Swedish Exchange Growth Companies With High Insider Ownership And At Least 26% Earnings Growth

Amidst a backdrop of fluctuating European markets and political uncertainties, Sweden's stock market presents a unique landscape for investors interested in growth companies with high insider ownership. These firms not only demonstrate robust earnings growth but also align closely with the interests of their key stakeholders, offering potential resilience in volatile times.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

BioArctic (OM:BIOA B) | 35.1% | 50.9% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

Biovica International (OM:BIOVIC B) | 12.7% | 73.8% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

Yubico (OM:YUBICO) | 37.5% | 43.4% |

SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

NIBE Industrier

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB, along with its subsidiaries, specializes in developing, manufacturing, marketing, and selling energy-efficient solutions for indoor climate comfort and intelligent heating and control systems across the Nordic countries, Europe, North America, and globally. The company has a market capitalization of approximately SEK 98.26 billion.

Operations: NIBE Industrier's revenue is primarily derived from three segments: Stoves (SEK 5.62 billion), Element (SEK 13.62 billion), and Climate Solutions (SEK 36.83 billion).

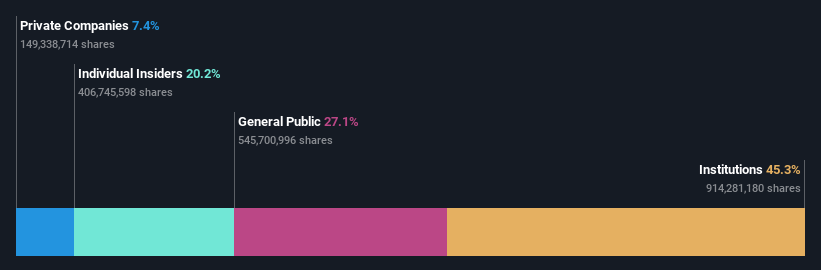

Insider Ownership: 20.2%

Earnings Growth Forecast: 27.6% p.a.

NIBE Industrier, a Swedish growth company with significant insider ownership, faces challenges despite its robust market position. Recently, the company reported a notable downturn in Q1 2024 with sales dropping to SEK 9.49 billion and a shift to a net loss of SEK 857 million from a profit last year. However, leadership changes including the appointment of Simon Karlin suggest strategic shifts aiming at global expansion and improved competitiveness. Despite these efforts, NIBE's revenue growth projection is modest at 6.1% annually, underperforming in comparison to its earnings growth forecast of 27.6% per year which indicates potential recovery and operational improvements ahead.

RaySearch Laboratories

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RaySearch Laboratories AB, a medical technology company based in Sweden, specializes in developing software solutions for cancer care across various global regions and has a market cap of approximately SEK 4.80 billion.

Operations: The company generates its revenue primarily from the healthcare software segment, totaling SEK 1.05 billion.

Insider Ownership: 24.1%

Earnings Growth Forecast: 33.6% p.a.

RaySearch Laboratories, a Swedish growth company with high insider ownership, has demonstrated robust earnings growth and significant product advancements. Recent developments include the launch of RayCare 2024A, enhancing treatment management efficiency in oncology systems. Despite trading at 49.8% below its estimated fair value and slower revenue growth at 10.6% annually, earnings are expected to surge by 33.62% per year, outpacing the Swedish market's average. The firm also declared a dividend of SEK 2 per share recently, reflecting financial health and shareholder commitment.

Surgical Science Sweden

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Surgical Science Sweden AB, headquartered in Europe, specializes in developing and marketing virtual reality simulators for evidence-based medical training globally, with a market capitalization of approximately SEK 6.62 billion.

Operations: The company generates revenue primarily through two segments: Industry/OEM at SEK 387.52 million and Educational Products at SEK 454.50 million.

Insider Ownership: 26.6%

Earnings Growth Forecast: 27% p.a.

Surgical Science Sweden, actively involved in the medical technology sector, is currently trading at a substantial 56.6% below its estimated fair value, indicating potential undervaluation. Although its Return on Equity is expected to remain modest at 6.2% in three years, the company's earnings are projected to grow by 26.98% annually, outperforming the Swedish market's forecasted growth. Revenue growth projections also exceed market averages significantly at 17.2% per year compared to just 1.8%. Recent activities include multiple presentations at international medical conferences, underscoring its industry engagement and innovation focus.

Taking Advantage

Investigate our full lineup of 84 Fast Growing Swedish Companies With High Insider Ownership right here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:NIBE B OM:RAY B and OM:SUS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance