Why Isetan’s minority shareholders believe the privatisation offer undervalues the company

Isetan's minority shareholders explain why they would like a higher price than the $7.20 privatisation offer.

On April 1, Isetan (Singapore) announced that it had received an offer from Isetan Mitsukoshi Holdings to acquire the shares that the latter doesn’t own, by way of a scheme of arrangement (SOA). The price being offered is $7.20. The undisturbed price of Isetan on March 26 was $2.84 versus its book net asset value (NAV) of $2.58. Oftentimes, Isetan would trade below its book value.

Why then, did Isetan Mitsukoshi, which holds 52.73% of Isetan (Singapore) offer $7.20 per share? And yet, according to a group of long-term shareholders, the SOA offer still values Isetan below its intrinsic value.

Here’s why.

Isetan adopts historical cost accounting (like City Developments). Its properties are valued at cost less depreciation and impairment. As a result, the valuation of both its investment properties, and its property, plant and equipment (PPE) are likely to be less than what they could receive on the open market.

Based on the revaluation surplus that Isetan has in its annual report for its investment properties (25.77% of Wisma Atria and 50% of Kallang Pudding Lane) of $308.9 million, and the book value of its investment properties of $25.8 million, the surplus is $283.1 million. This in itself works out as a $6.86 per share of surplus, which The Edge Singapore previously indicated.

A $6.86 surplus implies a revalued NAV (RNAV) of $9.44 per share.

However, the revaluation surplus does not take into account Isetan’s other properties under its property, plant and equipment (PPE). Based on the annual report, the property part of PPE is carried at $14.673 million as at Dec 31, 2023 in the balance sheet. The minorities argue that this value should be included.

The PPE properties comprise Isetan Office Building on Havelock Road, a 50% stake in Kallang Pudding Warehouse and a unit at Valley Park. The Isetan Office Building and Kallang Pudding Warehouse are freehold, and the Valley Park condominium sits on 999-year land (so, pretty much freehold).

The fair valuation of these properties as stated in the annual report are $47.85 million. Based on the fair value of both its investment properties, and those that Isetan (Singapore) uses for its business operations, the RNAV is around $10.21.

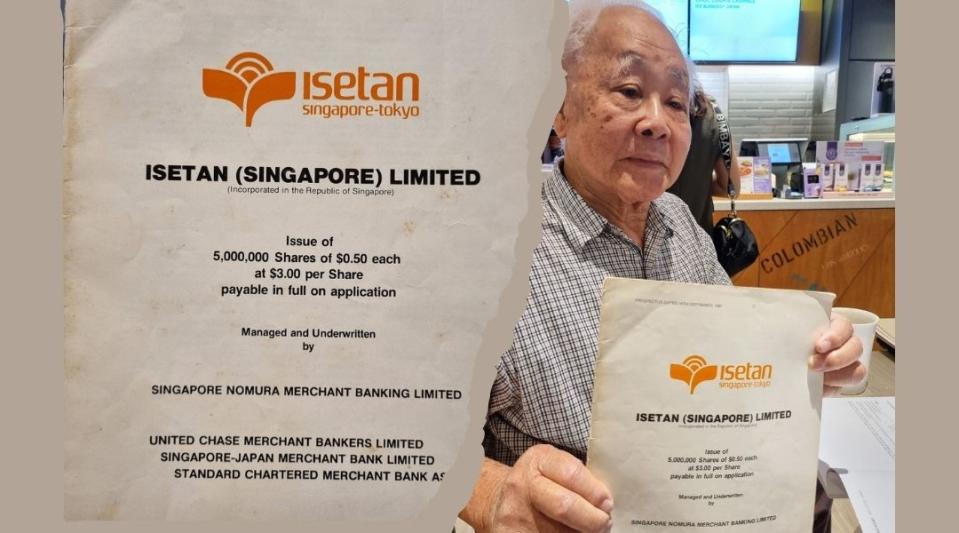

Mr How, an 88-year old shareholder of Isetan (Singapore) who has held the shares since its IPO in 1981, says: “Most people are not unreasonable, they are looking for a fairer offer. At the last minute [the Japanese] cannot kick us out at $7.20. If they don’t agree to a better offer, we will wait for them to liquidate.”

Chatting with Mr How was like getting a glimpse into the past. In the recent past, Mr How campaigned for Isetan (Singapore) to disburse its $60 million of tax credits by end-2007. Companies were given five years' notice from Jan 1, 2003 — when the one-tier corporate tax system came into effect — to Dec 31, 2007 to allow them to utilise the outstanding balance of their section 44A tax credits.

“Every year, the dividend was very low and all the profit was not fully distributed out. Then came the 2007 deadline. Eventually they gave us $1.20 in tax credits. The company declined to distribute the full tax credit. One of the reasons was that Isetan (Singapore) would have to pay more tax in Japan,” Mr How recalls.

Disbursing more dividends to minority shareholders in Singapore seemingly doesn’t benefit Isetan (Japan). This point was reiterated in a letter by David Gerald, CEO of SIAS back in 2007, who said that the majority shareholder having to pay additional tax in Japan on the dividends is not a good enough or acceptable reason for Isetan (Singapore) not distributing its Section 44 tax credits to minority shareholders.

Over the years, Mr How has had differences with Isetan’s board of directors. Back in 1988, Isetan had a rights issue which was at $5.10 per share. “Isetan (Japan) also subscribed to this, but two to three months later, after the rights issue (in 1989), Isetan (Singapore) had a private placement. Isetan (Japan) sold their shares from the rights issue along with the private placement,” he says.

However, as Mr How recalls, Isetan (Japan) “mopped” shares at as low as $1.03 during the Asian Financial Crisis and the closure of CLOB.

Following the privatisation offer, the minorities have written to the Isetan (Singapore) board and Isetan Mitsukoshi asking for a better price. Their rationale is if the two RNAVs, of $9.44 with just the fair value of the investment properties, or $10.21 which is the RNAV of the entire company, value Isetan at a significantly higher value than $7.20; surely Isetan Mitsukoshi should be able to better its $7.20 per share offer.

A caveat to this is the remaining land tenure of Isetan’s 25.77% of Wisma Atria stake, of 37 years; the freehold lease belongs to Ngee Ann Kongsi. Market observers have also pointed out that there may be only one buyer of Isetan’s stake in Wisma Atria, Starhill Global REIT P40u, who owns the remaining 74.23% of Wisma Atria including the office tower. Additionally, if Isetan (Singapore) continues to operate in Singapore, it would need its office and its warehouse. Nonetheless, Isetan’s annual report indirectly points to a revaluation surplus of $$6.86, and an RNAV of $9.44.

Interestingly, following Isetan Mitsukoshi Holdings’ announcement of the intention to privatise Isetan (Singapore), on May 10, Oversea-Chinese Banking Corp announced an offer to buy out the minority shareholders of Great Eastern Holdings G07, and to delist the insurer. Most recently, on May 19, RE&S Holdings 1g1 received an offer to privatise it via a SOA.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Isetan (Singapore)'s controlling shareholder makes privatisation offer at $7.20 per share

How Fuji Xerox Towers could boost City Development's future RNAV

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance