2024 First Half Review: 5 Industry Stock Market Trends

The year 2022 marked the most brutal bear market since the COVID-19 “Black Swan” crash event plagued Wall Street. However, since then, stocks have roared back, exhibiting the resiliency and long-term robustness of the U.S. equity market.

Picking up off 2023’s price momentum, the Nasdaq and the S&P 500 Index are each up more than 15% and have recently notched fresh all-time highs. Nevertheless, the performance of the major indices does not paint the whole picture of Wall Street. As the adage goes, “Never judge a book by its cover.”

Because of sky-high interest rates, a new technological revolution, and other macroeconomic factors, equity performance is bifurcated. As usual, investing is rarely straightforward, and the 2024 market resembles a classic “stock picker’s market.” Below are five of the most critical industry trends from the first half of 2024.

1. AI & Semiconductor Revolution

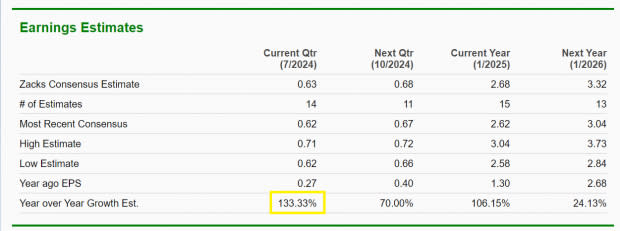

Artificial Intelligence, or AI, was once an obscure idea that sounded like a pipe dream. However, the wildly successful launch of ChatGPT in November 2022 brought AI from idea to product and into the public consciousness (ChatGpt is the fastest-growing consumer app in history). That said, 2024 is proving to be the real coming-out party. Investors need not look further than semiconductor juggernaut Nvidia (NVDA) for evidence of the AI revolution. The Zacks Rank #1 (Strong Buy) stock, now the largest publicly traded company, is up 150% year-to-date and is expected to grow earning 133% next quarter.

Image Source: Zacks Investment Research

2. Utilities: Powering the AI Revolution

Utilities are traditionally considered safe haven investments because of their steady earnings, dividends, and lack of volatility. However, the frenzy to build large language models (LLMs) to power AI chatbots like ChatGpt or Google’s Gemini has sparked a new bull market in these names. AI requires data centers to function, which requires an enormous energy appetite. Data center power usage will double by 2026, according to International Energy Agency (IEA). NRG Energy (NRG), a Texas-based electricity supplier, has trended above its intermediate-term 10-week moving average and has more than doubled over the past year.

Image Source: Zacks Investment Research

3. Bitcoin Benefits from ETF Launch

Bitcoin, the world’s largest cryptocurrency, is the top-performing asset over the past ten years and has achieved a mind-boggling annualized return well north of 100%. BTC is again outperforming other asset classes after the launch of the iShares Bitcoin Trust ETF (IBIT), the most successful ETF launch in history.

4. Metals: An Inflationary Hedge

Gold and silver have made a splash in 2024 after several years of stagnant and frustrating price action. The iShares Silver Trust (SLV) is up nearly 25% in 2024 as investors seek refuge from stubborn inflationary trends.

5. Big Tech

Higher interest rates have led to an exodus from rate-sensitive areas of the market, such as the small cap Russell 2000 Index. As a result, mega-cap tech stocks such as Apple (AAPL) have benefitted from investor participation and massive share buybacks. However, with lower rates on the horizon, money may rotate back into undervalued small cap stocks in the back half of the year.

Bottom Line

A high interest rate environment and a revolution in AI technology have led to a bifurcated market where specific industries outperform others.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NRG Energy, Inc. (NRG) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

iShares Silver Trust (SLV): ETF Research Reports

iShares Bitcoin Trust (IBIT): ETF Research Reports

Yahoo Finance

Yahoo Finance