Why You Should Stay Invested in First American (FAF) Stock

First American Financial FAF is poised to grow, given increased demand among millennials for first-time home purchases, expansion of its valuation and data businesses as well as strength in commercial business and technological upgrade. These, along with solid growth projections, make the stock worth retaining in one's portfolio.

FAF has a decent earnings surprise history, having surpassed estimates in two of the trailing four quarters and missing in two.

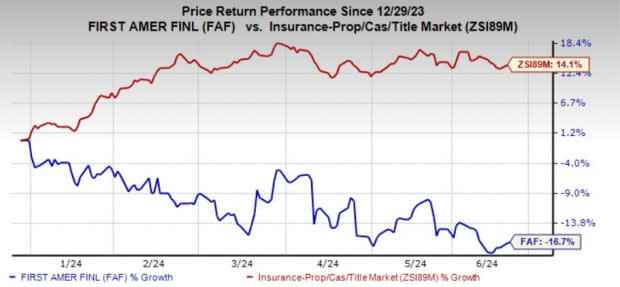

Zacks Rank & Price Performance

First American currently carries a Zacks Rank #3 (Hold). The stock has declined 16.8% year to date against the industry’s increase of 14.1%.

Image Source: Zacks Investment Research

Optimistic Growth Projection

The Zacks Consensus Estimate for 2024 earnings is pegged at $3.82, indicating an increase of 0.5% on 5.4% higher revenues of $6.3 billion. The consensus estimate for 2025 earnings is pegged at $5.13, indicating an increase of 34.2% on 9.5% higher revenues of $6.9 billion.

We expect 2026 EPS to witness a three-year CAGR of 11.2%.

Return on Equity

Return on equity is a measure of profitability, reflecting how efficiently a company is utilizing its shareholders’ fund. FAF’s trailing 12-month ROE of 8.2% outperformed the industry average of 7.8%.

Growth Drivers

First American remains well poised to capitalize on the increased demand among millennials for first-time home purchases. It expects housing demand, improving economy and labor markets to continue to drive home price appreciation. Growing leadership in title data, courtesy of proprietary data extraction, sturdy distribution relationships, prudent underwriting and continued investments in technology, should help it capitalize on the opportunity.

Growing direct premiums, escrow fees and title agent premiums should continue to drive the top line. We expect the 2026 top line to increase at a three-year CAGR of 8.2%.

Strategic initiatives to strengthen its product offerings and intensify its focus on its core business bode well.

Wealth Distribution

First American has a solid track record of dividend increase, with the metric witnessing an eight-year (2016-2024) CAGR of 8.2%. FAF’s dividend yield of 3.9% compares positively with the industry average of 0.3%.

It also engages in share buyback and had $210.4 million remaining under its authorization as of Mar 31, 2024.

Risks

Despite the upside potential, there are a few factors that investors should keep an eye on. First American continues to suffer due to challenging real estate and mortgage industries. Higher mortgage rates and slow inventory growth continue to drag down transaction volumes. A tough mortgage origination market is a concern.

Also, as the Fed intends to lower rates, the company estimates that for each 25-basis point decline in the Fed funds rate, the annualized investment income will decline $15 million, but the ultimate amount will fluctuate depending on the level of cash and escrow balances.

First American’s debt levels have been increasing in the past few years with debt-to-capital ratio deteriorating. Its times interest earned compares unfavorably with the industry average.

Stocks to Consider

Some top-ranked stocks from the insurance industry are HCI Group, Inc. HCI, Palomar Holdings PLMR and ProAssurance PRA. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

HCI Group’s earnings surpassed estimates in each of the last four quarters, the average beat being 139.15%. In the past year, shares of HCI have rallied 10.5%.

The Zacks Consensus Estimate for HCI’s 2024 and 2025 earnings implies 57.6% and 4.3% year-over-year growth, respectively.

Palomar’s earnings surpassed estimates in each of the last four quarters, the average earnings surprise being 15.10%. In the past year, PLMR’s stock has surged 54.8%.

The Zacks Consensus Estimate for PLMR’s 2024 and 2025 earnings indicates 25.8% and 16.1% year-over-year growth, respectively.

ProAssurance earnings surpassed estimates in two of the last four quarters and missed in the other two. In the past year, PRA’s stock has lost 2.5%.

The Zacks Consensus Estimate for PRA’s 2024 and 2025 earnings implies 371.4% and 71.6% year-over-year growth, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ProAssurance Corporation (PRA) : Free Stock Analysis Report

First American Financial Corporation (FAF) : Free Stock Analysis Report

HCI Group, Inc. (HCI) : Free Stock Analysis Report

Palomar Holdings, Inc. (PLMR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance