Top Three Dividend Stocks In Sweden For June 2024

As European markets navigate through a period of political uncertainty and fluctuating economic indicators, investors are keenly observing how these dynamics could influence market stability and investment returns. In this context, dividend stocks in Sweden may offer a measure of predictability and resilience, making them an appealing option for those looking to manage risk while seeking returns.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 6.08% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 4.26% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.38% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.24% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.07% | ★★★★★☆ |

Duni (OM:DUNI) | 4.83% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.55% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.12% | ★★★★★☆ |

Bahnhof (OM:BAHN B) | 4.02% | ★★★★☆☆ |

AB Traction (OM:TRAC B) | 3.97% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

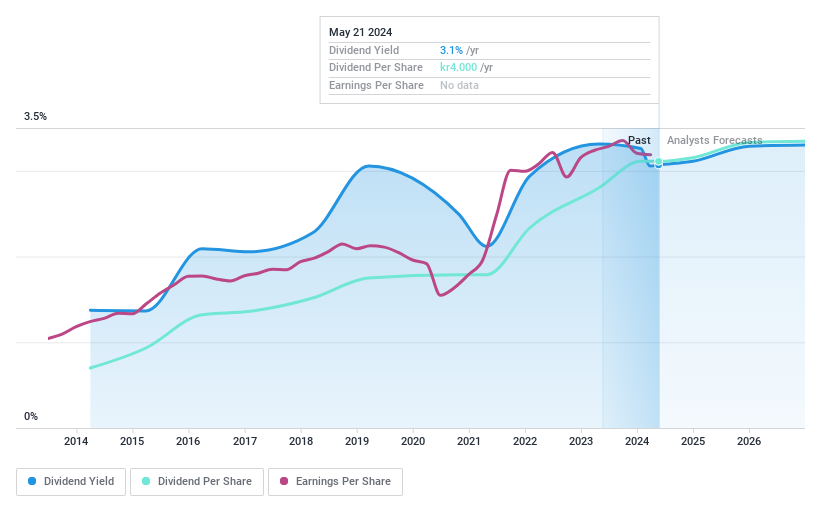

HEXPOL

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HEXPOL AB (publ) specializes in the development, manufacture, and sale of polymer compounds and engineered products across Sweden, Europe, the Americas, and Asia, with a market capitalization of approximately SEK 42.47 billion.

Operations: HEXPOL AB generates SEK 20.48 billion from its Compounding segment and SEK 1.59 billion from its Engineered Products segment.

Dividend Yield: 3.2%

HEXPOL AB, with a dividend increase to SEK 6.00 for FY 2023, demonstrates a commitment to shareholder returns, supported by a stable dividend history over the past decade. Despite its lower yield of 3.24% relative to some Swedish peers, the dividends are well-covered by both earnings and cash flows, with payout ratios around 54.9% and 54.6%, respectively. The firm is actively seeking acquisitions which might influence future financial flexibility but also indicates potential for growth beyond its modest earnings forecast of 5.36% annually.

Navigate through the intricacies of HEXPOL with our comprehensive dividend report here.

Our valuation report here indicates HEXPOL may be undervalued.

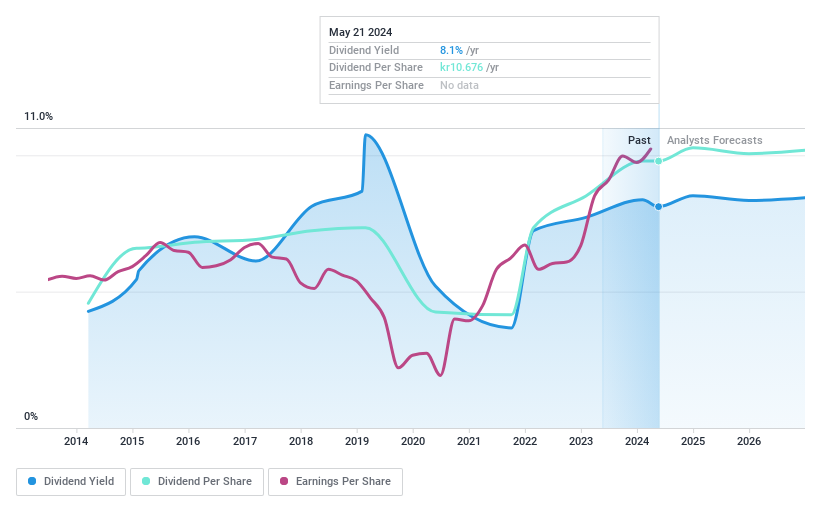

Nordea Bank Abp

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nordea Bank Abp provides banking products and services across Sweden, Finland, Norway, Denmark, and other international markets with a market capitalization of approximately SEK 445.81 billion.

Operations: Nordea Bank Abp generates revenue through various segments, with Personal Banking contributing €4.75 billion, Business Banking adding €3.55 billion, Large Corporates & Institutions at €2.46 billion, and Asset and Wealth Management bringing in €1.44 billion.

Dividend Yield: 8.1%

Nordea Bank Abp, despite a forecasted average earnings decline of 2.4% annually over the next three years, maintains a stable dividend with a high yield of 8.12%, ranking in the top 25% in Sweden. The dividends are well-covered by earnings with a current payout ratio of 63.8% and an expected slight increase to 65.6% in three years, indicating sustainability despite past volatility and unreliable payment patterns. Recent financial results show robust growth with net income rising to €1.36 billion from €1.15 billion year-over-year, supporting ongoing dividend commitments.

Take a closer look at Nordea Bank Abp's potential here in our dividend report.

Upon reviewing our latest valuation report, Nordea Bank Abp's share price might be too pessimistic.

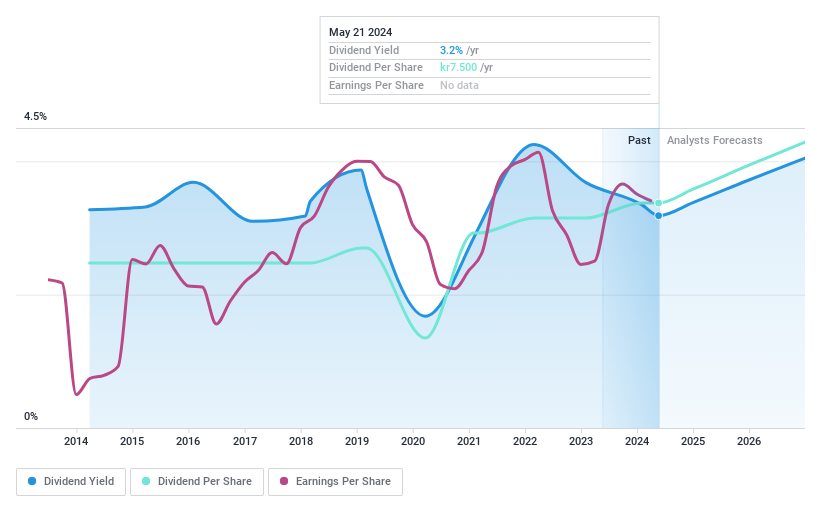

AB SKF

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB SKF (publ) is a global company that designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring services with a market capitalization of approximately SEK 97.50 billion.

Operations: AB SKF generates revenue primarily through two segments: Automotive, which contributes SEK 29.79 billion, and Industrial, with SEK 72.25 billion in sales.

Dividend Yield: 3.5%

AB SKF, while trading 43.4% below estimated fair value, presents a mixed scenario for dividend seekers with its dividend yield at 3.5%, lower than the Swedish market's top quartile at 4.3%. The dividends are supported by a payout ratio of 55% and cash flow coverage of 45.2%, indicating reasonable security in payments despite an unstable historical track record over the past decade. Recent innovations highlighted at the SKF Tech & Innovation Summit may bolster future performance, but past earnings have shown volatility with a recent drop in Q1 net income to SEK 1.88 billion from SEK 2.07 billion year-over-year.

Key Takeaways

Reveal the 23 hidden gems among our Top Dividend Stocks screener with a single click here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:HPOL B OM:NDA SE and OM:SKF B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance