Unveiling Three Hong Kong Dividend Stocks With Yields Up To 7.6%

Amidst a fluctuating global economic landscape, Hong Kong's market has shown resilience, reflecting broader trends seen in major indices worldwide. As investors navigate these conditions, dividend stocks remain appealing for their potential to offer steady income streams and relative stability.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.46% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.73% | ★★★★★★ |

China Construction Bank (SEHK:939) | 7.41% | ★★★★★☆ |

Playmates Toys (SEHK:869) | 8.82% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 8.62% | ★★★★★☆ |

China Resources Land (SEHK:1109) | 5.62% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.49% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.49% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 3.98% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.55% | ★★★★★☆ |

Click here to see the full list of 92 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

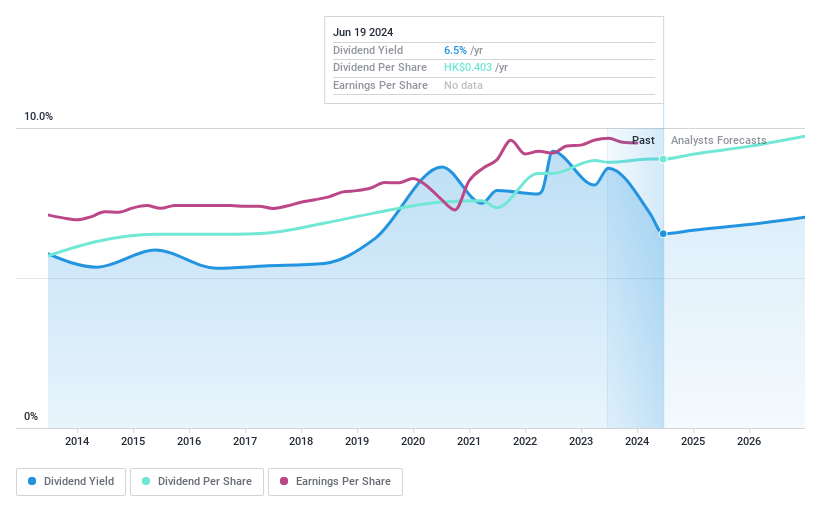

Bank of Communications

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Communications Co., Ltd. operates as a commercial bank offering a range of financial products and services, with a market capitalization of approximately HK$520.19 billion.

Operations: Bank of Communications Co., Ltd. generates revenue primarily through Corporate Banking Business (CN¥97.35 billion), Personal Banking (CN¥81.71 billion), and Treasury Business (CN¥20.99 billion).

Dividend Yield: 6.5%

Bank of Communications has recently undergone executive changes, with Mr. Zhang Baojiang set to become president pending regulatory approval, following Mr. Liu Jun's resignation. The bank issued CNY 26 billion in bonds and approved a dividend rate of 4.07% for domestic preference shares totaling RMB 1.83 billion due in September 2024. While its dividend yield of 6.48% is below the top quartile for Hong Kong stocks, dividends have been reliable and are well-covered by earnings with a payout ratio forecast at 31.1% over the next three years, indicating stability despite a lower yield relative to peers.

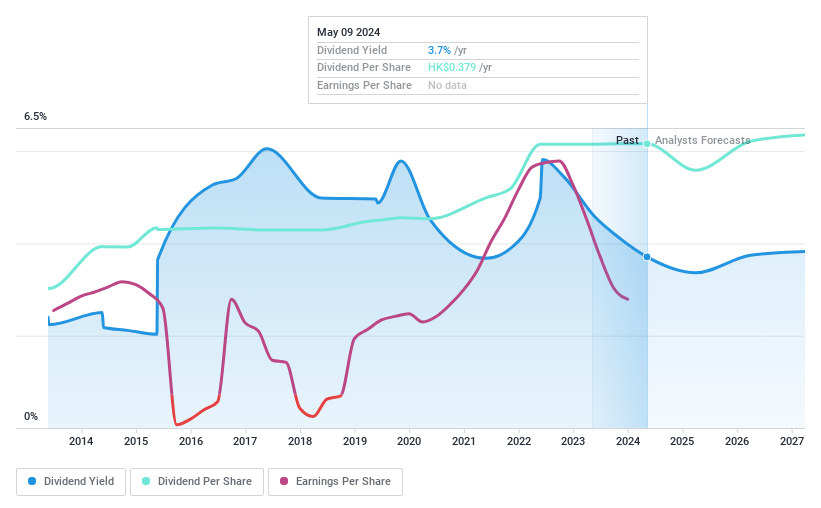

Lenovo Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services with a market capitalization of approximately HK$149.85 billion.

Operations: Lenovo Group's revenue is primarily generated through three segments: the Intelligent Devices Group (IDG) which earned $44.60 billion, the Solutions and Services Group (SSG) with $7.47 billion, and the Infrastructure Solutions Group (ISG) contributing $8.92 billion.

Dividend Yield: 3.1%

Lenovo Group's dividend yield at 3.14% remains modest compared to the Hong Kong market's top quartile at 7.79%. However, its dividends are well-supported by a payout ratio of 57.8% and a cash payout ratio of 83.1%, indicating sustainability from both earnings and cash flow perspectives. Over the past decade, dividends have shown stability and reliability with consistent growth, despite recent shareholder dilution and lower profit margins year-over-year—1.8% currently versus 2.6% previously—highlighting some financial pressures but overall resilience in maintaining shareholder returns.

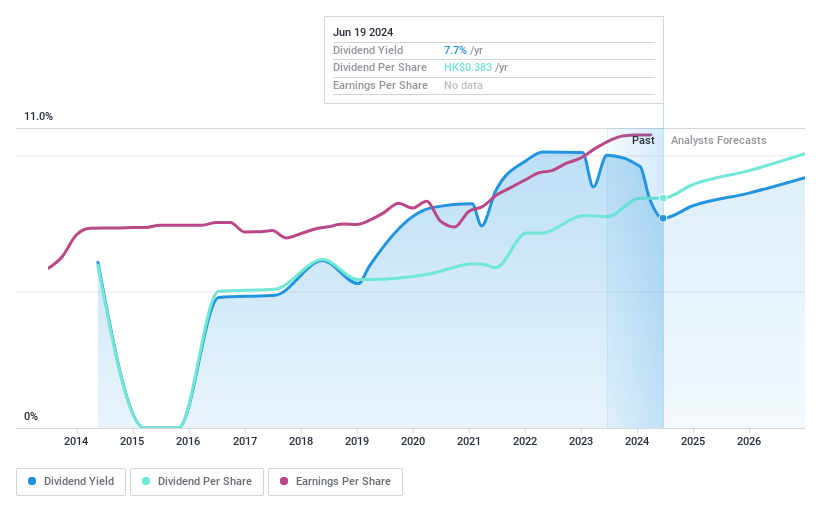

China CITIC Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China CITIC Bank Corporation Limited operates as a comprehensive banking institution offering a wide range of financial products and services across the People’s Republic of China and globally, with a market capitalization of approximately HK$345.64 billion.

Operations: China CITIC Bank Corporation Limited generates its revenue through various banking products and services within the People's Republic of China and on an international scale.

Dividend Yield: 7.7%

China CITIC Bank, with a dividend yield of 7.69%, falls slightly below Hong Kong's top quartile payers. Despite a low payout ratio of 28%, the bank's dividend history has been marked by volatility and unreliability over the past decade. Recent financials show stable earnings with CNY 19,191 million in net income for Q1 2024, but shareholder dilution has occurred within the year. Notably, dividends are forecasted to remain well-covered by earnings at a similar payout ratio in three years.

Get an in-depth perspective on China CITIC Bank's performance by reading our dividend report here.

Our valuation report here indicates China CITIC Bank may be undervalued.

Make It Happen

Explore the 92 names from our Top Dividend Stocks screener here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:3328 SEHK:992 and SEHK:998.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance