Unveiling 3 US Dividend Stocks With Yields Ranging From 3% to 8.2%

Over the past year, the United States stock market has seen a significant increase of 23%, despite remaining flat over the last week. With earnings expected to grow by 15% annually, investors might consider dividend stocks as a potentially stable component in their investment portfolios, especially those offering yields between 3% and 8.2%.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.73% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.29% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 5.39% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.08% | ★★★★★★ |

Regions Financial (NYSE:RF) | 5.06% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.98% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.93% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.83% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.45% | ★★★★★★ |

Peoples Bancorp (NasdaqGS:PEBO) | 5.58% | ★★★★★☆ |

Click here to see the full list of 211 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Vinci Partners Investments

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vinci Partners Investments Ltd. is an asset management firm based in Brazil, with a market capitalization of approximately $575.04 million.

Operations: Vinci Partners Investments Ltd. generates its revenue primarily from three segments: Private Markets at R$262.78 million, Corporate Advisory at R$42.91 million, and Investment Products and Solutions at R$70.98 million.

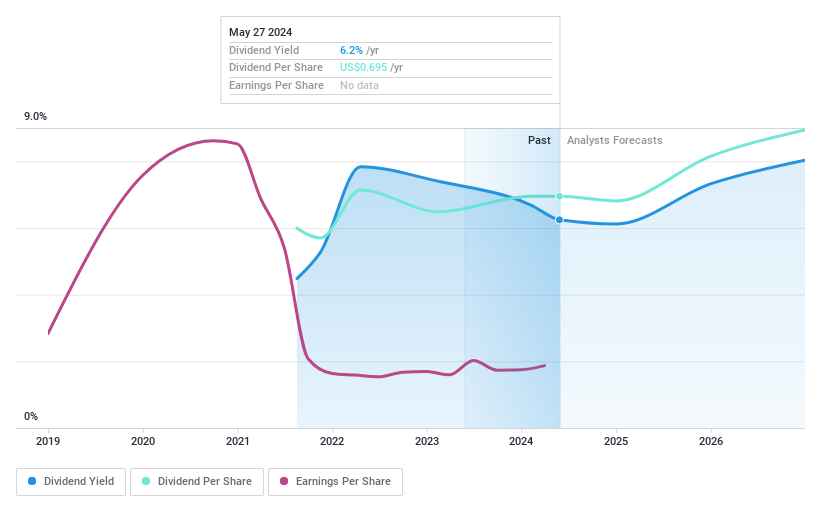

Dividend Yield: 6.1%

Vinci Partners Investments Ltd. offers a dividend yield of 6.1%, ranking in the top 25% of US dividend payers, supported by an earnings coverage with a payout ratio of 83.4%. Despite its appealing price-to-earnings ratio at 13.4x, below the US market average, concerns linger due to its short dividend history and recent reduction in quarterly dividend to US$0.17 per share as reported on May 9, 2024. Additionally, while dividends are well-covered by cash flows (cash payout ratio: 61.7%), the firm's unstable track record in maintaining consistent dividends poses a risk for long-term stability.

Haverty Furniture Companies

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Haverty Furniture Companies, Inc. is a specialty retailer of residential furniture and accessories in the United States, with a market capitalization of approximately $447.42 million.

Operations: Haverty Furniture Companies, Inc. generates its revenue primarily from the home furnishings retailing segment, totaling approximately $821.38 million.

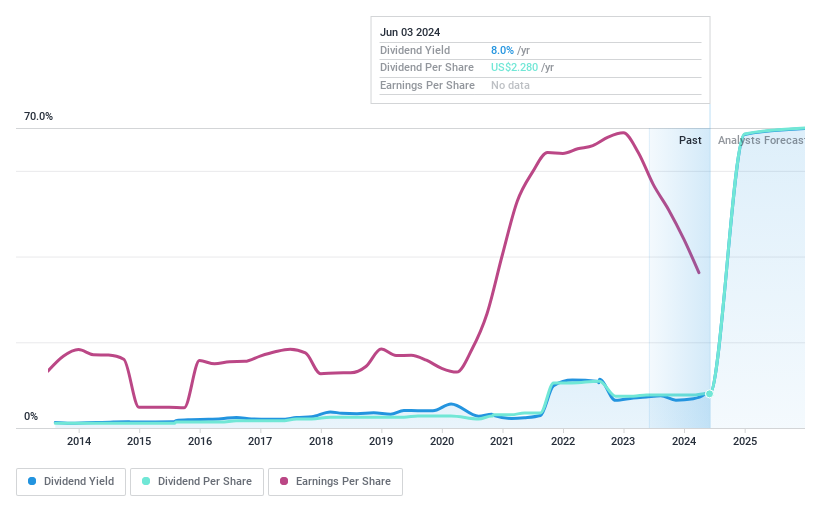

Dividend Yield: 8.3%

Haverty Furniture Companies recently reported a decrease in quarterly sales and net income, with earnings per share falling significantly from the previous year. Despite this downturn, the company raised its dividend by 6.7%, continuing a decade-long trend of increasing payouts. However, this raise comes amid concerns about the sustainability of dividends given that they are not well covered by cash flows—evidenced by a high cash payout ratio of 101.7%. Recent executive changes and strategic IT upgrades indicate efforts to bolster operations, which might impact future financial stability and dividend policies.

Omnicom Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Omnicom Group Inc., along with its subsidiaries, provides advertising, marketing, and corporate communications services, with a market capitalization of approximately $17.85 billion.

Operations: Omnicom Group Inc. generates $14.88 billion in revenue from its core services in advertising, marketing, and corporate communications.

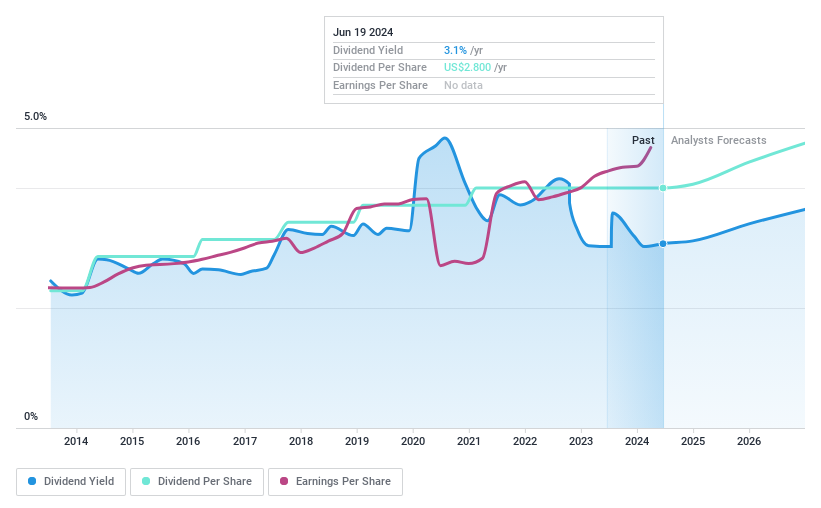

Dividend Yield: 3.1%

Omnicom Group maintains a stable dividend approach, evidenced by a 10-year history of consistent and growing payouts, currently at US$0.70 per share. With both earnings and cash flows covering dividends—payout ratios of 37.5% and 44% respectively—it demonstrates financial prudence amidst expansion efforts like the recent launch of Omnicom Production to enhance global capabilities. However, its dividend yield of 3.07% is modest compared to top US dividend payers, reflecting potential growth limitations in shareholder returns despite solid fundamentals.

Get an in-depth perspective on Omnicom Group's performance by reading our dividend report here.

Our valuation report unveils the possibility Omnicom Group's shares may be trading at a discount.

Next Steps

Delve into our full catalog of 211 Top Dividend Stocks here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:VINP NYSE:HVT and NYSE:OMC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance