Three UK Exchange Stocks Estimated To Be Up To 47.7% Below Intrinsic Value

As the FTSE 100 shows signs of resilience, gaining for a third consecutive day amidst global market fluctuations and key policy decisions, investors are closely monitoring the evolving economic landscape. In this context, identifying stocks that appear undervalued relative to their intrinsic value could be particularly compelling, especially when considering potential shifts in market dynamics influenced by central bank policies and economic indicators.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

TBC Bank Group (LSE:TBCG) | £24.80 | £47.76 | 48.1% |

Kier Group (LSE:KIE) | £1.40 | £2.73 | 48.7% |

Morgan Advanced Materials (LSE:MGAM) | £3.135 | £6.09 | 48.5% |

Mercia Asset Management (AIM:MERC) | £0.30 | £0.58 | 48.3% |

Deliveroo (LSE:ROO) | £1.321 | £2.51 | 47.4% |

John Wood Group (LSE:WG.) | £2.00 | £3.98 | 49.7% |

Loungers (AIM:LGRS) | £2.68 | £5.33 | 49.7% |

Elementis (LSE:ELM) | £1.456 | £2.79 | 47.7% |

Nexxen International (AIM:NEXN) | £2.48 | £4.89 | 49.3% |

eEnergy Group (AIM:EAAS) | £0.055 | £0.11 | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies

CMC Markets

Overview: CMC Markets plc operates as an online provider of retail financial services, catering to various client types including retail, professional, and institutional across multiple regions globally, with a market capitalization of approximately £0.78 billion.

Operations: The company generates its revenue from online financial services offered to a diverse client base across various global regions.

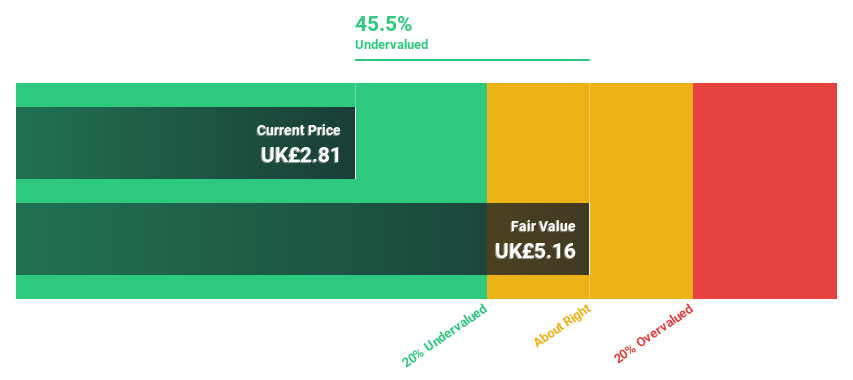

Estimated Discount To Fair Value: 45.5%

CMC Markets, priced at £2.81, is significantly undervalued with a fair value estimation of £5.16, reflecting a 45.5% discount. Despite lower profit margins this year at 4%, down from last year's 23.7%, the company's earnings are expected to grow robustly by 45.42% annually over the next three years, outpacing the UK market forecast of 13.1%. Recent inclusion in the FTSE 250 and revised upward earnings guidance further underscore its potential despite some concerns about quality due to one-off items impacting results.

Elementis

Overview: Elementis plc is a specialty chemical company with operations in the United Kingdom, Europe, North America, and internationally, boasting a market capitalization of approximately £0.86 billion.

Operations: Elementis generates revenue from three primary segments: Talc ($136.50 million), Personal Care ($209.30 million), and Coatings (Including Energy) ($367.60 million).

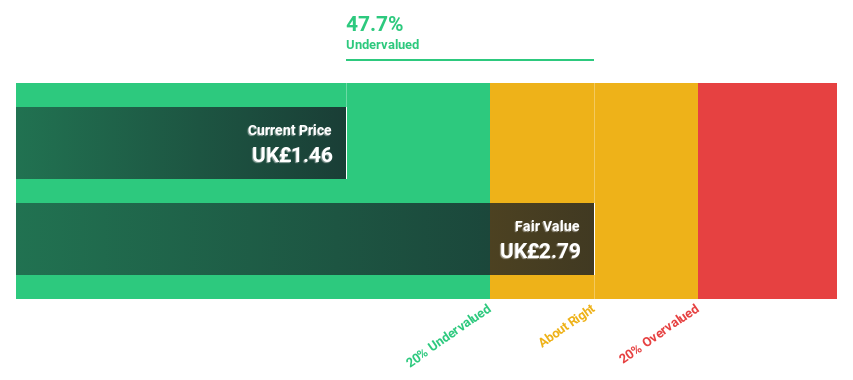

Estimated Discount To Fair Value: 47.7%

Elementis, currently priced at £1.46, is trading 47.7% below our estimated fair value of £2.79, highlighting its undervaluation based on cash flows. Although there's been significant insider selling recently, the company's earnings are projected to increase by 28.56% annually over the next three years, surpassing the UK market's growth rate of 13.1%. However, its expected revenue growth is modest at 3.7% per year and Return on Equity is forecasted to be low at 8.9%.

Foresight Group Holdings

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market capitalization of approximately £525.53 million.

Operations: The company generates revenue through three primary segments: Infrastructure (£85.68 million), Private Equity (£39.28 million), and Foresight Capital Management (£11.33 million).

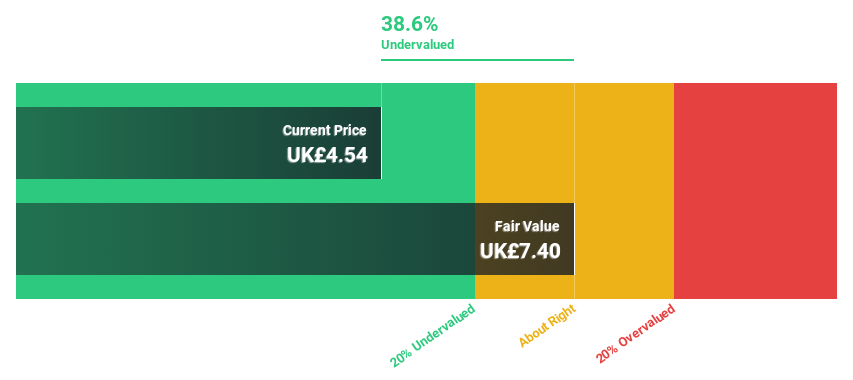

Estimated Discount To Fair Value: 38.6%

Foresight Group Holdings, priced at £4.54, is undervalued by 38.6%, with a fair value estimate of £7.4. Despite modest revenue growth projections of 10% annually, earnings are expected to surge by 30.9% each year over the next three years, outpacing the UK market's average of 13.1%. Analysts predict a significant stock price increase of 31%. However, its dividend coverage is weak and last year’s profit margin declined to 15.4% from a previous 25.5%.

Taking Advantage

Click through to start exploring the rest of the 64 Undervalued UK Stocks Based On Cash Flows now.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:CMCX LSE:ELM and LSE:FSG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance