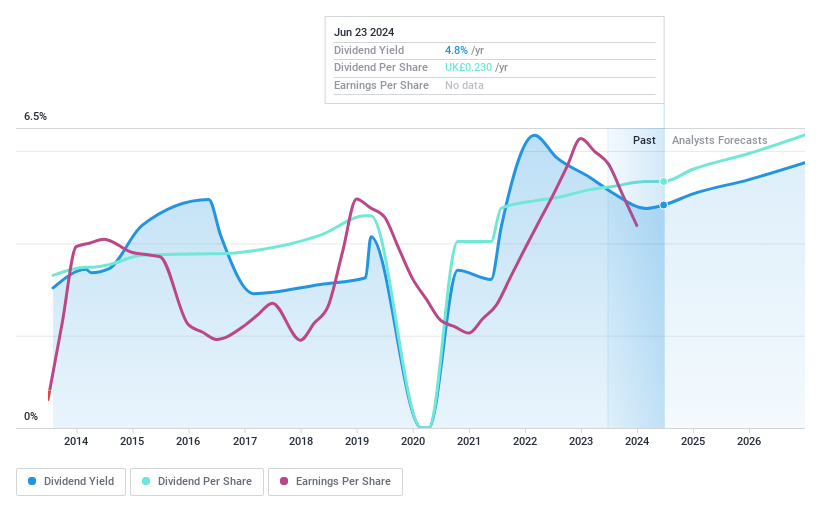

Vesuvius

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vesuvius plc specializes in molten metal flow engineering and technology services for the steel and foundry casting industries globally, with a market capitalization of approximately £1.26 billion.

Operations: Vesuvius plc generates revenue through distinct segments: £529.80 million from Foundry, £793 million from Steel - Flow Control, £39.10 million from Steel - Sensors & Probes, and £567.90 million from Steel - Advanced Refractories.

Dividend Yield: 4.8%

Vesuvius plc, trading 65.8% below estimated fair value, offers a dividend yield of 4.83%, which is lower than the top quartile in the UK market. Despite a decade of volatile dividends and a recent dip in profit margins to 6.1% from last year's 8.8%, dividends are supported by an earnings coverage ratio of 52.2% and cash flows with a payout ratio of 49.3%. Recent board changes could influence future governance, maintaining financial guidance for steady performance through 2024.

Navigate through the intricacies of Vesuvius with our comprehensive dividend report here.

Upon reviewing our latest valuation report, Vesuvius' share price might be too pessimistic.

Seize The Opportunity

Take a closer look at our Top Dividend Stocks list of 57 companies by clicking here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:GFTULSE:PETS and LSE:VSVS

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance