Swedish Exchange Showcases Betsson And Two More Growth Companies With High Insider Ownership

As global markets navigate through fluctuating economic signals, Sweden's stock market remains a focal point for investors seeking stability and growth. Amidst this backdrop, companies with high insider ownership like Betsson stand out, suggesting a strong alignment of interests between shareholders and management which is particularly reassuring in the current uncertain market environment.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

BioArctic (OM:BIOA B) | 35.1% | 50.9% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Biovica International (OM:BIOVIC B) | 12.7% | 73.8% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

Yubico (OM:YUBICO) | 37.5% | 43.4% |

SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

Let's dive into some prime choices out of from the screener.

Betsson

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Betsson AB (publ) operates primarily in the online gaming industry across regions including the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, and Central Asia, with a market capitalization of approximately SEK 16.36 billion.

Operations: Betsson's revenue from its Casinos & Resorts segment amounts to approximately €974.50 million.

Insider Ownership: 10.9%

Earnings Growth Forecast: 14.0% p.a.

Betsson, a Swedish company, is trading at 70% below its estimated fair value and has shown a robust insider buying trend with no significant selling in the past three months. Analysts predict a 27.2% potential increase in stock price. The firm's earnings are expected to grow by 14% annually, outpacing the Swedish market forecast of 13.9%. However, it has an unstable dividend track record despite recent dividend increases and adjustments in shareholder policies.

Click here to discover the nuances of Betsson with our detailed analytical future growth report.

Our expertly prepared valuation report Betsson implies its share price may be lower than expected.

NIBE Industrier

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB operates globally, focusing on the development, manufacturing, and marketing of energy-efficient indoor climate comfort solutions and intelligent heating and control components, with a market capitalization of approximately SEK 98.26 billion.

Operations: The company's revenue is segmented into Stoves (SEK 5.62 billion), Element (SEK 13.62 billion), and Climate Solutions (SEK 36.83 billion).

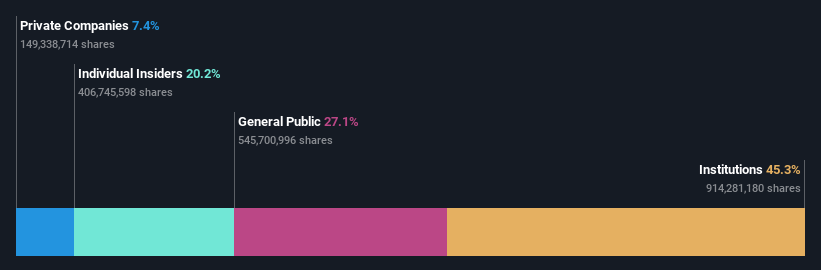

Insider Ownership: 20.2%

Earnings Growth Forecast: 27.6% p.a.

NIBE Industrier, despite trading 23.2% below its estimated fair value, faces challenges with a low forecasted Return on Equity of 12.3% and shrinking profit margins from 11.5% to 6%. Nevertheless, it shows promise with earnings expected to grow by 27.57% annually, outstripping the Swedish market's growth rate. Recent strategic appointments and expansion efforts indicate a focus on strengthening their competitive position in the climate solutions sector.

Dive into the specifics of NIBE Industrier here with our thorough growth forecast report.

Our valuation report here indicates NIBE Industrier may be undervalued.

Vimian Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vimian Group AB operates globally in the animal health sector and has a market capitalization of approximately SEK 18.15 billion.

Operations: Vimian Group's revenue is generated through several key segments: Medtech (€109.03 million), Diagnostics (€21.14 million), Specialty Pharma (€153.26 million), and Veterinary Services (€51.63 million).

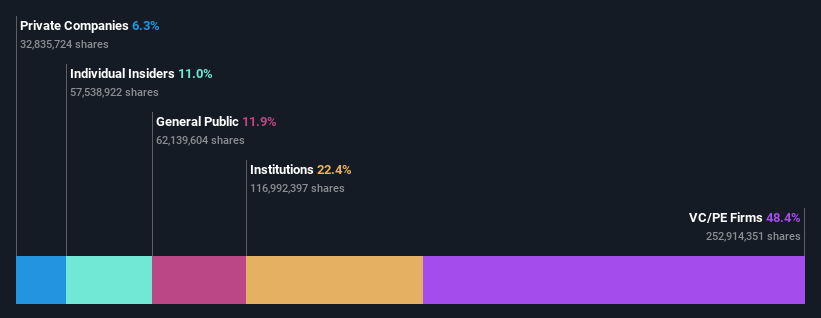

Insider Ownership: 11%

Earnings Growth Forecast: 58.6% p.a.

Vimian Group, recently profitable, is poised for notable earnings growth at 58.6% annually, outpacing the Swedish market's 13.9%. Despite this, its revenue growth at 12.2% lags behind the ideal 20% threshold but still exceeds the market average of 1.8%. Insider activity shows more buying than selling, although not in large volumes. Challenges include substantial one-off items affecting earnings and shareholder dilution over the past year. Recent leadership changes with Magnus Welander's election as chairman could signal strategic shifts.

Take a closer look at Vimian Group's potential here in our earnings growth report.

Our valuation report unveils the possibility Vimian Group's shares may be trading at a discount.

Key Takeaways

Click this link to deep-dive into the 84 companies within our Fast Growing Swedish Companies With High Insider Ownership screener.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:BETS B OM:NIBE B and OM:VIMIAN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance