Top Dividend Stocks In Hong Kong For June 2024

As global markets navigate through a landscape marked by political uncertainties and fluctuating inflation rates, investors continue to seek stable returns, making dividend stocks in Hong Kong an attractive option. These stocks often provide consistent income streams, which can be particularly appealing in times of market volatility and economic unpredictability.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.45% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.66% | ★★★★★★ |

China Construction Bank (SEHK:939) | 7.43% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 8.82% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.53% | ★★★★★☆ |

China Resources Land (SEHK:1109) | 5.68% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.43% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 3.98% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.75% | ★★★★★☆ |

Shougang Fushan Resources Group (SEHK:639) | 8.51% | ★★★★★☆ |

Click here to see the full list of 92 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

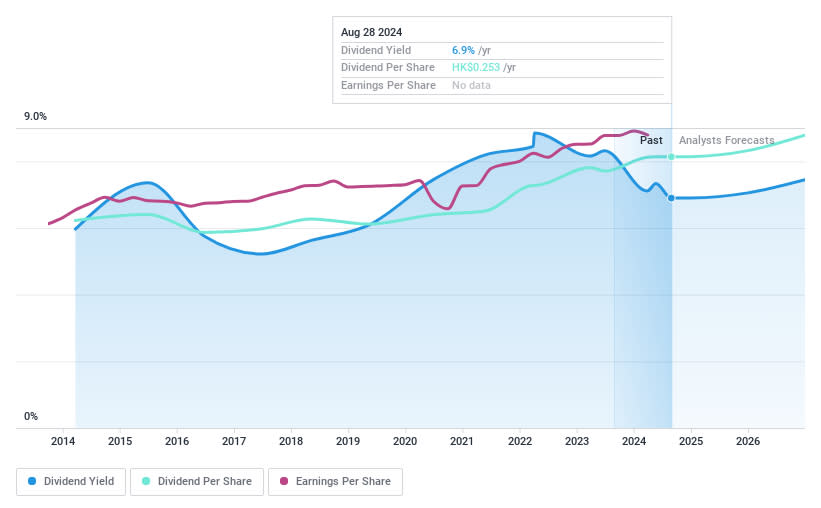

Agricultural Bank of China

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Agricultural Bank of China Limited, along with its subsidiaries, offers a range of banking products and services and has a market capitalization of approximately HK$1.56 trillion.

Operations: The Agricultural Bank of China generates its revenue primarily through a variety of banking products and services.

Dividend Yield: 7.2%

Agricultural Bank of China offers a dividend yield of 7.22%, slightly below the top quartile in Hong Kong's market. While its dividends are currently well-covered by earnings with a 32.3% payout ratio, this is expected to remain stable at around 30.6% in three years, indicating sustainability. The bank has consistently raised its dividends over the past decade, demonstrating reliability and stability in its dividend payments despite trading at a significant discount to estimated fair value and recent executive changes which include appointing Mr. WANG Zhiheng as President pending regulatory approval.

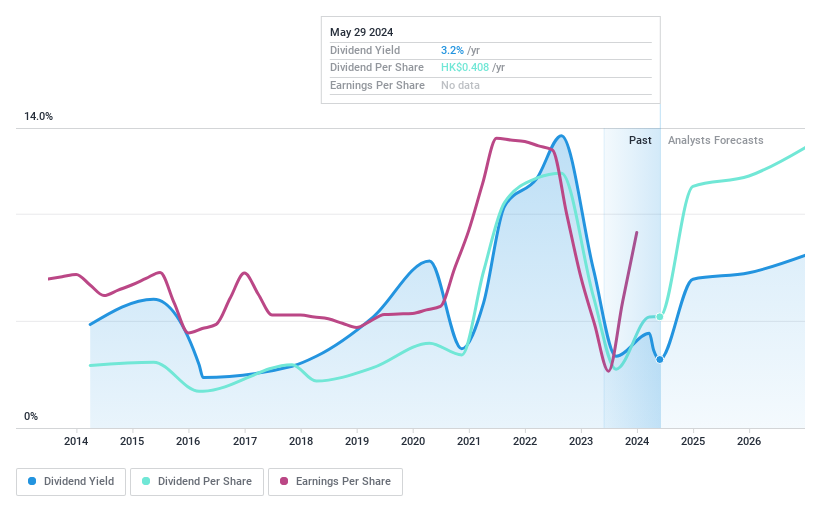

China Hongqiao Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Hongqiao Group Limited is an investment holding company that manufactures and sells aluminum products in the People's Republic of China and Indonesia, with a market capitalization of approximately HK$119.39 billion.

Operations: China Hongqiao Group Limited generates revenue primarily through the manufacture and sales of aluminum products, totaling CN¥133.62 billion.

Dividend Yield: 3.2%

China Hongqiao Group recently projected a significant net profit increase for the first half of 2024, largely due to higher sales and lower raw material costs. Despite this positive financial outlook, the company's dividend yield remains relatively low at 3.23% compared to other top dividend payers in Hong Kong. However, its dividends are well-supported by earnings and cash flows with payout ratios of 30.8% and 21.9%, respectively. The recent approval of a final dividend of HK$0.29 per share underscores a commitment to returning value to shareholders, although its track record shows some volatility in dividend payments over the last decade.

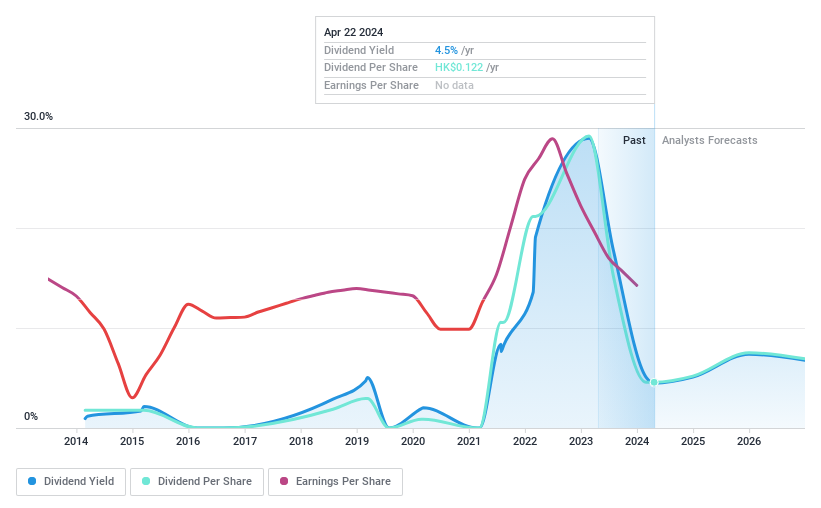

Pacific Basin Shipping

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pacific Basin Shipping Limited operates globally, providing dry bulk shipping services, with a market capitalization of approximately HK$14.07 billion.

Operations: Pacific Basin Shipping Limited generates its revenue primarily from dry bulk shipping services, totaling approximately HK$2.30 billion.

Dividend Yield: 4.5%

Pacific Basin Shipping's profit margin has declined to 4.8% from last year's 21.4%, and its dividend yield of 4.52% trails behind Hong Kong’s top dividend payers at 7.75%. Despite a volatile dividend history over the past decade, dividends have grown, supported by a payout ratio of 47.6% and cash payout ratio of 80.3%, suggesting coverage by both earnings and cash flows. The company recently initiated a share repurchase program, enhancing shareholder value through potential increases in net asset value per share and earnings per share.

Turning Ideas Into Actions

Dive into all 92 of the Top Dividend Stocks we have identified here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1288 SEHK:1378 and SEHK:2343.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance