What Vinod Khosla says he's 'worried about the most'

Vinod Khosla is more popular than ever right now. The Sun Microsystems co-founder turned prominent investor — first at Kleiner Perkins and, for the last 20 years, at his venture firm Khosla Ventures — has always been sought after by founders thanks to his no-nonsense advice and his firm's track record, including bets on Stripe, Square, Affirm, and DoorDash. But a $50 million gamble on OpenAI back in 2019 — when it was far from clear that the outfit would succeed on the scale that it has — put Khosla Ventures, and Khosla himself, squarely in the spotlight.

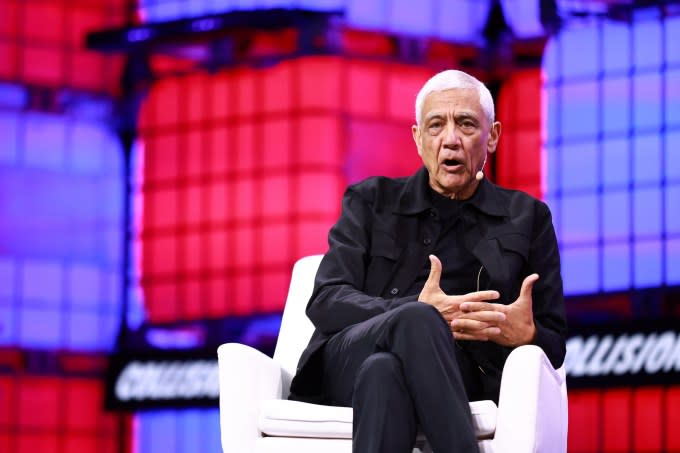

He’s thoroughly enjoying himself. I sat down with Khosla this past week in Toronto at the Collision conference, and ahead of our stage appearance, he told me that he’s been appearing in public — either onstage or on podcasts or television interviews — several times a week lately. Asked if he was exhausted by the schedule — for example, he flew into Toronto just hours before our sit-down — he shrugged off the suggestion.

Certainly, there are things he prefers to talk about, and the art of deal-making is not among these things. “Frankly, the investor side is much less interesting to me,” he said when I asked him about something I heard recently, which is that he hasn’t taken a dollar in management fees since starting Khosla Ventures, despite that it now has $18 billion in assets under management. (He confirmed this, but he said that’s only true of himself and not a corporate-wide policy.)

He’s much more passionate about the startup opportunities he spies in a landscape being changed daily by advances in AI, so we talked about some of this white space. We also talked about what concerns him the most about AI’s ripple effects; FTC Chair Lina Khan; and why, in his view, the “Europeans have regulated themselves out of leading in any technology area.”

We talked first about Apple’s splashy new deal with OpenAI, which allows Apple to integrate ChatGPT into Siri and its generative AI tools. Apple may be striking similar deals with other AI models, including with Meta, but naturally, as an OpenAI investor, Khosla is bullish on the tie-up, which is the only one Apple has announced publicly so far.

Khosla called it “validation" for OpenAI; by announcing its pact with OpenAI during its high-profile developers’ conference, Apple was also “expressing confidence, I believe, in [OpenAI CEO] Sam [Altman] to lead [developments in AI] the next five or 10 years,” said Khosla. “When a company like Apple bets on a technology, they don't change it the next year usually.”

But was it good news and also bad news for Khosla, I wondered? As we’ve noted in TechCrunch, many startups will likely be disrupted right out of existence by some of Apple’s newest features, and it seemed likely that Khosla’s portfolio companies aren't entirely immune. I was especially curious about Rabbit, whose AI-powered hardware device promises to be a kind of AI assistant to users and is backed by Khosla Ventures.

Asked if the device could be made obsolete by Apple, Khosla suggested the device is more flexible than people imagine and could wind up being used by enterprises like hospitals, including in emergency room environments. He put it in the growing array of things that will “watch what you do, see what you do, and respond automatically.”

In fact, Khosla suggested that his team has actively avoided anything that could become “roadkill” as large language models like that of OpenAI progress further. And he highlighted at least one company that’s not in his portfolio: Grammarly, a writing assistant startup that was valued by its backers not so long ago at $13 billion.

“If you're doing Grammarly, say, it's really a light wrapper on today's model, and Grammarly won't keep up; it should never have been an app. It shows the need for that capability, but it will be part of Word or Google Docs. It's pretty obvious. When we talk to YC companies or others,” Khosla continued, “I can usually say, ‘Half of these companies will be obsolete before the YC batch is over.’”

Where Khosla sees plenty of opportunities are in verticals where expertise will become near free, although it’s not clear to me how these companies will sustainably make money (even after asking him). Think tutoring, or even oncology.

Said Khosla: “Open AI or Google isn't going to build a chip designer [to have on your smartphone]. OpenAI and Google aren't going to build a structural engineer. They’re not going to build a primary care doctor or a mental health therapist,” he said. “So there are so many areas for [founders to mine]. But they have to look at where the models are going next year and five years from now, and say, ‘We want to leverage that capability.’"

We also talked about regulation. I observed that Khosla has said before that closed large language models like that of OpenAI should be safeguarded, even while there should be a regulatory framework around them. I wondered if that means that Khosla will forever forswear other, “open source” AI.

Not at all, he said, noting that he’s a “huge fan” of open source. Sun was one of the first companies to “jump on open source,” opening sourcing its file system, he said. He also noted that Khosla Ventures was the earliest investor in GitLab, whose software invites people to work on code jointly.

But he suggested that open source in the context of large language models is a different animal altogether. The “largest risk we face with AI is China” and “powerful Chinese AI” that competes with the “liberal values” of the U.S., he said, adding that “we need to make sure that China stays behind us.” Otherwise, he warned, it will be China providing the “free doctors and free oncologists” to the rest of the world and, while they are at it, they’ll “export both the economic power that comes with AI and their political philosophy.”

Onstage, I mentioned to Khosla my recent sit-down with FTC Chair Lina Khan, who does not believe in the national champions model as a reason to coddle outfits like Google or OpenAI as they further their development of AI.

Khan hears all the time from executives and investors who say that government intervention will put the U.S. on a dangerous path. But during my sit-down with Khan, she argued that time and again, the U.S. has chosen “the path of competition” and it has “ended up fueling and catalyzing so many of these breakthrough innovations and so much of the remarkable growth that our country has enjoyed and that has allowed us to stay ahead globally.”

"If you look at some other countries that instead chose that national champions model,” Khan added at the time, “they’re the ones who got left behind.”

I had barely mentioned Khan, however, when Khosla became dismissive, calling her “not a rational human being” and accusing her of not understanding business.

“[Khan] shouldn't be in that role,” said Khosla. “Antitrust is a good thing to have in any country, any economic system. But antitrust [that’s] over enforced or over executed is bad economic policy."

"One thing the U.S. has over its European rivals is much more rational business environments. That's why the Europeans have regulated themselves out of leading in any technology area; they just basically have regulated themselves out of AI, out of all social media, out of all internet startups,” he said.

Of course, if some antitrust enforcement is good, but too much is not good, the question is where to draw the line. On this point, before we parted ways, I brought up the “abundance” that Altman foresees created by AI. During one of TechCrunch's StrictlyVC events last year, Altman said that the “good case” for AI is “just so unbelievably good that you sound like a really crazy person to start talking about it.”

Khosla has said he believes the same. But I’ve long wondered how, exactly, society will enjoy all this upside if regulators don’t get more involved in the trajectory of these companies. After all, I told Khosla onstage, we’ve already seen a massive aggregation of wealth and power tied to a smaller and smaller group of companies and individuals. When will enough be enough?

Here, Khosla said the issue bothers him greatly. “I think 25 years from now, when I hope I'm still working … the need to work will mostly disappear.” Still, while AI should create “great abundance, great GDP growth, great productivity — all the things economists measure,” he said, he worries “more than anything else” about “increasing income disparity. How do we [ensure the] equitable distribution of the benefits of AI?”

He has an inkling where the tipping point might be. “If [U.S] GDP growth goes from 2% today — it’s less than 1% in Europe right now — to 4%, 5%, 6%, we’ll have enough abundance to share the wealth and share the benefits.”

Whether and how that happens, of course, are even bigger questions, and for all his brilliance, Khosla, a self-described techno optimist, didn't have the answers.

Instead, after one last closing remark, he thanked the crowd for their time. Then he walked offstage, where a dozen young founders were gathered in the wings, each of them hoping to bend his ear for as long as they could.

https://techcrunch.com/2024/06/15/ftc-chair-lina-khan-on-startups-scaling-and-innovations-in-potential-law-breaking

Yahoo Finance

Yahoo Finance