WEX Rides On Revenue Stability Amid Decreasing Liquidity

WEX Inc. WEX is experiencing steady growth in its top line due to a strong network of partners, product quality and customer base. The acquisition of Payzer is strengthening the company’s growth strategy.

WEX reported unimpressive first-quarter 2024 results. Adjusted earnings (excluding 1.9 cents from non-recurring items) of $3.5 share missed the Zacks Consensus Estimate by a slight margin but increased 4.5% year over year. Revenues of $652.7 million missed the consensus estimate marginally but rose 6.7% from the year-ago quarter.

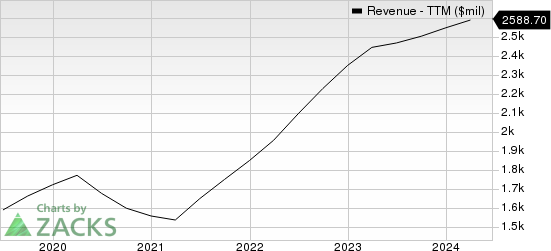

WEX Inc. Revenue (TTM)

WEX Inc. revenue-ttm | WEX Inc. Quote

How Is WEX Doing?

WEX’s revenues continue to grow, driven by its extensive network of fuel and service providers, growth of transaction volume, product excellence, marketing strategies, sales force productivity and other revenue-generation efforts. Rising demand for its payment processing, account servicing and transaction processing services, along with operational efficiency, has assisted WEX in achieving solid revenues and witnessing bottom-line growth. In 2023, the company’s revenues increased 8.4% year over year. We expect the top line to grow 7.7%, 6.8% and 7.5% in 2024, 2025 and 2026, respectively.

The company has achieved revenue stability due to its quality of products and services, deep client knowledge, and operational requirements, coupled with long-standing strategic relationships, multi-year contracts and high rates of contract renewal. WEX has a considerable customer base and co-branded strategic relationships with some of the largest U.S. fleet management providers, as well as with multiple oil companies and convenience store operators. Strength in its private-label portfolios, and value-added product and service offerings results in healthy customer retention.

A key growth catalyst for the company is its acquisitions. The company acquired Payzer in 2023, which is a cloud-based field service management software provider. It strengthens WEX’s growth strategy, offering scalable SaaS to 150,000 small business customers. In 2021, the company acquired certain contractual rights to serve as custodian or sub-custodian for more than $3 billion of HSAs from Bell Bank’s HealthcareBank division. This strategy is improving the organization's role within its customer-directed healthcare ecosystem, assisting it to perfectly align with its growth strategy.

WEX's current ratio at the end of first-quarter 2024 was pegged at 1.05, lower than the year-ago quarter's 1.07. A decreasing current ratio does not bode well.

Zacks Rank & Stocks to Consider

WEX currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Barrett Business Services BBSI and Deluxe DLX.

Barrett Business Servicescurrently carries a Zacks Rank of 2 (Buy). It has a long-term earnings growth expectation of 14%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BBSI delivered a trailing four-quarter earnings surprise of 38.6%, on average.

Deluxe has a Zacks Rank of 2 at present.

DLX has a long-term earnings growth expectation of 12%. It delivered a trailing four-quarter earnings surprise of 23.3%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barrett Business Services, Inc. (BBSI) : Free Stock Analysis Report

Deluxe Corporation (DLX) : Free Stock Analysis Report

WEX Inc. (WEX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance