The Transformer Crisis: An Industry on the Brink

Facing unprecedented lead times and skyrocketing costs, the transformer supply chain crisis threatens the backbone of the electric power industry, driving urgent calls for increased manufacturing capacity and innovative solutions. Can the industry rise to the challenge?

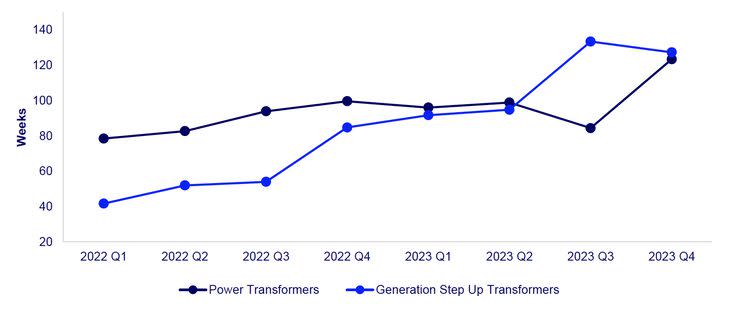

For several years now, the power sector has frantically raised the alarm about an impending transformer supply chain crisis, seeking to reinforce the availability of the component that many consider the backbone of the electric industry. But since the COVID pandemic, the crisis has descended full-blown and grown crippling. In April, global research and consultancy firm Wood Mackenzie warned that transformer lead times have continued an upward trajectory and now stand at 115 to 130 weeks—more than two years—on average. Lead times for large transformers, both substation power transformers and generator step-up (GSU) transformers, have surged to 120 to 210 weeks—or 2.3 to 4 years. At the same time, depending on the size and application, transformer prices have risen 60% to 80% on average since January 2020, driven upward by raw material commodities. Prices for grain-oriented electrical steel (GOES), though significantly volatile, have almost doubled since the pandemic, while copper prices surged upwards of 40%. “For reference, pre-pandemic lead times ranged from 30–60 weeks, depending on specifications/size and if the transformer had been regularly ordered over time with a proven design (therefore allowing the manufacturing process to be streamlined),” the firm noted. Now, “averages continue to rise quarter to quarter [Figure 1] with no clear signs of relief (i.e., new manufacturing capacity) and the extreme growth of grid-tied renewable projects will keep up a relentless demand for the next decade.” [caption id="attachment_220406" align="aligncenter" width="740"]

1. As large developers and utilities increase transformer orders, lead times for large power transformers and generator step-up units have surged to 120–130 weeks on average as of the fourth quarter of 2023, with no signs of relief. Pre-pandemic, lead times ranged from 30–60 weeks. Courtesy: Wood Mackenzie Supply Chain[/caption]

Transformer Demand Drivers Testing Current Inventory

The crisis comes as the power sector grapples with an unprecedented boom, both for new modes of power generation and power demand. Transformers have been an indispensable component for competitive transmission of electric power since 1891, when their invention proved to be a breakthrough. “Transformers made it possible to generate electric power at low voltages and then transform it to a higher level at which transmission incurs considerably lower losses, and finally, transform the voltage back to a safer level at the site of consumption,” explains Hitachi Energy (then ABB) in a written history. The most recent transformer manufacturing boom came between 2004 and 2007, driven by growing power demand, advancements in insulation and cooling technologies, and the need for higher voltage and larger capacity transformers to support industrial and urban development. But today, the grid is undergoing a forceful, unprecedented shift, propelled by the triple-impact push for decarbonization, the necessity to replace aging infrastructure, and the urgent expansion required due to vigorous demand, including from new loads like data centers and electrification of the industry, commercial, transportation, and residential sectors. “I’ve been in this industry for 32 years, and I’ve seen booms and busts in our industry,” said Richard Voorberg, president of Siemens Energy, North America. “I’ve never seen something like this that is going up at such a rate that looks sustainable as well.” According to Joshua Yun, senior vice president of Sales and Marketing at Virginia Transformer, the largest U.S-owned transformer manufacturer in North America, the current market gap for transformers stems from a “perfect storm” of drivers, where post-pandemic pent-up demand unleashed a “big tsunami” across every market segment, spanning from energy to bitcoin mining to artificial intelligence. “I’ve never seen a market dynamic like this,” he said during the 2024 IEEE PES T&D Conference & Exposition in Anaheim, California, in May. If the current transformer boom could be boiled down to two key factors, they would cover a critical need for reliability and resilience, Wade Lauer, senior vice president of Grid Technologies at Siemens Energy, North America, told POWER. A big worry is how old the transformer fleet already is. A 2020 study by the U.S. Department of Commerce suggests that the average age of in-service large power transformers (LPTs) is 38 years—near or even past design life. Meanwhile, the Electric Power Research Institute (EPRI) has said changing duty cycles linked to grid transformation and renewable energy integration may shorten the lifespan of certain transformers or cause capacity deratings, further straining the available capacity. Moreover, the nation’s current stock of between 60 million and 80 million distribution transformers could need to increase between 160% and 260% compared to 2021 levels, the National Renewable Energy Laboratory (NREL) estimated in February. Prominent among the myriad drivers NREL pointed to that support an urgent boost for expanded transformer manufacturing capacity relates to significant transformer damage from the increasing frequency and severity of extreme weather events. Additionally, “the type of transformers utilities will require is expected to change; demand for larger transformer sizes is expected to increase due to electrification,” it noted. The lab suggests that while demand for smaller transformers—like 10 kVA or 15 kVA—is declining as utilities adopt 25 kVA as the new minimum size due to increased load growth from electrification, pole-mount transformers are also being replaced by pad-mount transformers as utilities expand undergrounding for storm and wildfire resilience. For wildfire-prone areas, the lab suggests demand could rise for dry-type transformers, while flood-prone areas will see increased demand for submersible and corrosion-resistant transformers. Finally, step-up transformers, essential for wind and solar generation, will add up to 2 TW of demand by 2050, requiring sizes from 0.5 MVA to 5 MVA for both bulk-system connected and large distributed generation plants, significantly boosting manufacturer orders, the lab said. Demand for this class of transformer (see “Transformer Basics” sidebar) has already ramped up significantly, Wood Mackenzie warned. “Based on conversations with developers and suppliers, as much as 25% of global renewable projects could be at risk of project delays due to transformer lead times,” it said in April.

Transformers are essential electrical devices that adjust voltage levels in power systems, enabling efficient power distribution and use. Their core components include a laminated magnetic core, and primary and secondary windings (Figure 2). By varying the number of turns in these windings, transformers either step up or step down voltage levels. For instance, more secondary turns than primary results in a higher secondary voltage (step-up), while fewer turns result in a lower voltage (step-down). [caption id="attachment_220407" align="aligncenter" width="440"]  2. Key components of transformers. Courtesy: Harris Williams[/caption] Transformers play a crucial role across the electric grid, from power generation to distribution. They isolate circuits, prevent direct-current (DC) from passing through alternating-current (AC) systems, and occasionally adjust inductance or capacitance for power factor correction. Specialty transformers serve markets like technology centers, electric vehicle charging, and renewable energy facilities, each tailored for specific needs. Transformers are classified by their voltage and power ratings, ranging from low voltage (up to 600 V) to high voltage (over 69 kV). They are also categorized into dry-type (air-cooled) and liquid-immersed types, with large, high-voltage transformers typically using insulating fluids for cooling. |

An Outsized Role for Transformer Manufacturing

Given current transformer supply constraints and soaring future projections, the onus has shifted squarely on transformer manufacturers. A particular issue is that, owing to periods of boom and bust between the 1980s and 2000s, the transformer industry has morphed into a “smaller group of manufacturers,” Wood Mackenzie notes, while acknowledging that the group has improved financials and technological abilities. Today, the market comprises large multinational electrical equipment manufacturers, small and medium suppliers specializing in custom units, and aftermarket providers focused on reconditioning and repair services. A key reason is that most transformers are special, made-to-order pieces of equipment, often laden with custom specifications and limited alignment across the industry, surmises Harris Williams, a global investment bank specializing in private capital advisory services. The multinational business model supports the high capital spend, and significant size and complexity associated with power transformer manufacturing, along with commodity exposure and a wide range of specifications, it says. In 2019, notably, more than 80% of large power transformers (LPTs) were imported, according to the Commerce Department, largely due to dumping practices that undermined domestic manufacturers’ ability to sell their products at competitive prices. The distribution transformer market is relatively insulated from import competition, given shipping costs, labor access, and high customization needs. Still, like the LPT market, the distribution transformer market is currently grappling with a long list of challenges, as discussed in more detail below. Warnings by both the Federal Energy Regulatory Commission and the North American Electric Reliability Corp. nearly 10 years ago that transformer failures pose insidious vulnerabilities to the nation’s economy, public health, and security issues somewhat rattled the federal government into action. While previous administrations acted to address longstanding concerns about the current reliance on foreign-made transformers and components, the Biden administration has responded to urgent pleas by the power industry to address transformer-related critical infrastructure project delays and their potential to hinder the integration of renewable energy sources. In June 2022, President Biden signed executive orders invoking the Defense Production Act to help domestic manufacturers increase their production. “That said, funding for the domestic transformer industry was neither specified in the manufacturing tax credits of the Inflation Reduction Act (45X and 48C) nor was any funding for transformer manufacturing included in the Omnibus Appropriations Bill at the end of 2022,” said Wood Mackenzie. “Given the high start-up cost and skilled labor requirements of transformer manufacturing, it is unlikely that we will see any reshoring or expansion of the domestic manufacturing base absent incentives.” Over the past year, meanwhile, the Department of Energy (DOE) proposed a fiercely contested rule that would have required almost 90% of all covered distribution transformers to feature amorphous metal (AM) cores by 2027, requiring a substantial shakeup in transformer manufacturing. The final rule, issued in April, much softened, will allow 75% of distribution transformer cores to rely on GOES, a primary core steel used in distribution transformers, while also supporting a 10% to 25% increase in the availability of distribution transformers. However, given significantly optimistic market conditions, the industry has stepped up, responding with significant investments in new or expanded manufacturing capacity. In February, Siemens Energy announced it would invest $150 million to expand operations at a transformer factory in Charlotte, North Carolina, to produce 57 LPTs per year with a capacity of 15,000 MVA by the end of 2026. And, in April, Hitachi Energy revealed investments of more than $1.5 billion to ramp up its global transformer manufacturing capacity by 2027 (Figure 3). The investments include a new “state-of-the-art transformer factory” in the Vaasa region of Finland, along with expansions to facilities in Virginia and Missouri, Germany, Colombia, China, Vietnam, and Australia. These measures follow crucial announcements by transformer heavyweights like Virginia Transformers, which in 2023 opened a new facility in Mexico capable of producing transformers up to 100 MVA. [caption id="attachment_220408" align="aligncenter" width="740"]

3. Hitachi Energy’s transformer factory in Ludvika, Sweden, has been a hub of innovation for over 120 years. In June 2024, Hitachi announced a $330 million investment to expand and modernize the flagship facility. The Ludvika factory will expand by more than 30,000 square meters to enhance manufacturing capacity for large transformers, crucial for high-voltage direct-current projects. Courtesy: Hitachi Energy[/caption]

Navigating a Critical Materials Supply Chain Crunch

Still, as some major transformer manufacturers told POWER, transformer availability relies on resolving a precarious set of challenges. Perhaps the most glaring issue rests on a debilitating supply chain crunch that is afflicting all parts of the power industry, exacerbating competition for materials and talent. Transformer costs rely heavily on a combination of material costs, such as steel, copper, and fuel oils, which are guided by macroeconomic market drivers. “The main components are the core steel and the copper windings,” Siemens Energy’s Lauer told POWER. “And then from there, you would get into items like tap changers and bushings, which could become a critical path for the lead time, but the steel, copper, and GOES, [which is] electrical steel, first has to be of such a high quality and then it needs to be available.” GOES is a particular concern, given that prices have surged by more than 90% since January 2020. Meanwhile, the U.S. currently has only one domestic GOES supplier, AK Steel. Alternative options for distribution transformers could leverage amorphous core transformers, but domestic production for that also currently relies on one domestic supplier, Metglas. Amorphous steel distribution transformers are highly efficient, potentially reducing the amount of electricity lost by more than 70%, said Metglas President Rob Reed. “Amorphous steel has no crystalline structure and reduces hysteretic losses in the magnetization/demagnetization cycle. The thinness of the laminations reduces eddy current losses,” he explained. Metglas has already demonstrated that it can double its existing capacity, Reed added. What it boils down to is stiff competition for basic materials. “Copper is becoming increasingly scarce because the demand for copper is accelerating rapidly beyond anyone’s expectation,” noted Paul DeCotis, a senior partner at consulting firm West Monroe. Hitachi Energy told POWER that while it is carefully watching GOES and copper markets, it expects an increasing demand for power converters, electronic equipment, and semiconductors, as they are the key enablers for the needed flexibility, security, and reliability of the grid. “Looking at the market situation, we have already taken actions to minimize the effect of the shortage of electronics working in parallel on two different fronts: first, strengthening our production in-house, and secondly, implementing partnerships with our suppliers to secure the suppliers’ capacity and working with our customers with new business models,” it said. Hitachi Energy also stressed its ability to harness a diverse supplier base. “We have a global footprint where we can leverage our strategic supplier base to serve multiple markets across geographies,” it said. At the same time, major manufacturers are also competing for labor. “It’s skilled labor—there’s a lot of manual labor in the windings of a transformer, and that’s where people have failed in the past,” Voorberg noted. “The plan for us right now is to train and start today. Even though the factory groundbreaking hasn’t occurred, we’ve already started hiring, and we’ll take the talent, and then we’ll take it to other factories to train them and have them work side by side.”

A Crucial Need for Standardization

The most significant longstanding production challenge is perhaps industry’s pressing need for transformer design standardization. Because transformers are typically designed to match disparate customer loads and generator sizes, they exist in various sizes. More than 80,000 distribution transformers are on the market, for example. But, according to the National Infrastructure Advisory Council (NIAC)—a 2001-established group of senior public and private power company executives appointed to advise the U.S. president on critical infrastructure risk strategies—the necessary customization of transformer designs has added complexity to production processes and reduced potential throughput. In a June draft report exploring transformer challenges, NIAC recommends standardizing the interfaces between transformers and other grid components, and promotes a public-private effort, led, for example, by the DOE or EPRI, to develop a standard transformer model that utilities can widely adopt. The council notes that one reason standardization has lagged is because “neither the utility industry nor the manufacturers of transformers had sufficient incentives to pursue it.” While gaining a “broad agreement on standards may be arduous,” an industry-wide effort is already supported by utility trade associations and the National Electrical Manufacturers Association, which recognize its potential to drive cost reductions and productivity boosts, it said. In addition, standardization could help pare down the existing spare parts complexity and utility training requirements, and provide performance benchmarks that could improve equipment reliability. The transformer manufacturing industry already recognizes the benefits of standardization, particularly given engineering demands from emerging loads, such as data centers, as electrification takes shape. Yun suggested Virginia Transformer is already pursuing standardization in some form in response to engineering demands, leveraging more than 20,000 reference designs. Lauer underscored other underlying benefits, including integrating digitalization and modularization. “It’s simple to say, but we really need to do it from the design, which isn’t easy because you have different interconnection points, but from the supply base, the more we can standardize, the more we can help our suppliers be able to duplicate and replicate the equipment further,” he said.

Cultivating Sustainable Growth

Voorberg, meanwhile, pointed to the sustainability benefits of more efficient and standardized production processes. Siemens Energy, like many of its customers, is pursuing environmental, social, and governance (ESG) initiatives, with a “firm commitment in 2030 to be net-neutral,” he said. However, for the transformer industry, which has historically been cautious given intense periods of boom and bust, “sustainability” also appears to be firmly tied to business continuity. All experts POWER spoke to underscored the importance of long-term supply agreements and commitments from customers (see “Transformative Technology” sidebar).

As transformer manufacturers make gains to improve processes, the industry has developed and adopted several technological advancements in recent years that promise to boost efficiency, sustainability, and resilience. The following is a list of recent demonstrations or novel offerings. Flexible Transformers. In 2021, GE Research and Prolec GE, funded in part by the DOE TRAC Program, installed the “world’s first flexible large power transformer” at a Cooperative Energy substation in Mississippi (Figure 4). The six-month field demonstration evaluated the benefits of flexible transformers, including adapting to various voltage ratios and impedance levels, withstanding severe weather, and providing stability amid renewable generation surges or drops. [caption id="attachment_220409" align="aligncenter" width="740"]  4. GE Research and Prolec GE teamed with Cooperative Energy to develop and install the world’s first flexible large power transformer at the utility’s major substation in Columbia, Mississippi. Courtesy: Cooperative Energy[/caption] Rapid Response Transformers. In 2021, Siemens Energy delivered and installed three single-phase generator step-up transformers at a combined cycle power plant. These multi-voltage, modular transformers, installed within weeks rather than the typical nine to 12 months, feature smart technology that transmits real-time data to a cloud-based analytics platform for performance optimization. Solid State Power’s Demonstration. Starting in June 2023, Solid State Power LLC, in collaboration with EPRI and six major U.S. utilities, initiated a five-month demonstration of an all-solid-state medium-voltage transformer (SST) at EPRI’s test facility in Lenox, Massachusetts. This program aims to showcase the SST’s ability to handle typical grid load profiles and provide automatic voltage regulation, addressing the acute shortages and longer lead times in the U.S. distribution transformer market. Project ULTRA. Launched in 2021 by a consortium of utilities and manufacturers in the U.S., this project demonstrates the use of cast resin transformers in a real-world distribution grid setting. Its focus is on evaluating the performance, reliability, and cost-effectiveness of these transformers in commercial settings, which offer improved fire safety and compactness suitable for urban substations. EPRI IntelliGrid Transformer Monitoring Project. Launched in 2020, this project pilots the use of smart transformers with integrated sensors and communication capabilities. These transformers collect real-time data on health, temperature, and load, enabling predictive maintenance and optimizing grid operations. REScoop RISE Project. Initiated in 2018 across Europe, this project demonstrates advanced transformers with digital monitoring capabilities in rural and remote areas. It seeks to integrate these transformers with smart grid systems to improve grid resilience and facilitate renewable energy integration. GE Grid’s SF6-Free Gas-Insulated Transformer (GIT). GE Grid has developed an SF6-free GIT that uses a novel, fluorinated alternative gas insulation with a lower environmental impact. The project demonstrates the feasibility of transformers with environmentally friendly alternatives to SF6 gas, which is a potent greenhouse gas. Avangrid’s Mobile Transformer. In May 2024, Avangrid, in collaboration with Hitachi Energy, introduced a state-of-the-art mobile transformer designed to be deployed quickly, significantly decreasing downtime in the event of a damaged transformer. The 168-MVA mobile transformer can be installed within a couple of months, ensuring reliability and resiliency across Avangrid’s onshore wind and solar facilities. |

For suppliers, long-term agreements allow for better planning of material production and inventory, ensuring a steady flow of components. But to make a substantial investment in manufacturing expansion, as well as to determine planned output, transformer makers often cautiously weigh the return on investment, Voorberg explained. “We want to make sure that the market is real and the markets are there for a sustained period of time,” he said. “So, customers have an obligation here as well, and they can’t just act transactionally with us.” In Europe, customers are pursuing longer-term commitments of up to 10 years, but in the U.S., “we see blanket orders, but we don’t see commitments—at least not in the same strength as Europe,” he said. “In the U.S., none of our utilities can commit, and if they commit, then they take that risk 100% on themselves,” he explained. Voorberg argued that no one party should bear all the risks. While governments can take on some of the risks via incentives, relying on incentives creates “false economies.” Incentives best serve to “put the foot on the gas” and “stimulate markets,” but governments also need to “take their foot off the gas at the right time.” Hitachi Energy told POWER it approaches the conundrum with an emphasis on collaboration. “We are working together on long-term planning and discussing the best way to fulfill their need for transformers, even discussing investments and additional cooperation if economically sound for all the parties,” it said. The company, however, acknowledged the challenges in accurately forecasting demand, given rapid shifts in the consumer profile. “We are addressing the challenges posed by the increased demand from different angles: understanding the market needs across geographies, segments, and applications, translating that into market demand,” it added. Over the long run, manufacturing flexibility to scale up and down to meet demand may eventually evolve into a sound business practice. But as Voorberg warned: “flexibility comes with a cost.” Rather than allowing one party to bear too much of the risk, a sustainable industry expansion will require proper cost balancing shared between utilities, suppliers, and manufacturers, he said. Finally, Voorberg, too, underscored the importance of collaboration for the transformer industry, noting the company has prioritized partnerships with media, universities, government, customers, venture capital, and even competitors on certain projects. He stressed, “If we try to do it alone, we’re not going to get there.” —Sonal Patel is a POWER senior editor.

Yahoo Finance

Yahoo Finance