Xiamen Xiangyu And Two Other Top Dividend Stocks

As global markets navigate through varying economic signals, China's market has shown resilience despite facing deflationary pressures and consumer caution. In this context, dividend stocks like Xiamen Xiangyu offer a potential avenue for investors seeking stability in a fluctuating market environment.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.22% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.65% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.44% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 3.44% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 7.12% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.46% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.60% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.00% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.39% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.55% | ★★★★★★ |

Click here to see the full list of 217 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

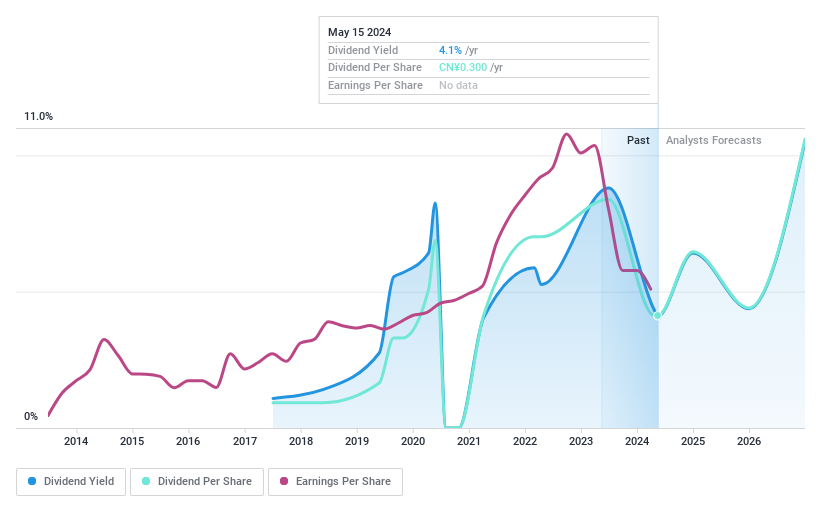

Xiamen Xiangyu

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xiamen Xiangyu Co., Ltd. operates as a supply chain services provider in the People’s Republic of China, with a market capitalization of approximately CN¥17.92 billion.

Operations: Xiamen Xiangyu Co., Ltd. specializes in supply chain services across various sectors in China.

Dividend Yield: 3.8%

Xiamen Xiangyu, with a payout ratio of 54%, has its dividends well-covered by earnings and cash flows (cash payout ratio at 3.5%), indicating sustainability. Despite a high debt level and recent declines in sales and net income—CNY 104.57 billion in Q1 2024 revenue, down from CNY 129.15 billion year-over-year—the company's dividend yield remains competitive at 3.8%. However, the firm's profit margins have dipped to 0.3% from last year’s 0.5%, reflecting some financial pressures amidst its growth efforts forecasted at an annual rate of 27.63%.

Delve into the full analysis dividend report here for a deeper understanding of Xiamen Xiangyu.

Our valuation report unveils the possibility Xiamen Xiangyu's shares may be trading at a discount.

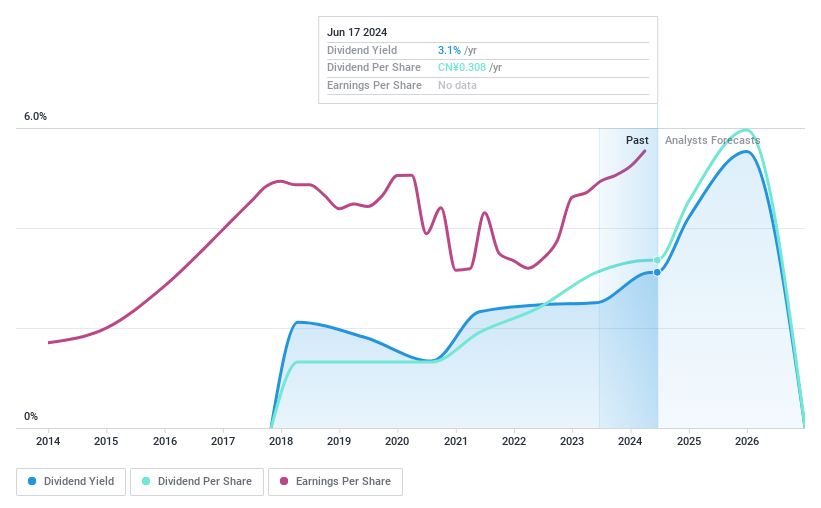

Shanghai Daimay Automotive Interior

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Daimay Automotive Interior Co., Ltd specializes in researching, developing, producing, and selling passenger car components for OEMs and automakers both domestically and internationally, with a market capitalization of CN¥16.33 billion.

Operations: Shanghai Daimay Automotive Interior Co., Ltd generates its revenue primarily from the research, development, production, and sale of passenger car components to OEMs and automakers across global markets.

Dividend Yield: 3.1%

Shanghai Daimay Automotive Interior Co., Ltd, despite a short dividend history of just six years, shows promising financial health with dividends well-covered by earnings and cash flows, boasting payout ratios at 74% and 71.5%, respectively. The company's recent performance includes a year-over-year net income increase to CNY 653.98 million for the full year ended December 31, 2023, supporting its dividend sustainability. However, its dividend track record remains relatively unstable due to its brief history of payouts.

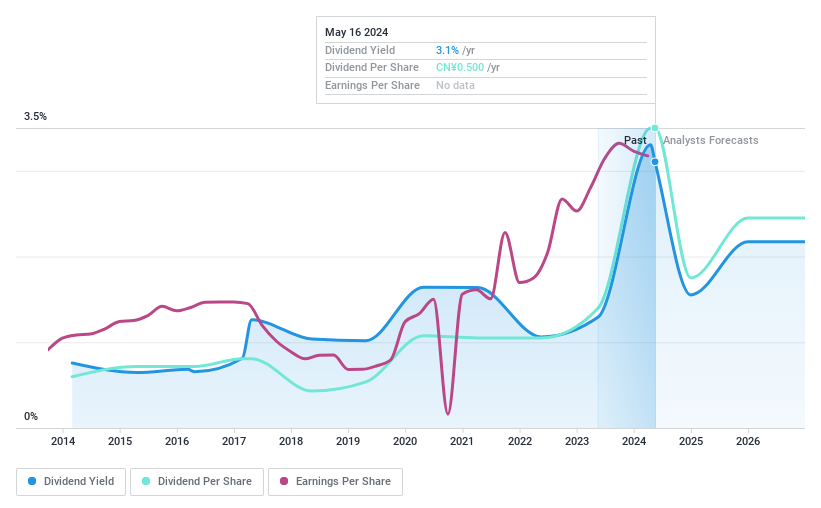

Hangzhou Sunrise TechnologyLtd

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hangzhou Sunrise Technology Co., Ltd. specializes in designing, developing, manufacturing, and selling electricity energy meters and power information collection systems in China, with a market capitalization of approximately CN¥7.49 billion.

Operations: Hangzhou Sunrise Technology Co., Ltd. generates its revenue primarily from the design, development, manufacture, and sale of electricity energy meters and power information collection systems within China.

Dividend Yield: 3.4%

Hangzhou Sunrise TechnologyLtd. recently declared a consistent dividend of CNY 5 per 10 shares, reflecting its latest profit distribution plan. Despite a robust revenue increase to CNY 1.77 billion in 2023 from CNY 1.51 billion the previous year, and net income growth to CNY 607.29 million, the company's dividend history has been marked by volatility over the past decade. The dividends are reasonably covered by earnings with a payout ratio of 42.4% and cash flows at a cash payout ratio of 61.3%, suggesting some level of sustainability despite past inconsistencies in payouts.

Taking Advantage

Investigate our full lineup of 217 Top Dividend Stocks right here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:600057 SHSE:603730 and SZSE:300360.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance